Lifetime Income Annuity Options

Over 100 Annuity Carriers to Quote From. Here are a few of them!

Planning for steady income in retirement starts with the right strategy. At Diversified Insurance Brokers, we help retirees and pre-retirees explore a wide range of lifetime income annuity options to create a reliable paycheck they can’t outlive. With decades of experience and access to over 100 top-rated carriers, we compare multiple products side-by-side to find the solution that fits your exact needs. Whether you want maximum guaranteed income, flexibility, or inflation protection, we’ll help you choose the right approach and make the process simple.

💡 What Is a Lifetime Income Annuity?

A lifetime income annuity is a financial product designed to provide guaranteed payments for as long as you live. You can choose to start income immediately or at a future date, making it a flexible tool for retirees and those still planning ahead. The payments can be structured for a single individual or for joint lifetimes, ensuring a surviving spouse continues receiving income.

🔍 Common Lifetime Income Annuity Options

- Immediate Income Annuities: Start payments right away, often within 30 days of purchase—ideal for those retiring now.

- Deferred Income Annuities: Delay income for years to increase the payout amount when payments begin.

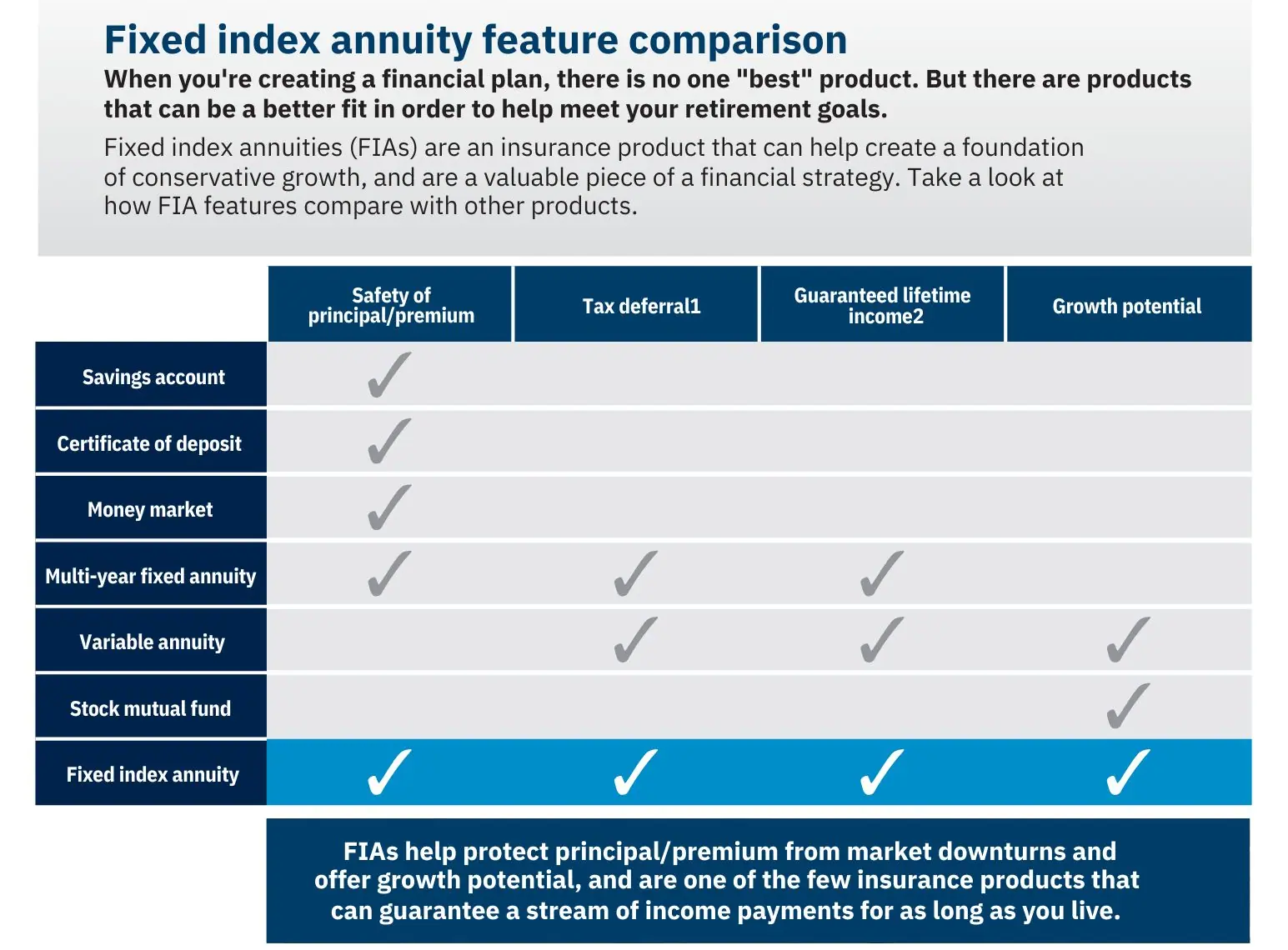

- Fixed Indexed Annuities with Income Riders: Provide lifetime income with potential for growth linked to an index.

- Inflation-Adjusted Annuities: Payments that grow over time to help offset the rising cost of living.

- Joint-Life Annuities: Designed for couples, ensuring income continues for both spouses’ lifetimes.

📊 Example Scenario

Let’s say you’re 62 and plan to retire at 67. You invest $300,000 into a deferred lifetime income annuity. By the time you start payments at age 67, your monthly income could be significantly higher than if you had started right away—sometimes 40–50% more—depending on current rates and the product chosen. If you choose a joint option, payments would continue for your spouse’s lifetime as well.

🎯 Who This Is a Good Fit For

- Retirees who want a predictable monthly income they can’t outlive

- Individuals concerned about market volatility affecting retirement savings

- Couples who want to ensure income continues for both lives

- Those looking for a “pension replacement” in the absence of an employer plan

📌 Why Work With Diversified Insurance Brokers

- We shop the market across 100+ carriers to find the best payout rates

- Customized planning to align income start dates with your retirement goals

- Expertise in balancing guaranteed income with liquidity and growth

- Clear, transparent comparisons so you know exactly what you’re getting

🚀 Benefits of a Lifetime Income Annuity

- Removes the fear of running out of money

- Can be combined with other income sources for a well-rounded plan

- May include death benefit provisions for beneficiaries

- Helps maintain financial independence and stability

With so many lifetime income annuity options available, the key is finding the right fit for your needs and lifestyle. Our team will walk you through the choices, explain the benefits, and help you lock in the income you need for peace of mind in retirement.

FAQs: Lifetime Income Annuity Options

What is a lifetime income annuity?

A lifetime income annuity is a contract where you give a lump sum (or series of payments) to an insurance company, and in return you receive regular income payments for the rest of your life.

What types of lifetime income annuities are common?

Some common types include: immediate annuities (payments start right away), deferred income annuities (payments begin later), fixed vs variable annuities, and joint & survivor options (to cover a spouse).

How does “period certain” work with lifetime annuity?

“Lifetime income with period certain” means you get income for your lifetime, and if you die early, payments continue for a guaranteed minimum period to your beneficiary. There is also “period certain only,” which pays for a set number of years regardless of life status.

What is an enhanced or impaired annuity?

That’s a version of lifetime income annuity offering higher payouts if your life expectancy is shorter than average (due to health issues, risky occupations, or lifestyle). The insurer adjusts premium/payout based on those risk factors.

How do fixed and variable annuities compare for lifetime income?

Fixed annuities offer guaranteed income and are not subject to market swings. Variable ones allow growth potential (investment‐based), but payouts can vary depending on investment performance. Fixed tend to be safer; variable potentially higher but riskier.

What is a joint & survivor annuity?

This option provides income for your lifetime, and then continues (often at a lower rate) for your spouse (or another designated person) after your death.

What are the trade-offs of choosing lifetime income annuities?

You gain income certainty and protection against outliving your savings, but you may lose liquidity (can’t access the lump sum easily), give up some control, and your heirs may receive less after you die if you selected “life only” versions.

How do age, gender, and timing affect payouts?

Younger purchasers or those who delay payouts earn higher payments later; gender can affect rate outcomes (often due to life expectancy differences). Starting payments later generally increases the monthly income you receive.

Are there riders or options to protect beneficiaries?

Yes. Riders such as period-certain, refund options (guaranteed minimum total payouts), or joint & survivor ensure some benefit to heirs. You can also include inflation riders or cost-of‐living increases.

When is a lifetime income annuity the right choice?

If you want guaranteed steady income that you can’t outlive, have enough funds to allocate without needing access to everything, and want peace of mind versus market risk/investment management worries. It helps cover essential expenses in retirement.

Talk With an Advisor Today

Choose how you’d like to connect—call or message us, then book a time that works for you.

Schedule here:

calendly.com/jason-dibcompanies/diversified-quotes

Licensed in all 50 states • Fiduciary, family-owned since 1980

About the Author:

Jason Stolz, CLTC, CRPC, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.