Annuity for Monthly Retirement Income

Over 100 Annuity Carriers to Quote From. Here are a few of them!

At Diversified Insurance Brokers, we help retirees and pre-retirees create predictable, reliable monthly income using annuities. With access to over 100 top-rated insurance carriers and decades of experience, our advisors specialize in designing annuity strategies that turn your savings into guaranteed lifetime paychecks. Whether you’re rolling over a retirement account or planning ahead, we can help you find the right annuity to meet your monthly income goals. Get a quote today and see your personalized options.

Why Use an Annuity for Monthly Retirement Income?

Unlike investments that fluctuate with the market, annuities can provide dependable monthly income—no matter how long you live. Here are some of the key benefits:

- Guaranteed Paychecks: Convert a portion of your savings into income that lasts for life.

- Custom Payout Options: Choose single life, joint life, period certain, or flexible withdrawals.

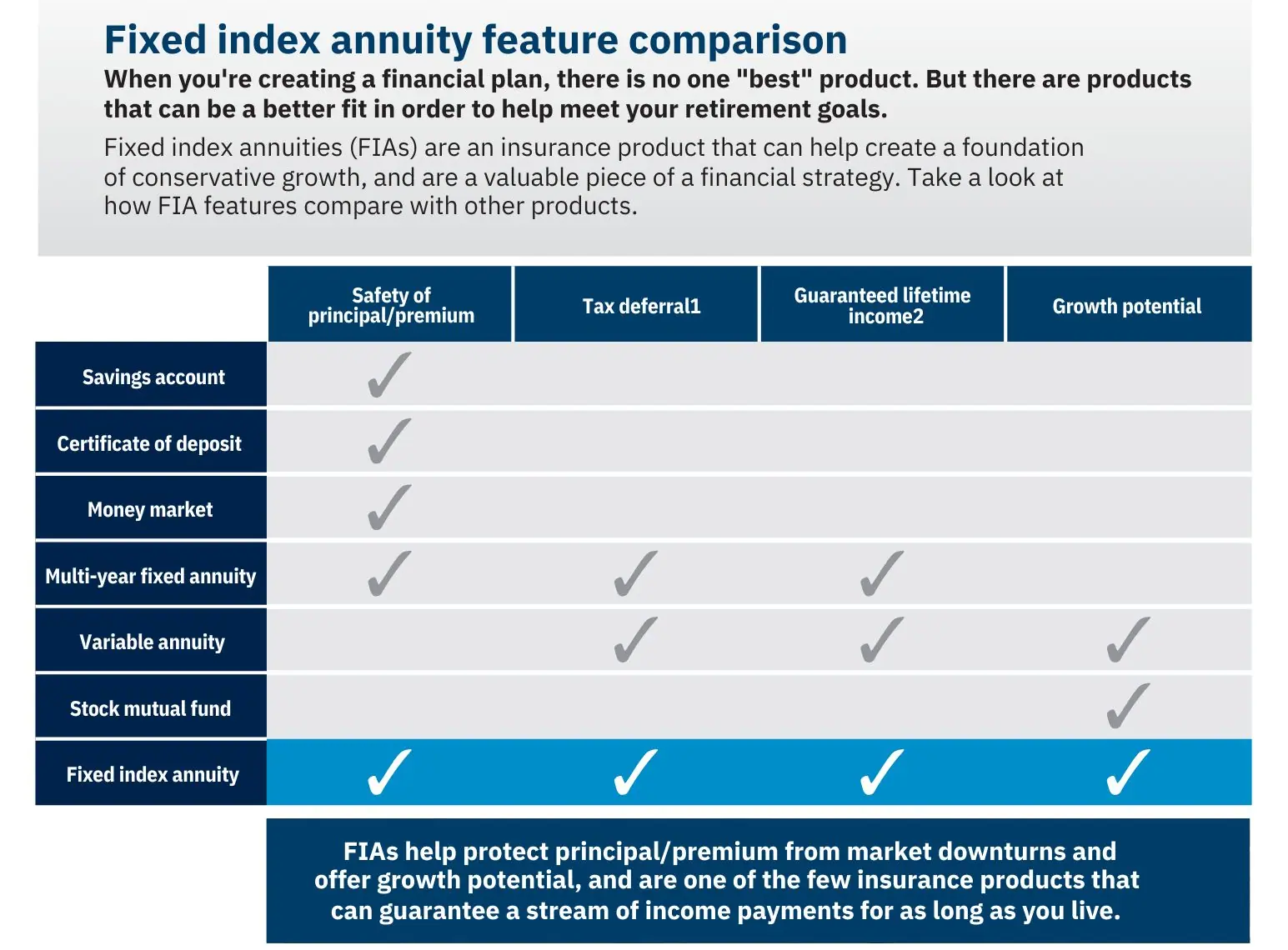

- Market Protection: Many income annuities shield your principal from market volatility.

- Optional Growth: Indexed annuities can offer income growth potential based on market-linked strategies.

- Tax-Deferred Accumulation: Earnings grow without annual taxes until withdrawn.

Who Should Consider This Type of Annuity?

Annuities for monthly retirement income are ideal for:

- People nearing retirement who want income to begin now or in the next few years

- Retirees looking to replace a lost pension or Social Security gap

- Individuals who prefer peace of mind over market risk

- Couples who want joint lifetime income that continues even if one spouse passes away

- Anyone worried about outliving their savings

Example Scenario:

A 65-year-old male rolls over $300,000 from his IRA into a fixed indexed annuity with an income rider. At the time of publication, this provides:

- Income beginning in 12 months

- Guaranteed monthly payments of approximately $1,750 for life

- Joint income continuation if his spouse is added to the rider

This strategy creates stability and simplifies retirement planning—no more guessing how much to withdraw each month.