Annuities as a Life Insurance Alternative

Annuities as a Life Insurance Alternative

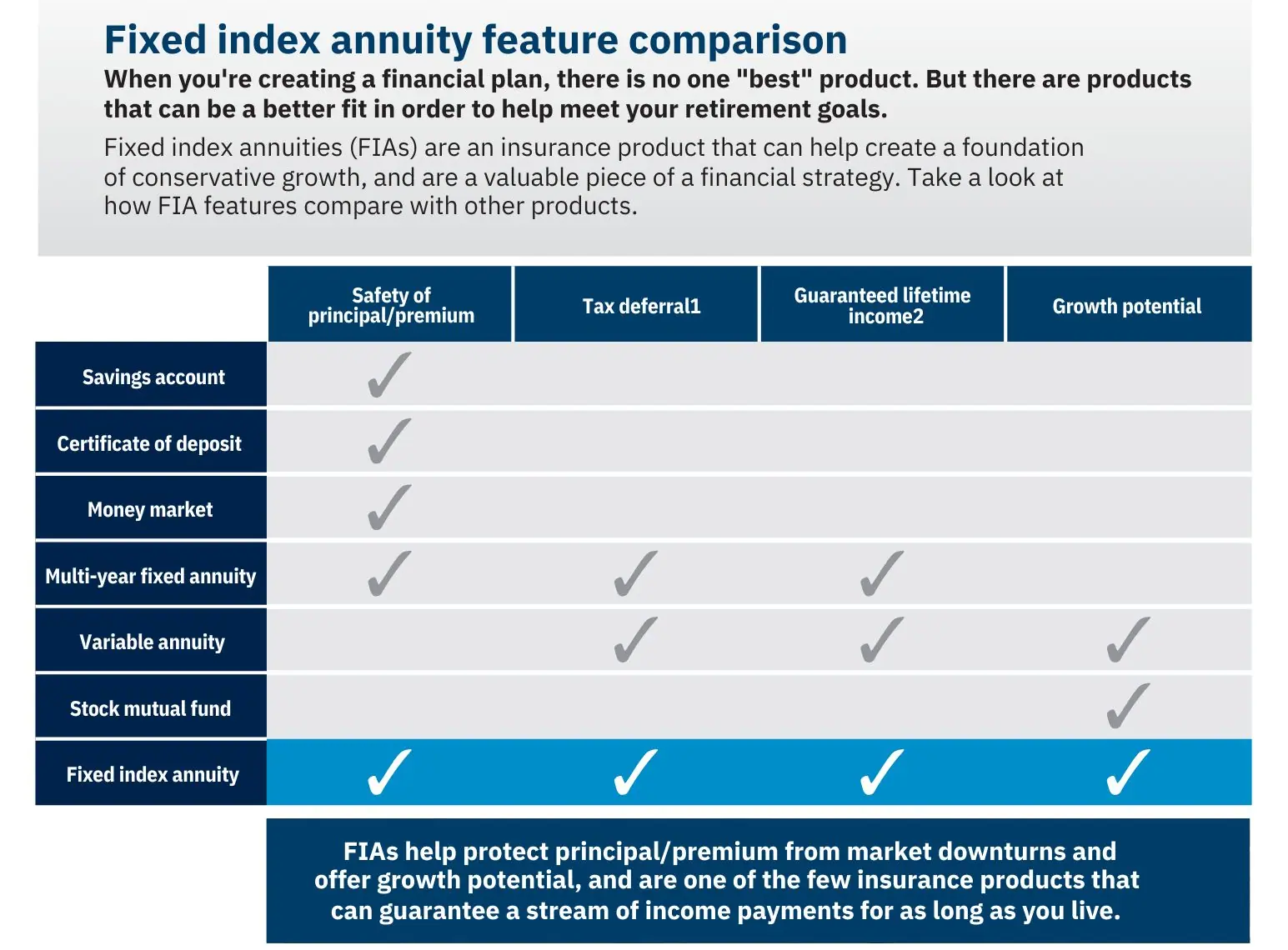

If you’ve been denied traditional life insurance due to age or health conditions, you’re not out of options. A fixed indexed annuity can serve as a secure and accessible alternative—no medical underwriting required. These annuities offer guaranteed growth, protection from market losses, and payout options that can benefit your loved ones. Whether you’re focused on building a financial legacy or ensuring your family’s stability, an annuity can help you provide long-term value and peace of mind—even without a life insurance policy.

Why Choose A Fixed Indexed Annuity as a Life Insurance Alternative?

📈 Want to See Today’s Top Annuity Rates?

Explore the most competitive fixed and bonus annuity rates available now.

👉 Check Current Annuity Rates

-

For many people with serious or chronic health conditions, traditional life insurance can be difficult—or impossible—to obtain. Medical underwriting often leads to denials or unaffordable premiums, leaving high-risk individuals without a way to protect their families financially. Annuities, however, offer a solution. Because they don’t require medical exams or underwriting, annuities allow individuals to build a secure financial legacy regardless of their health. It’s a powerful alternative for those who’ve been turned away by life insurance but still want to leave something meaningful behind.

Use the calculator below to determine your guaranteed lifetime income

Additional Benefits

-

Many annuities offer optional income riders that grow the Benefit Base over time—potentially increasing both your retirement income and the death benefit passed to your heirs. If you choose to activate the rider, it can provide a guaranteed stream of income for life. If unused, the accumulated Benefit Base may be used to deliver a larger death benefit, creating a more substantial financial legacy. This dual-purpose feature makes annuities a smart choice for those who want to protect their own future while enhancing what they leave behind.

No Obligation Consultation

Annuities offer a flexible and secure way to leave a lasting financial legacy—especially for those who may not qualify for traditional life insurance. With growth potential, principal protection, and a variety of payout options, they serve as a reliable alternative for individuals facing medical underwriting challenges.

In addition to legacy planning, annuities can provide guaranteed lifetime income, tax advantages, and valuable estate planning features that help you protect and pass on more of what you’ve built.

Ready to explore whether an annuity fits your legacy goals?

Schedule a free, no-obligation consultation today to review your options with an experienced advisor.

📞 Call us at 770-662-8510

📅 Book your appointment with Jason here

Or visit our Contact Page: https://www.diversifiedquotes.com/contact-us/

Annuities as a Life Insurance Alternative: A Smarter Way to Protect and Grow Your Assets

If you’ve been declined for life insurance or are looking for a simpler, more flexible way to leave a legacy, annuities might offer the solution you didn’t know existed. Certain annuities provide death benefits, income guarantees, and tax advantages—without the need for medical underwriting. In this overview, we’ll explain how annuities can serve as a powerful life insurance alternative for retirees, high-risk individuals, or anyone seeking asset protection and peace of mind.

Could an Annuity with a 50% Bonus be a Life Insurance alternative for you? Find out below.

Could an Annuity with a Bonus be a Life Insurance alternative for you? Learn more below.

FAQ: Life Insurance Alternatives

What are some alternatives to traditional term life insurance?

When might a life insurance alternative be better?

How much more expensive are alternatives compared to term policies?

Can life insurance alternatives provide income or investment value?

Are there downsides or risks to choosing a life insurance alternative?

How do I choose the right alternative?