Life Insurance Table Ratings Explained

Understand Your Life Insurance Table Rating

Learn how table ratings affect your premium, why they happen, and how to position your case for a better offer.

Life insurance table ratings are underwriting classifications used when an applicant does not qualify for Preferred or Standard pricing. Instead of declining coverage, the insurance carrier offers approval with an added surcharge to reflect higher perceived risk. That additional cost is structured in levels—commonly called tables—and each level increases the premium relative to Standard rates. While the concept can feel discouraging at first, a table rating is often an approval pathway rather than a rejection. In many cases, it creates access to meaningful coverage when a decline would otherwise occur.

Table ratings are most frequently tied to medical history, build, prescription patterns, lab results, driving history, or lifestyle factors. However, underwriting is not one-size-fits-all. Each insurance company has its own guidelines, risk tolerance, and pricing model. That means one carrier’s Table 3 may cost less than another carrier’s Table 2. The difference can be substantial over the life of a policy. For applicants who want to understand the broader framework of policy types and underwriting, reviewing our life insurance overview page can help establish context before comparing table-rated offers.

Most carriers structure table ratings on a scale that increases approximately twenty-five percent per level, though exact calculations vary. A Table 1 or Table A rating typically adds around twenty-five percent to Standard pricing. A Table 2 may add fifty percent, and higher tables increase incrementally from there. Some insurers use letters, others use numbers, but the underlying concept remains the same. The higher the table, the greater the premium adjustment. What matters most is not the label itself, but how that label translates into actual cost and whether another carrier might price your profile more favorably.

One of the most overlooked aspects of table ratings is how underwriting records are shared across the industry. When a formal application is submitted and a decision is rendered, that activity can create a record. For applicants who apply broadly without pre-screening, this can complicate future shopping. Understanding how underwriting data is tracked through industry systems is important, and you can learn more about that process in our guide explaining what MIB is in insurance. Strategic pre-screening often prevents unnecessary declines or overly harsh ratings from appearing on record.

Table ratings commonly arise from controlled but chronic medical conditions. Diabetes, treated hypertension, sleep apnea, elevated liver enzymes, autoimmune disorders, or cardiac history can all result in a substandard class depending on severity and control. In many cases, the diagnosis itself is not the sole determining factor. Underwriters evaluate trends, stability, compliance, and complications. Applicants with kidney-related history, for example, may receive significantly different offers depending on current lab stability and physician documentation. If renal history is part of your background, reviewing our underwriting breakdown on life insurance for kidney disease can provide insight into how carriers evaluate those risks.

How Life Insurance Table Ratings Affect Premiums

Most life insurance companies structure table ratings in incremental levels that increase pricing relative to Standard rates. While exact calculations vary by carrier, product, age, and state, the common framework increases approximately 25% per table level. The table below illustrates how most insurers apply substandard ratings.

| Table Level | Letter Equivalent | Typical Premium Increase* | Example if Standard = $100/month |

|---|---|---|---|

| Table 1 | Table A | +25% | $125/month |

| Table 2 | Table B | +50% | $150/month |

| Table 3 | Table C | +75% | $175/month |

| Table 4 | Table D | +100% | $200/month |

| Table 5 | Table E | +125% | $225/month |

| Table 6 | Table F | +150% | $250/month |

| Table 7 | Table G | +175% | $275/month |

| Table 8 | Table H | +200% | $300/month |

*Illustrative example only. Actual rating scales and premium calculations vary by insurance company, product design, underwriting class, age, gender, and state.

Keep in mind that a Table 2 offer from one carrier may still cost less than a Table 1 offer from another company because each insurer prices its Standard class differently. That is why comparing multiple carriers is essential when navigating substandard life insurance ratings.

Lifestyle factors also influence ratings. Multiple moving violations, DUIs, hazardous occupations, or aviation activity may lead to either a table rating or a flat extra. A flat extra differs from a table rating in that it is typically a temporary dollar charge per thousand of coverage. For example, an applicant may receive Standard rates with an added flat extra for a defined period following a recent medical event. Once the risk window closes, the extra charge may be removed, lowering the premium. Understanding whether a surcharge is permanent or time-limited can dramatically affect long-term cost planning.

Importantly, table ratings are not always permanent. Many carriers allow reconsideration if health metrics improve or additional stability is demonstrated. Updated labs, improved build, consistent follow-up care, and extended time since treatment can shift an applicant into a lower table or even back to Standard classification. Timing is often critical. Applying three months too early after a medical event can produce a higher rating than waiting until a six- or twelve-month stability benchmark is met. Strategic timing combined with carrier selection frequently produces better financial outcomes.

Policy structure also matters when navigating a table rating. Some applicants benefit from starting with term coverage to secure immediate protection at the lowest available cost, especially when convertible features are included. Convertible term allows future transition to permanent coverage without additional medical underwriting during the conversion window. This can be particularly useful when health improvement is expected. If you are weighing term options carefully, our detailed guide on choosing the best term life insurance policy provides additional planning considerations.

Applicants with substance history often assume coverage is unavailable, yet many carriers will consider stable recovery with sufficient time elapsed. The difference between a decline and a table rating often depends on documentation and carrier appetite. If that applies to your situation, reviewing underwriting expectations for life insurance with drug abuse history may clarify how stability timelines influence pricing outcomes.

Ultimately, the goal with any table rating is not simply to accept the first offer presented. It is to compare carriers, evaluate structure, consider timing, and determine whether improvement is realistic. An informed approach often reduces lifetime premium costs significantly. Establishing a baseline quote range is the first step, followed by careful case positioning.

Compare Life Insurance Quotes

Instant quotes provide a starting point for evaluating cost, but underwriting strategy determines the final offer. Begin by reviewing available pricing and then refine your approach based on your unique health and lifestyle profile.

If you prefer individualized guidance, you may request a personalized life insurance quote or begin with a secure online life insurance application.

Life Insurance Overview

Explore policy types, underwriting basics, and planning strategies on our comprehensive life insurance resource page.

Visit Life Insurance OverviewBest Term Life Insurance Policy

Learn how to structure term coverage effectively when navigating underwriting classifications or substandard ratings.

Read Term Life GuideWhat Is MIB in Insurance?

Understand how underwriting activity is recorded and why strategic pre-screening protects future applications.

Learn About MIBLife Insurance for Kidney Disease

See how carriers evaluate renal conditions and what improves underwriting outcomes over time.

View Renal Underwriting GuideLife Insurance with Drug Abuse History

Review stability timelines and documentation requirements that influence table ratings and approval decisions.

Explore Underwriting Guidelines

Talk With an Advisor Today

Choose how you’d like to connect—call or message us, then book a time that works for you.

Schedule here:

calendly.com/jason-dibcompanies/diversified-quotes

Licensed in all 50 states • Fiduciary, family-owned since 1980

FAQs: Life Insurance Table Ratings

What is a life insurance table rating?

A life insurance table rating is a surcharge above Standard pricing used when an applicant’s risk is higher than average. The table level indicates how much extra cost is added, often in steps that are commonly illustrated as about 25% per table (depending on the carrier).

How many table ratings are there?

Most carriers use 8 table levels, commonly shown as 1–8 or A–H. Some companies use different internal scales, but the concept is the same: higher tables generally mean higher surcharges.

Can a table rating improve later?

Often, yes. Many carriers will consider reconsideration after issue if your labs improve, your condition remains stable, or more time passes since treatment or a major medical event. Timing and documentation are key, and improvements are sometimes possible within 6–12 months depending on the situation.

What’s the difference between a table rating and a flat extra?

A table rating is typically a percentage surcharge on Standard premiums, while a flat extra is a dollar charge per $1,000 of coverage—often applied for a set number of years when the carrier views the elevated risk as time-limited.

Do all companies use the same scale and pricing?

No. While the table labels (A–H or 1–8) are common, underwriting thresholds and pricing vary by carrier, product, age, and state. That’s why shopping carriers and pre-screening can materially improve outcomes.

Does a table rating always mean I’m stuck with expensive coverage?

Not necessarily. In many cases, the right carrier selection can reduce cost at the same table, and some situations allow for reconsideration later. Also, a short flat extra can sometimes be cheaper than a higher permanent table, depending on the risk pattern.

What’s the smartest first step if I think I’ll be table rated?

Start with a pre-screen whenever possible. It helps identify the most favorable carriers before you submit a full application and can reduce the chances of unnecessary declines or overly steep offers that complicate later shopping.

About the Author:

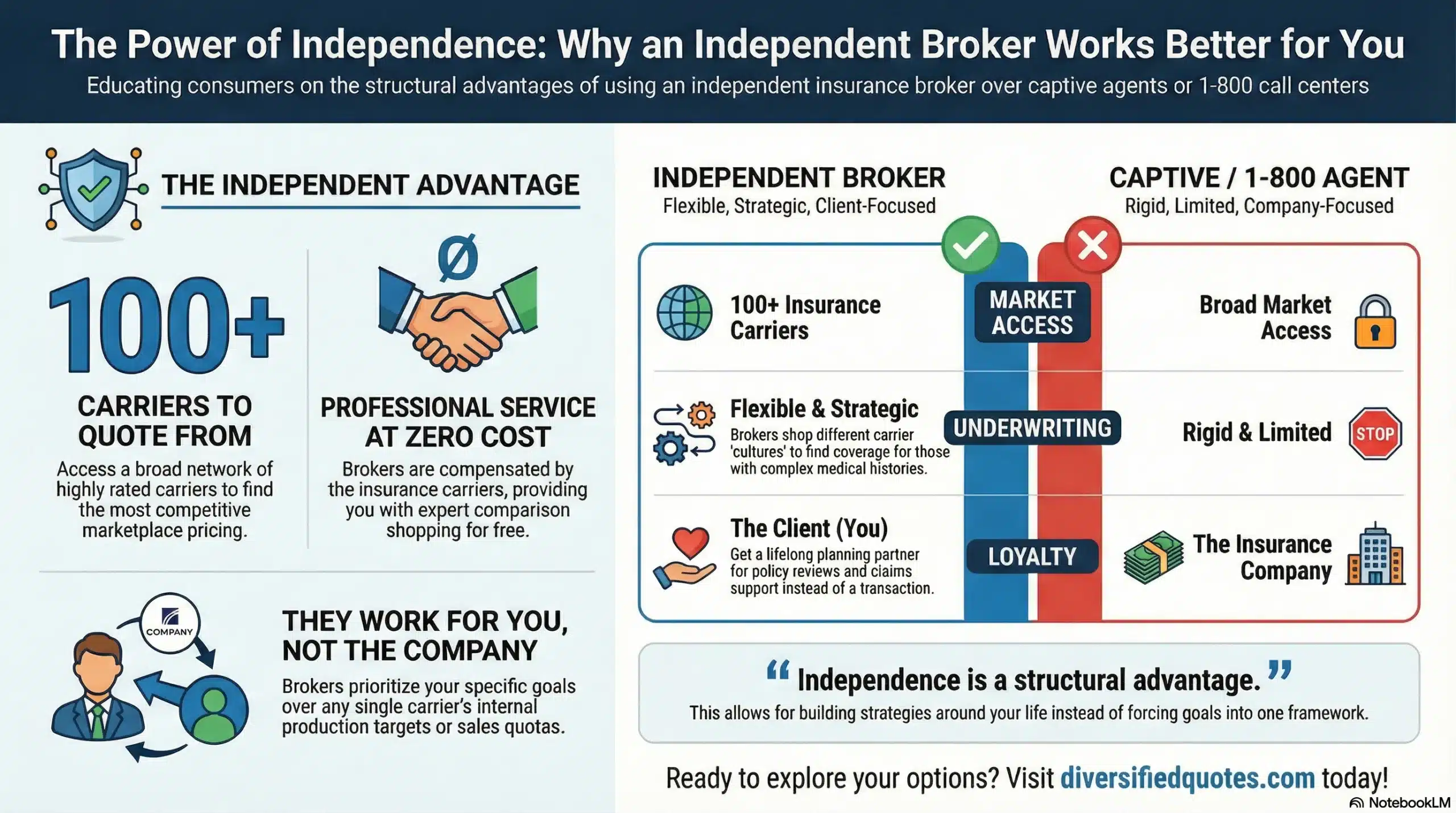

Jason Stolz, CLTC, CRPC, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.