What is Annuity Suitability?

What is annuity suitability? In plain English, “suitability” means the annuity being recommended should be a good fit for your goals, time horizon, risk tolerance, liquidity needs, and financial situation. Most states use the NAIC Annuity Model (adopted with state-specific rules) that requires producers to gather your information, compare options, disclose material features and trade-offs, and document why a recommendation aligns with your best interest under the rule adopted in that state.

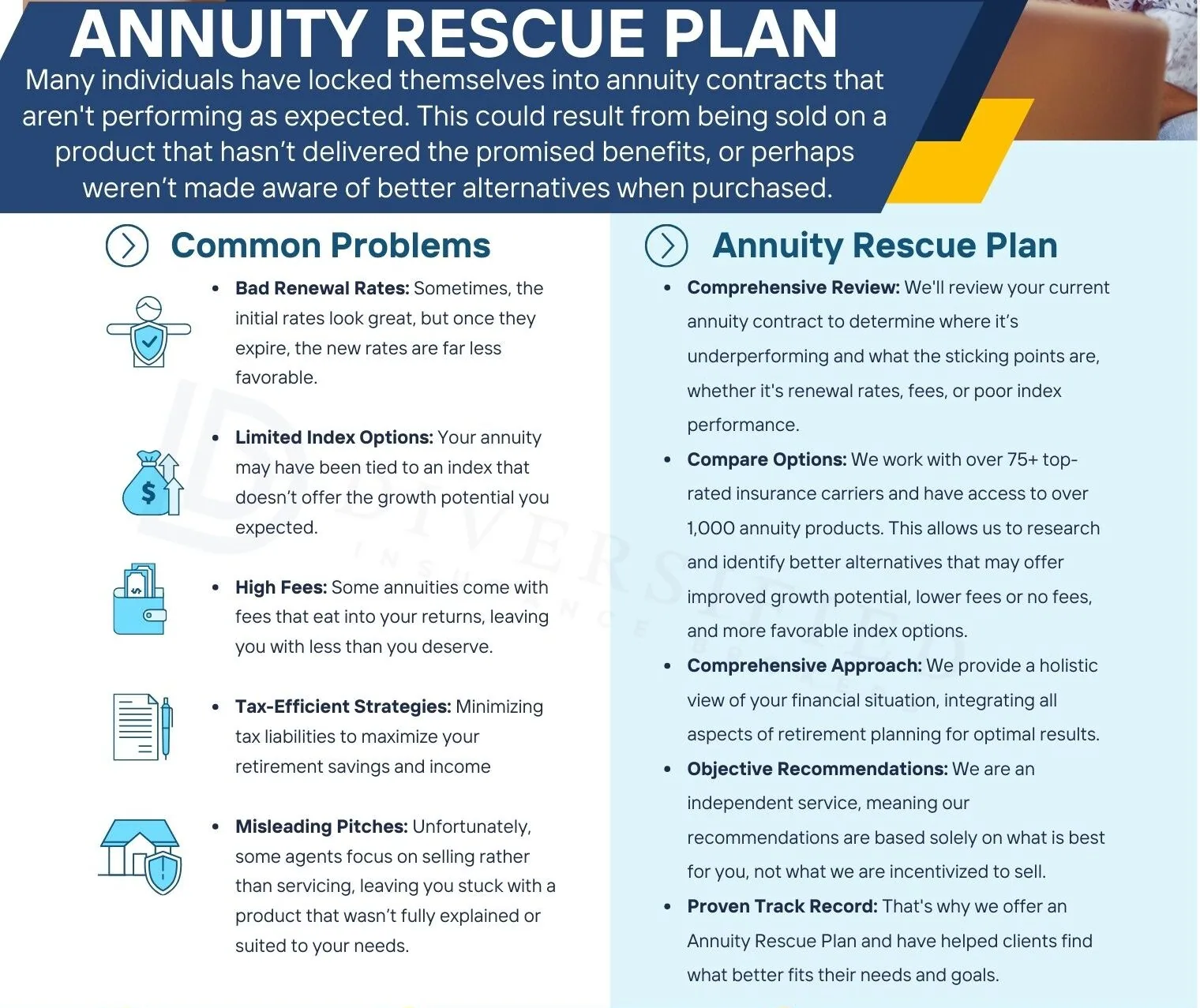

Get a Suitability-First Comparison

We review income needs, liquidity, risk tolerance, and timelines—then compare options across 100+ carriers.

What Information Goes Into Annuity Suitability?

- Goals & use-case: Lifetime income, principal protection, legacy, or a time-certain payout.

- Time horizon: When you’ll need income and for how long.

- Risk tolerance & capacity: Comfort with market variability and ability to absorb risk.

- Liquidity needs: Expected withdrawals, emergency reserves, and surrender-charge awareness.

- Financial profile: Income, assets, debts, tax bracket, other retirement resources (e.g., Social Security, pensions).

- Health & longevity factors: Can affect the value of lifetime-income features.

- Tax status of funds: Qualified (IRA/401(k)) vs non-qualified (after-tax) can change how distributions are taxed.

What Your Producer Must Do

- Gather and document your relevant profile and objectives.

- Explain material features—crediting method, caps/participation, riders and costs, surrender schedule, free withdrawals, and fees.

- Compare reasonably available options and recommend one that fits your profile and goals.

- Disclose conflicts/compensation and provide clear, plain-English rationale for the recommendation.

- Provide documentation you can keep—summary of why the product aligns with your needs.

Suitability vs. Best Interest vs. Fiduciary

| Standard | Who It Applies To | What It Means | When It Applies |

|---|---|---|---|

| NAIC Annuity Best Interest (state-adopted) | Insurance producers | Act in the consumer’s best interest; gather data, compare, disclose; manage conflicts. | At the time of annuity recommendation/sale |

| Suitability | Insurance/brokerage contexts | Recommendation must fit the client’s profile; fewer ongoing obligations. | At the time of sale/recommendation |

| Fiduciary (RIA) | SEC-registered investment advisers | Ongoing duties of loyalty & care; avoid/mitigate conflicts; client-first across the relationship. | Throughout advisory engagement |

When an Annuity May Be Unsuitable

- Short time horizon and you’ll likely need most funds before surrender charges end.

- Insufficient emergency savings—tying up too much cash could strain liquidity.

- Mismatched goals—e.g., buying accumulation-only when you truly need guaranteed lifetime income (or vice versa).

- Stacked fees for riders you won’t use.

- Replacement issues—swapping an existing annuity without a clear, documented benefit relative to costs and lost features.

Replacements, Surrender Charges & Free-Look

If you already own an annuity, any recommendation to replace it requires a side-by-side comparison: surrender charges, lost benefits/bonuses, new features, and net projected value. You also receive a state-mandated free-look period on new policies—use it to confirm the contract matches your expectations.

How We Apply a Suitability-First Process

- Discovery: We document goals, timelines, income needs, liquidity, and taxes.

- Compare across 100+ carriers: Fixed annuities (MYGAs), Fixed Indexed Annuities, and income-rider solutions.

- Model outcomes: Illustrate guaranteed values, income, liquidity, and—if relevant—inflation-adjusted options.

- Explain trade-offs: Caps/participation, surrender schedule, rider costs, and taxes in plain English.

- Document the “why”: Provide a written rationale you can keep for your records.

FAQs: Annuity Suitability

What documents will I be asked to provide?

Can I still access my money?

Do income riders always make sense?

Is a replacement a red flag?

How long do I have to change my mind?

Schedule a Free Suitability Review

We’ll align product features with your goals—and document the rationale for a clear decision.

Prefer to talk? Call 800-533-5969

Compare Annuities Across 100+ Carriers

See guaranteed values, income options, liquidity, and costs—side by side.

Request Your Personalized Quote

Questions? Call 800-533-5969

About the Author:

Jason Stolz, CLTC, CRPC, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.