Diversified Insurance Brokers

Family-Owned Since 1980

For over 45 years, we’ve helped individuals, families, and business owners protect what matters most—with trusted guidance, personalized service, and insurance solutions that stand the test of time.

A Family-Owned Firm Built on Trust, Integrity, and Service

Since 1980, Diversified Insurance Brokers has proudly served clients across the U.S. and internationally, providing trusted guidance with integrity, respect, and a deep commitment to doing what’s right. Founded by Jason and Jarad’s family, our firm was built on strong values—and strengthened even further when Mike, a close friend and partner of nearly 25 years, joined the team.

As fiduciaries, we’re committed to putting your best interests first, offering personalized insurance and financial solutions that reflect your goals, needs, and long-term security.

A Message From Our Founders

Rick and Margaret Stolz

In 1980, I started this business from the basement of my home with a simple vision: to fill a gap in the insurance industry by putting people first. I saw too many companies focused on sales instead of solutions, leaving individuals and families without the right protection for their futures. I knew there had to be a better way—one built on trust, transparency, and doing what’s best for the customer.

From the very beginning, my goal was to build lasting relationships, not just with our clients but also with top-rated insurance carriers. By working closely with these companies, we gained access to the best products and services available, allowing us to tailor solutions that truly meet our clients’ needs—without ever charging a fee.

What started as a small, family-run business has grown into something much bigger, yet our core values remain the same. Now in our second generation, our family continues to operate with the same commitment to integrity and service that we had from day one. We realized early on that the need for honest, solution-driven insurance advice wasn’t just in Georgia—it was nationwide. That’s why we expanded our reach, becoming licensed in all 50 states to help individuals and businesses across the country secure their financial futures.

We are not salespeople. We are problem solvers. Whether it’s life insurance, annuities, long-term care, or funding for college, our mission is to find the right solution for you—one that provides security, stability, and peace of mind.

Thank you for trusting us to be part of your journey. We look forward to serving you for generations to come

-Rick Stolz CLU, ChFC, RHU, CLTC, LUTCF

Our Story: The Diversified Timeline

A legacy of trust, innovation, and family values—since 1980.

Founding partners of National Association of Insurance Marketers

1980

1986

1990

2008

2015

2020

2025

Diversified Insurance Brokers, Est. 1980

Over 45 Years of Trusted, Family-Owned Guidance

For more than four decades, our family-owned firm has helped individuals, families, and businesses secure their financial future with clarity and confidence. As a second-generation company, we’ve built a no-fee, client-first approach that puts your goals—not commissions—at the heart of every recommendation.

Trusted by over 100,000 clients nationwide, we believe the key to long-term financial success is understanding your options. Not all insurance or financial products are created equal—and we take the time to walk you through the details, so you always know exactly what you’re choosing and why.

Unmatched Access. Unbiased Advice. Trusted Expertise.

With over $500 million in personalized insurance coverage placed, Diversified Insurance Brokers offers one of the most extensive carrier networks in the industry. We partner with 100+ top-rated companies and quote from over 1,000 insurance products, ensuring truly customized solutions based on your goals—not someone else’s sales quota.

Because we’re independent, we’re not tied to any one carrier—our only commitment is to you. That means no pressure, no pushy sales tactics—just honest, straightforward guidance designed to help you make informed, confident decisions about your financial future.

Our team exceeds state licensing standards and holds advanced designations such as CRPC (Chartered Retirement Planning Counselor), CLTC (Certified in Long-Term Care) and CMIP (Certified Medicare Insurance Planner) —bringing integrity, expertise, and decades of experience to every conversation.

Experienced Professionals, Committed to Excellence

Jason Stolz, CRPC, CLTC

Jason Stolz, CRPC, CLTC, is a highly respected financial professional with nearly 20 years of experience in the insurance industry. His insurance career began in 2010, and through hard work, dedication, and an unwavering commitment to his clients, he has become one of the top agents in the country concerning insurance and annuities. As a graduate of Auburn University, he is licensed in Georgia and is renowned for his deep expertise in life insurance, annuities, and long-term care planning. His ability to navigate the industry’s complexities and provide customized solutions has made him a trusted advisor to individuals, families, and businesses seeking financial security.

Jason’s approach is rooted in a client-first philosophy, ensuring that every recommendation aligns with the long-term goals and needs of those he serves. He takes pride in helping clients safeguard their financial future through comprehensive life insurance strategies, income-generating annuities, or long-term care planning designed to protect assets and preserve independence. His knowledge and insight have positioned him as a leader in the industry. Having close working relationships with many of the top tech companies in the insurance industry, he has earned the respect of colleagues and clients alike.

Beyond his professional accomplishments, Jason is passionate about music and film, appreciating the artistry, creativity, and storytelling that both mediums bring to life. He enjoys spending quality time with his family, including his wife, Kaylyn, and their child. Whether it’s a relaxing night watching a favorite movie, exploring new music, or engaging in meaningful conversations with loved ones, Jason values the moments that bring joy and connection. His dedication to both his career and his family reflects his core values of integrity, loyalty, and a commitment to excellence in all areas of life.

Jarad Stolz, CRPC, CLTC

Jarad Stolz, CRPC, CLTC brings a combination of sharp industry knowledge and a natural ability to connect with people that has made him a trusted advisor to families and businesses across the country. With nearly two decades of experience in the insurance and financial services industry, Jarad has developed a reputation for his expertise in life insurance, annuities, Medicare planning, and advanced retirement income strategies. His forward-thinking approach ensures clients are not only protected today but also well-positioned for the challenges and opportunities of tomorrow.

Known for his strategic mindset, Jarad thrives on helping clients see the bigger picture. He is passionate about educating families on how to maximize financial security, protect their assets, and create reliable streams of income they cannot outlive. Whether guiding parents through the complexities of college planning, structuring annuities for guaranteed retirement income, or advising on long-term care solutions, Jarad takes pride in simplifying financial decisions and creating clarity in areas that often feel overwhelming.

As a second-generation leader at Diversified Insurance Brokers, Jarad continues to carry forward the family tradition of integrity, service, and innovation. He is deeply committed to upholding the firm’s fiduciary standard—always putting the client’s best interests first—and ensuring that every recommendation aligns with their personal goals and long-term vision.

Beyond his professional work, Jarad is a devoted husband and father who values time with family above all else. He enjoys sports, travel, and staying engaged in his community, always finding ways to build lasting connections with the people around him. To his clients and colleagues, Jarad represents the perfect blend of experience, heart, and forward-looking leadership.

Mike Dusombre, CRPC, CLTC

Mike Dusombre, CLTC, CRPC has built his career on a simple promise: treat every client like family. As a partner at Diversified Insurance Brokers, Mike has become known for his steady guidance, approachable style, and ability to simplify complex financial decisions. Families and business owners alike turn to him for trusted advice on life insurance, annuities, retirement income strategies, and long-term care solutions.

Mike’s path into the industry was shaped by a deep desire to help people protect what matters most. Over the years, he has worked with thousands of clients across the country, creating strategies designed not only to meet today’s needs but to carry families through the future with confidence. His strength lies in his ability to listen carefully, understand each client’s unique circumstances, and then design tailored solutions that provide security and peace of mind.

Colleagues often describe Mike as the heart of the firm—someone who leads with loyalty, steadiness, and genuine care for those around him. His decades of experience are matched by a down-to-earth style that makes clients feel at ease, no matter how big the financial decision at hand.

Away from the office, Mike is a devoted husband and father who treasures time with his family. He enjoys the outdoors, staying active, and connecting with his community. To those who know him best, Mike embodies the very values that Diversified Insurance Brokers was founded on: trust, service, and doing what’s right for every client.

Tonia Pettitt, CMIP©

Tonia Pettitt is recognized as one of the leading Medicare specialists at Diversified Insurance Brokers, bringing both expertise and compassion to a field that can often feel confusing for retirees. With years of hands-on experience guiding individuals through the complexities of Medicare, Tonia has developed a reputation for simplifying choices and helping clients find coverage that truly fits their needs and budgets.

Her focus is on making Medicare understandable. From Original Medicare and Medicare Advantage to prescription drug coverage and Medigap policies, Tonia takes the time to walk each client through their options step by step. She believes no one should feel overwhelmed when making decisions about healthcare, and she prides herself on creating clear, customized strategies that offer confidence and peace of mind.

Clients consistently praise Tonia for her patience, knowledge, and ability to listen. She sees every conversation as an opportunity to empower people with the information they need to make the best decision for themselves and their families. As part of the Diversified Insurance Brokers team, she extends the firm’s commitment to integrity, service, and putting clients first.

Outside of work, Tonia values spending time with her family and enjoys being active in her community. Her warmth and approachable nature carry through both professionally and personally, making her not just a Medicare advisor but a trusted partner in planning for the future.

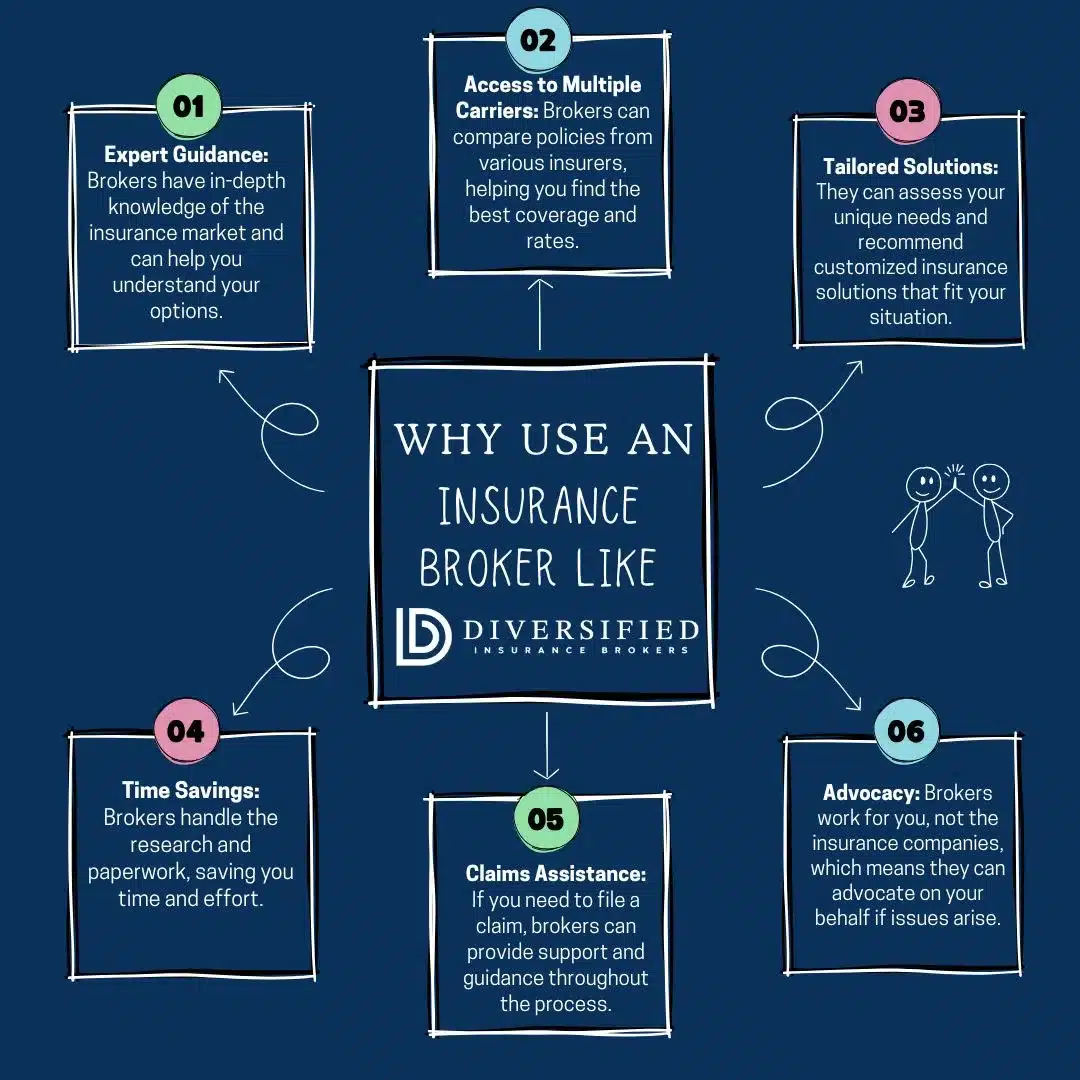

Why Use An Insurance Broker?

-

Insurance brokers aren’t tied to a single company—they work with a wide range of top-rated carriers. This means they can compare multiple policies side by side, helping you find the best coverage, price, and underwriting fit for your unique situation. Instead of settling for a one-size-fits-all solution, you get personalized options that truly match your needs and budget.

Need Insurance Guidance? Start Here with Expert Insights

Why work with Diversified Insurance Brokers?

With access to over 75 top-rated carriers and decades of experience, we go beyond quotes to deliver personalized advice, in-depth product knowledge, and expert service for life insurance, annuities, long-term care, Medicare, and more. Learn how our training and independence set us apart.

Get Answers to Your Biggest Insurance Questions

Wondering how much life insurance you really need? Confused about annuity options or how underwriting works for high-risk applicants? In this video, we answer the most common questions we hear from clients—and explain the real differences that matter when choosing coverage.

FAQs: About Diversified Insurance Brokers

Who is Diversified Insurance Brokers?

We’re an independent, family-owned insurance brokerage founded in 1980. Our team compares policies across 100+ top-rated carriers to help you find clear, competitive solutions for life insurance, annuities, long-term care, Medicare, and Social Security planning.

Are you tied to one insurance company?

No. We are fully independent and carrier-neutral. That means we shop multiple companies and present side-by-side options so you can choose the policy that best fits your goals and budget.

Do you work with clients nationwide?

Yes. We serve clients across the United States. If a product has state-specific availability, we’ll confirm eligibility and provide comparable alternatives when needed.

What types of insurance and planning do you offer?

We help with term and permanent life insurance, fixed and fixed indexed annuities, long-term care solutions (including hybrids), Medicare plan reviews, and Social Security timing strategies.

How are you compensated?

We’re typically paid by the insurance carrier if you choose a policy—there’s usually no additional cost to you. We disclose compensation when applicable and focus on transparent comparisons.

What makes your process different?

Clarity and comparison. We gather a brief profile, pre-screen where appropriate, and present curated options with plain-English pros and cons—no pressure, just guidance.

Can you review my existing policies?

Absolutely. We can evaluate current coverage, check guarantees, riders, costs, and suitability, and suggest keep-as-is, update, or replace scenarios when beneficial.

How do I get started?

You can book a free consultation, call 800-533-5969, or send a quick message from our contact page. We’ll outline next steps and what to have ready.