Does Working Past 65 Affect Social Security Benefits?

Does working past 65 affect Social Security benefits? Yes—how you work and when you claim can change both your near-term payments and your lifetime value. Working at 65 or later can temporarily reduce checks if you claim before Full Retirement Age (FRA), but it can also increase your benefit over time and earn Delayed Retirement Credits if you wait to file. This guide explains what changes (and what doesn’t) so you can choose the best timing for your situation.

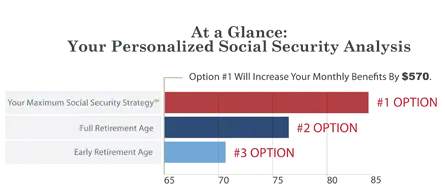

Get a Social Security Timing Review

Coordinate claiming age with work income, Medicare, and taxes for the highest lifetime value.

Working Past 65: What Actually Changes?

- Eligibility doesn’t change. You can claim as early as 62, at your FRA (66–67 depending on birth year), or delay to 70.

- Before FRA: If you’re working and claim early, the earnings test can temporarily reduce monthly checks when your wages exceed the annual limit (set by SSA and updated yearly). Those withheld amounts aren’t lost—SSA recalculates your benefit at FRA.

- At FRA or later: The earnings test ends. You can work and earn any amount with no reduction to monthly benefits.

- Delayed Retirement Credits: Waiting after FRA increases your benefit ~8% per year (simple) until age 70. See our guide on Delayed Retirement Credits.

Working Past 65 & Claiming Before FRA: The Earnings Test

If you file while still under FRA, Social Security withholds part of your benefit when your earnings exceed the annual limit. This reduction is temporary; when you hit FRA, SSA re-computes your payment to credit back the months withheld.

- Near-term impact: Smaller (or zero) monthly checks in high-earning months/years.

- Long-term impact: Higher payment after FRA due to recomputation.

- Strategy: If you plan to keep earning meaningful wages, consider waiting to file—especially if you’ll cross the earnings limit.

Working Past 65 & Claiming at FRA or Later: No Earnings Test

Once you reach FRA, you can earn any amount without a benefit reduction. If you delay filing, you also earn Delayed Retirement Credits through age 70, raising your permanent payment.

Can Working Raise Your Benefit?

Yes. SSA bases your benefit on your highest 35 years of indexed earnings. Additional years of higher income can replace lower or zero-earning years, increasing your Average Indexed Monthly Earnings (AIME) and your benefit—even if you’ve already started receiving checks (SSA performs annual recomputations).

Medicare at 65, HSAs, and Working

Medicare and Social Security are connected but not the same program. You can enroll in Medicare without filing for Social Security, or delay Part B if you have creditable employer coverage. Important considerations:

- HSA contributions: Once Part A is active, HSA contributions aren’t allowed (and Part A can start retroactively up to 6 months if you file for Social Security). Coordinate timing carefully.

- Part B timing: If your employer plan is creditable (generally 20+ employees), you can often delay Part B without penalty and enroll via a Special Enrollment Period later.

- Learn more: How Medicare & Social Security Work Together.

Taxes on Social Security While You Work

Your benefits may be taxable based on combined income (AGI + nontaxable interest + half of benefits). Working can push you into ranges where up to 85% of benefits are taxable. Smart coordination of withdrawals, Roth conversions, and annuity income can help manage brackets and IRMAA surcharges.

When Working Past 65 Makes Sense

- You earn well above the earnings test limit before FRA: Consider delaying filing and let Delayed Retirement Credits grow your check.

- You already reached FRA: You can work freely; decide whether to claim now or delay to 70 for a larger base benefit.

- You need coverage: Keep employer health insurance if it’s strong and creditable; coordinate Part B later.

- Longevity & survivor planning: Delaying the higher earner’s benefit can materially boost a future survivor benefit.

Helpful resources:

Schedule A Free Social Security Consultation

Optimize filing age, spousal/survivor benefits, and taxes with a personalized review.

Prefer to talk now? Call us 800-533-5969

FAQs: Working After 65 & Social Security

Does working past 65 reduce my Social Security?

Not automatically. Reductions apply only if you claim before FRA and earn above the annual limit. At FRA and beyond, there’s no earnings test.

Will I get the withheld money back?

Yes. SSA recalculates your benefit at FRA to credit back months withheld by the earnings test, raising your ongoing payment.

Can I delay Social Security but start Medicare?

Yes. You can enroll in Medicare without filing for benefits. If you delay Social Security, you’ll generally pay Part B premiums directly until benefits begin.

Should I delay to 70 if I’m still working?

Delaying can make sense if you have longevity expectations and don’t need the income now—your check grows with Delayed Retirement Credits. We’ll model both options.