High Risk Life Insurance Playbook

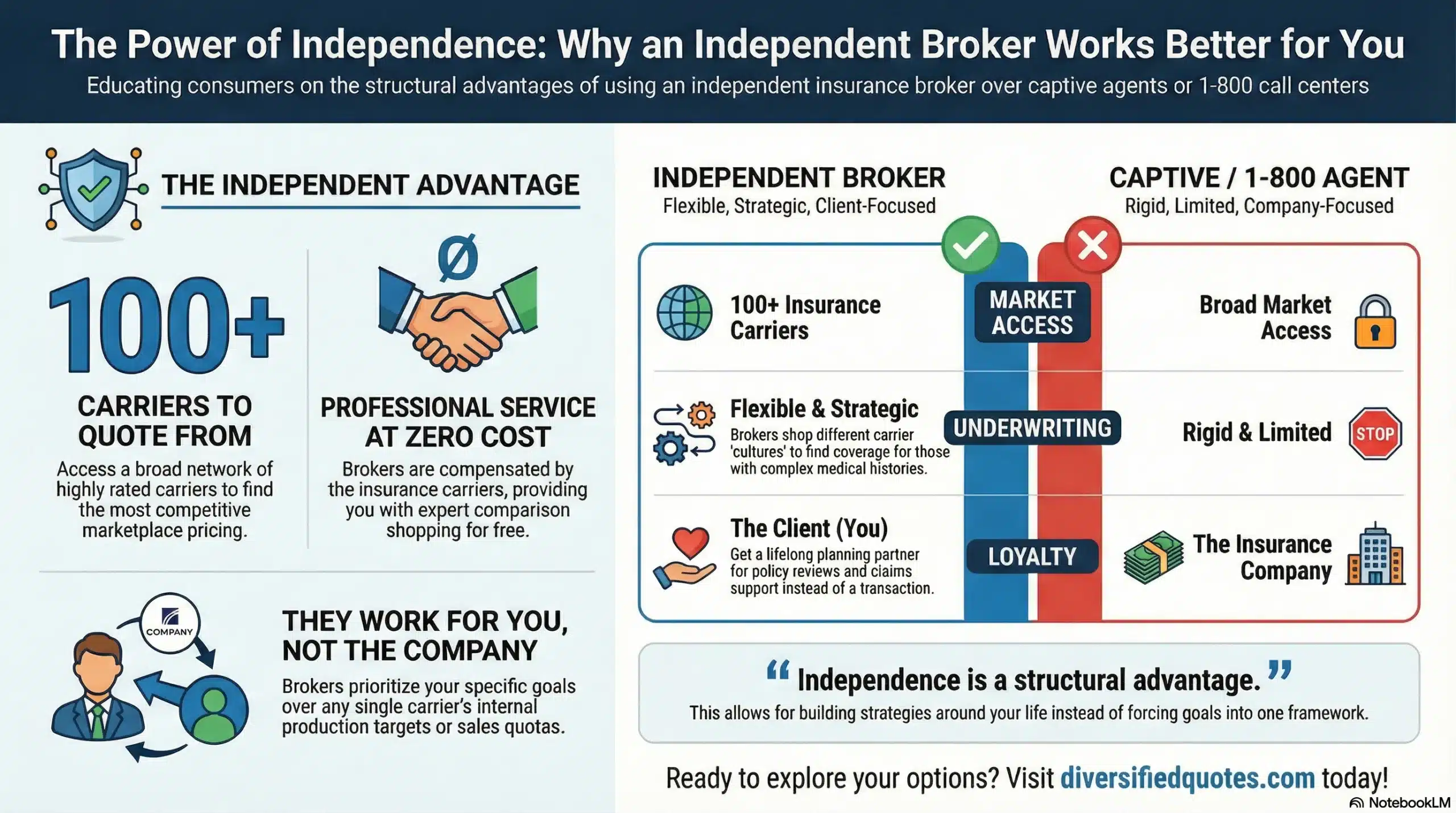

At Diversified Insurance Brokers, we specialize in helping clients secure life insurance even when other agents or companies have said “no.” Our High Risk Life Insurance Playbook is designed to guide individuals with medical conditions, hazardous occupations, lifestyle factors, or other challenges through the process of finding the right coverage at the best possible rates. With access to more than 100 top-rated carriers and decades of underwriting experience, we know exactly which companies are most likely to approve your application and how to present your case in the most favorable way.

High-Risk Life Insurance Playbook

If you’ve ever been declined, rated, postponed, or told you’re “uninsurable,” this High-Risk Life Insurance Playbook was built for you. At Diversified Insurance Brokers, we specialize in complex underwriting cases—medical conditions, hazardous occupations, lifestyle risks, and prior substance history—and we match each client to the carrier most likely to approve them at the best possible rate. While many online platforms rely on quick, automated decisions (such as simplified instant-issue models like instant decision term programs), high-risk cases require strategy, nuance, and deep underwriting relationships. This guide walks you through how carrier selection works, how to prepare your medical file before applying, how to recover after a decline, and how to structure coverage when traditional underwriting is challenging.

High-risk does not mean high-cost by default. It means your case must be positioned correctly. Insurance companies specialize. One carrier may decline a cardiac case within five years of a heart attack, while another may offer standard rates after stable follow-ups and compliant medication use. One insurer may heavily surcharge private aviation; another may treat it more favorably with documented flight hours and certifications. Our job is to understand the underwriting manuals, informal inquiry systems, and medical director preferences that determine your outcome. Instead of submitting applications blindly, we pre-screen cases confidentially and submit to the carrier most aligned with your risk profile.

Get a Confidential High-Risk Case Review

Before you apply, let our underwriting team evaluate your case and match you with the right carrier.

What’s Inside the Playbook

Inside, you’ll learn carrier-matching strategies that dramatically improve approval odds. Not all insurers treat diabetes, heart disease, cancer history, kidney disorders, or autoimmune conditions the same. We outline how stability periods, A1C ranges, medication compliance, and specialist follow-ups influence rating classes. You’ll also see how lifestyle factors—tobacco use, scuba diving, skydiving, international travel, or private aviation—are evaluated differently depending on frequency and documentation. We break down how occupational risks (commercial pilots, offshore oil workers, firefighters, law enforcement, and construction supervisors) are underwritten and when flat extras versus table ratings apply.

The guide also details alternative policy types. For applicants with recent diagnoses or severe medical history, we explain when graded benefit policies or guaranteed issue options make sense—and when they don’t. If your health has changed since you first bought coverage, you may also explore converting existing term insurance through options explained in our term conversion guide. In some cases, partial conversion combined with new coverage offers a balanced, cost-effective solution.

Common High-Risk Categories Covered

Medical Conditions: heart disease, prior heart attack, stents, bypass surgery, diabetes (Type 1 and Type 2), cancer history, COPD, sleep apnea, kidney disorders, neurological disorders, and more. We explain how years since diagnosis, treatment adherence, lab trends, and follow-up reports influence underwriting decisions.

Lifestyle Risks: tobacco use, nicotine alternatives, hazardous hobbies, private aviation, high-altitude climbing, and certain travel destinations. We outline strategies for minimizing premium impact, including documentation and structured questionnaires.

Occupational Risks: commercial aviation, offshore drilling, high-rise construction, firefighting, law enforcement, and executive international travel. Some carriers specialize in these markets—we show you how to find them.

Substance Use History: alcohol or drug abuse history, sobriety milestones, treatment documentation, and relapse timelines. We explain how different carriers treat recovery periods and how to apply after documented stability.

Compare Your Options Instantly

Run live quotes, compare term lengths, and evaluate alternatives before submitting a formal application.

Example Scenarios

A 52-year-old with a prior heart attack approved at standard rates after we matched him to a cardiac-friendly carrier with strong post-event stability guidelines. A commercial pilot securing a seven-figure policy despite aviation exposure because we positioned flight logs correctly. A recovering alcoholic approved three years after sobriety due to documented compliance and specialist follow-ups. These are not exceptions—they are outcomes driven by strategy.

We also address what to do after a decline. Many applicants make the mistake of immediately reapplying elsewhere without correcting the underlying issue. That can create a negative paper trail. Instead, we analyze the decline reason, gather missing documentation, and reposition the case properly. In certain circumstances, layering coverage—combining traditional underwriting with guaranteed options—can create immediate protection while improving insurability over time.

Download the High-Risk Life Insurance Playbook

Get the step-by-step strategies used to secure approvals in complex cases.

Why Work With Diversified Insurance Brokers?

Experience matters in high-risk underwriting. We work with more than 100 A-rated carriers, allowing us to compare offers and underwriting philosophies before you commit to a formal submission. Our process is confidential, strategic, and efficient. We believe no one should assume they are uninsurable without a thorough review. If you have complex needs, start with our dedicated high-risk life insurance specialists and build your case the right way from the beginning.

Talk With an Advisor Today

Choose how you’d like to connect—call or message us, then book a time that works for you.

Schedule here:

calendly.com/jason-dibcompanies/diversified-quotes

Licensed in all 50 states • Fiduciary, family-owned since 1980

High-risk life insurance typically applies to applicants with serious medical conditions (heart disease, diabetes, cancer history), hazardous occupations, risky hobbies, or prior substance use. If you’ve been declined or heavily rated before, you likely fall into this category. Learn more about underwriting strategy on our high-risk life insurance services page.

Yes. A decline often means the wrong carrier was chosen. Different insurers specialize in different risk profiles. Before reapplying, review common positioning mistakes in our guide to life insurance buying mistakes to avoid creating multiple negative records.

If your policy includes a conversion rider, you may be able to convert some or all of your term coverage to permanent insurance without a new medical exam. See how it works in our term-to-permanent conversion guide.

Guaranteed issue life insurance can provide coverage without medical underwriting, but it usually has graded benefits and higher premiums. It’s often used as a last-resort or supplemental solution within a broader high-risk strategy.

Comparing term lengths, riders, and pricing before submitting a full application helps you avoid unnecessary declines. You can start with our life insurance calculator to estimate coverage needs and premium ranges.

About the Author:

Jason Stolz, CLTC, CRPC, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.