Life Insurance for Construction Workers

Jason Stolz CLTC, CRPC

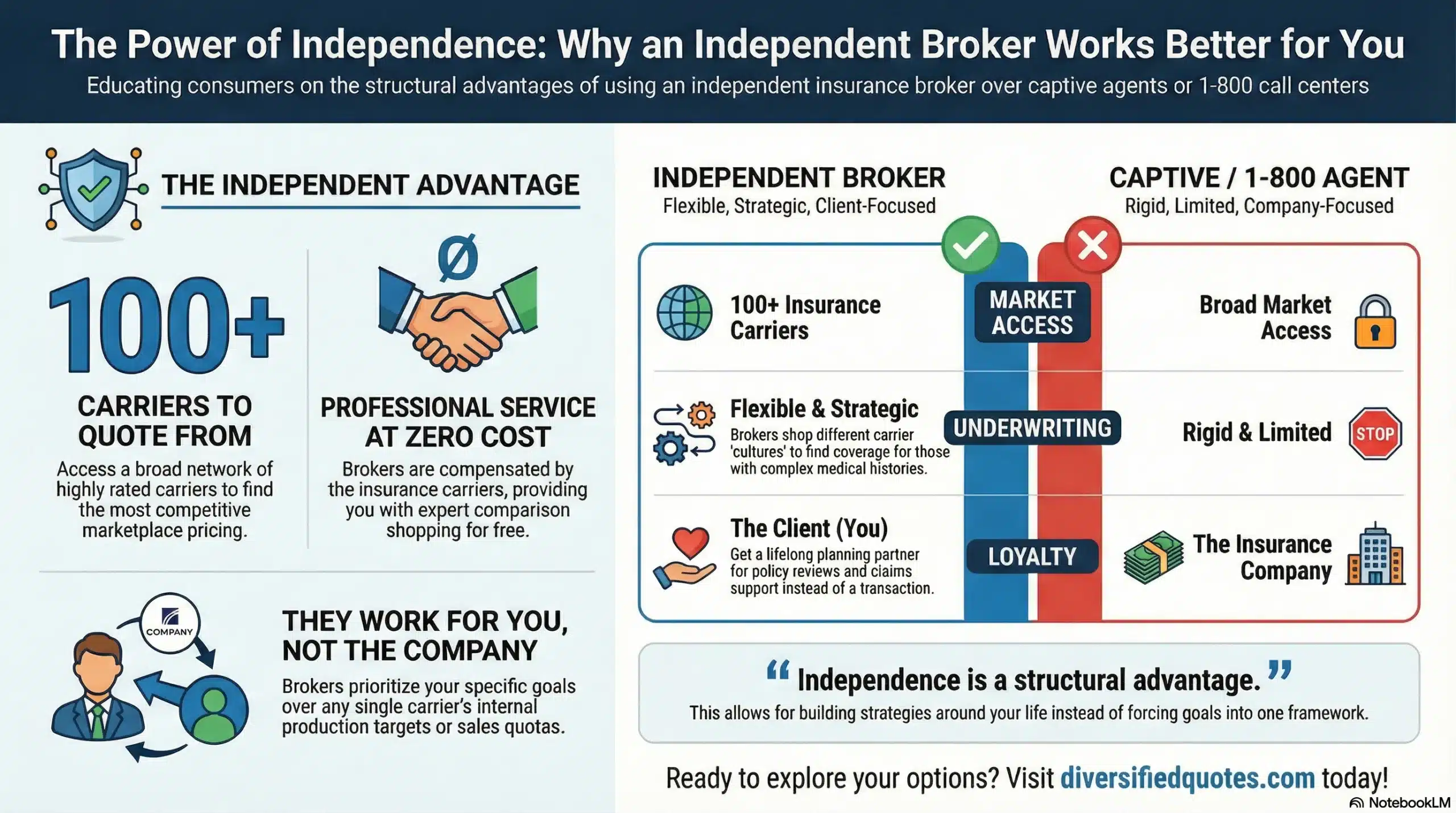

Life Insurance for Construction Workers matters because construction is essential work—and it can carry real risk. The right policy can replace income, keep the mortgage paid, protect your family’s day-to-day lifestyle, and fund long-term goals. At Diversified Insurance Brokers, our advisors compare coverage from 100+ top-rated carriers nationwide to help construction professionals (craft workers, foremen, heavy equipment operators, ironworkers, electricians, roofers, concrete crews, supervisors, estimators, and project leaders) get the right coverage at the right price.

The biggest mistake we see is treating “construction” like one underwriting category. Carriers don’t do that. They price based on your specific trade, daily duties, exposure level (heights, confined space, heavy equipment, demolition, excavation, underground work), and whether you’re primarily hands-on, supervisory, or office-based. One carrier may rate a job heavily while another prices it more reasonably—especially when your role is well-defined. If you want a broader overview of hazardous job categories and how they’re usually classified, start here: Life Insurance for High-Risk Occupations.

Compare Life Insurance for Your Trade

Instant quotes first—then a quick, no-pressure review with a licensed advisor who understands construction underwriting.

Compare Life Insurance Schedule a Consultation Call 800-533-5969

Instant Quotes for Construction Worker Life Insurance

Start with instant pricing, then we’ll verify your trade classification and shop carriers that fit your duties.

Why Construction Workers Buy Life Insurance

Construction income is often the engine that powers everything else: the mortgage, vehicles, childcare, health insurance, and long-term savings. Life insurance is the tool that keeps the plan intact if something happens to you. The most common reasons construction professionals buy coverage include:

Income replacement. If you’re the primary earner, your family may need years of income to maintain stability.

Mortgage and debt protection. Many families want the home paid off and major debts eliminated so the household can stay afloat.

Family goals. College funding, childcare costs, and keeping day-to-day life consistent are common planning drivers.

Business continuity. If you own a company or have partners, life insurance can support buy-sell planning or key person coverage when you’re critical to operations.

The key is matching the coverage to the timeline of your obligations. That’s why term life is so popular in the trades: it delivers the most death benefit per dollar for the years your family needs it most.

How Construction Jobs Are Classified (And Why It Matters)

In underwriting, “construction worker” is not specific enough. Carriers price on what you actually do day to day—and they’re looking for measurable risk signals: heights, equipment, confined space, demolition, underground work, roadwork exposure, travel to remote sites, and how often you’re hands-on versus supervisory.

A few examples of how classification differences can affect pricing:

Supervisor vs hands-on. A working foreman who is on the tools 70% of the time will often price differently than a supervisor who is mostly oversight and paperwork.

Heights exposure. Roofers, tower crews, structural steel, and bridge work can trigger additional occupational rating depending on typical and maximum heights.

Heavy equipment and road exposure. Operators may be rated differently depending on whether they’re operating on private sites versus roadside/highway environments.

Underground/confined space. Tunneling, mining-related work, confined spaces, and certain utility work can reduce carrier options—so shopping matters even more.

This is why we start with your duties first, not your job title. The goal is to tell the underwriting story accurately and consistently, so you’re classified correctly and not overcharged due to a vague description.

Underwriting & Eligibility: What Carriers Look For

Most carriers evaluate construction risk using a combination of occupational questions and your overall health profile. When you work with Diversified Insurance Brokers, we “pre-map” your case to carriers that tend to treat your trade more favorably, so we avoid unnecessary declines and keep pricing competitive.

1) Duties and exposure (the real drivers)

Carriers may ask: your trade, union classification (if applicable), percent of time on site, percent supervisory/administrative, and your highest-risk tasks. Common high-impact details include:

- Heights: typical and maximum heights; ladders vs scaffolding vs structural steel; frequency of exposure

- Equipment: cranes/rigging, heavy equipment, lifts, specialty machinery, and whether you operate or only work around it

- Demolition/explosives: any blasting, hazardous materials exposure, or high-risk demolition environments

- Excavation/trenching: depth, frequency, and confined space work

- Underground/tunneling: jobsite environment and safety protocols

- Travel/remote sites: long commutes, frequent out-of-state work, or remote project locations

- Commercial driving: CDL use, DOT physicals (if applicable), and driving history

2) Safety culture and training

Safety doesn’t just matter on the job—it can help underwriting confidence. Many carriers respond better when the application shows structured training and consistent protocols. Examples that can help include OSHA training, documented PPE requirements, and specialized certifications relevant to your role.

3) Driving history and lifestyle risks

Construction professionals often drive more (job sites, equipment, travel crews), so driving history can meaningfully impact pricing. Carriers also consider higher-risk hobbies (certain motorsports, aviation, climbing) separately from occupation. If anything in your file is borderline, carrier selection becomes even more important.

4) What if you were declined elsewhere?

Declines in construction are often not “you’re uninsurable.” They’re frequently a mismatch: the wrong carrier, vague duty descriptions, or a medical factor that needs to be framed correctly. If you want to understand how the medical side is evaluated across conditions, this overview is helpful: Life Insurance with Pre-Existing Conditions.

Medical Factors That Affect Pricing (Even More Than Your Trade)

Occupational class matters, but your rate is still driven heavily by your health profile. Underwriting is cumulative. A “moderate” job risk plus excellent health can price well. A “moderate” job risk plus untreated blood pressure or nicotine use can get expensive quickly.

Blood pressure, cholesterol, and build

Carriers commonly focus on blood pressure, lipid profile, and build. If you’re applying with an exam, those numbers are measured and verified. If you’re unsure what the exam process looks like (and what gets tested), this guide walks through the typical process: What Is a Life Insurance Exam?.

Nicotine and tobacco

Nicotine use is one of the biggest pricing levers in life insurance. Cigarettes, vaping, chewing tobacco, and nicotine replacement often trigger “tobacco” classes with many carriers. If you do not use cigarettes and do not have ongoing nicotine exposure, many companies can still offer non-tobacco pricing depending on your situation. If you use tobacco regularly (or have nicotine-positive labs), pricing typically changes materially.

Sleep apnea, diabetes, and common trade-related conditions

Sleep apnea (especially when untreated), diabetes control, and other chronic conditions can shift rate class more than occupation. The goal is not to hide anything—it’s to present stable management and consistent follow-up so underwriting sees your true risk.

If your case is trending toward a rated outcome, understanding the rating framework helps you make a better decision: Life Insurance Table Ratings Explained.

How Much Coverage Do Construction Workers Need?

A common starting point is 10–15× annual income, then add major obligations like a mortgage, vehicle loans, and any personal or business debt. Next, consider “life expenses” that show up immediately if something happens: childcare, time off work for a spouse/partner, and the cost of maintaining health coverage.

Construction income can be variable (seasonality, overtime, project-based pay), so we often plan with a conservative base income and then build in buffer coverage. If you’re early-career with young kids, coverage is often highest during those years. If you’re later-career with the mortgage nearly paid, the need may shift toward legacy goals or final expenses.

Many construction families use a ladder strategy to keep cost down: a larger policy for the longest obligation (like the mortgage) plus a second smaller policy for shorter-term debts. For example, pairing a 20-year term with a smaller 10-year term can be more cost-efficient than buying one oversized policy for the full horizon.

If you want one policy built for a longer runway, a 30-year term may fit, and some situations may justify longer-term designs where available.

Policy Structures That Work Well in Construction

Level term life (the most common choice)

Level term delivers high death benefit at the lowest premium during the years your family needs coverage most. For most construction households, this is the “foundation policy” that protects income, the home, and lifestyle.

Convertible term (flexibility if health changes)

Construction is a physical career, and health can change as the years go on. Many clients want the option to convert some or all of their term policy to permanent coverage later without starting from scratch. If that’s important, we’ll quote carriers with strong conversion provisions. Here’s a deeper dive: Convertible Term Life Insurance Options.

Permanent life (when lifetime coverage makes sense)

Permanent coverage can fit when you want lifelong protection, legacy planning, special-needs planning, or you anticipate needing coverage beyond the term years. It’s not “better” than term—it’s simply built for a different objective. If budget matters most, we often solve the main need with term first, then layer permanent coverage if the plan calls for it.

Riders and features commonly requested by construction clients

Depending on the carrier, riders can include Accidental Death (extra payout for accidental death), waiver of premium, and accelerated death benefits. Not every carrier offers the same riders, and definitions vary, so we’ll compare the details side-by-side.

Union/Employer Group Life vs Individual Policies

Group life through a union or employer is often a great start—especially when it’s free or low cost. The problem is that group life is commonly limited (often 1–2× salary) and may not follow you if you change employers, shift locals, or retire.

An individual policy is portable and built around your personal underwriting class and coverage amount. Many families use a combination strategy: keep the group coverage for baseline protection, then add an individual policy to reach the real target number.

If you’re deciding between keeping group-only versus building a personal plan, this comparison is helpful: Group vs Individual Life Insurance.

What to Do If You Were Declined Elsewhere

A decline can feel final—but in construction, it’s often situational. It may be a carrier that is conservative on heights, a misclassification of duties, or a medical factor that requires better documentation. Our process is designed to avoid “trial-and-error” submissions: we clarify your duties, identify the right occupational class, and approach carriers that are consistent with your profile.

If you need smaller coverage quickly, or you’re in a short-term window where traditional underwriting is difficult, we can also review simplified or guaranteed options and then revisit a stronger plan when your file improves. For some families, burial/final expense coverage can be a practical backstop: Burial & Final Expense Insurance.

Case Examples (How Classification Changes Outcomes)

Ironworker, 42: Works structural steel with frequent heights above 30 ft. Prior quote came back heavily rated. We clarified duties, safety protocols, and the exact exposure level, then placed a $750,000 20-year term with a carrier that prices steel work more competitively—saving meaningful premium compared to the first offer.

Project manager/estimator, 36: Mostly office-based with periodic site visits under 10%. Because the duties were clearly documented, the occupational class was significantly better than “construction general.” Qualified for standard non-tobacco on a 30-year term to match a long mortgage horizon.

Heavy equipment operator, 50: Stable medical condition and consistent follow-up. We compared no-exam versus fully underwritten options, then selected the best value based on total cost over time, not just the first-year premium.

Ready to Compare Construction-Friendly Life Insurance Options?

We’ll match your trade and duties to carriers that price construction risk fairly—then show you clear, side-by-side options.

Compare Life Insurance Schedule a Consultation Call 800-533-5969

Prefer email? Contact us here.

Related Pages

More resources that pair well with construction underwriting questions.

Talk With an Advisor Today

Choose how you’d like to connect—call or message us, then book a time that works for you.

Schedule here:

calendly.com/jason-dibcompanies/diversified-quotes

Licensed in all 50 states • Fiduciary, family-owned since 1980

FAQs: Life Insurance for Construction Workers

Can construction workers get life insurance?

Yes. Most construction workers can qualify for life insurance. Underwriting typically focuses on your specific trade, job duties, work-at-heights exposure, safety practices, driving history (if applicable), and your overall health profile.

Is construction considered a high-risk occupation for life insurance?

Some construction roles are considered higher risk than others. Rooftop work, ironwork, tower work, heavy equipment operation, demolition, and trenching often receive more scrutiny than supervisory or office-heavy roles. Carrier selection matters because each company classifies trades differently.

What job details do life insurance companies ask about?

Carriers commonly ask about your job title and duties, percent of time “hands-on” vs supervisory, average and maximum heights worked, frequency of ladder/scaffold/steel work, crane/rigging exposure, confined spaces, demolition or explosives, travel to remote sites, and whether you operate company vehicles or require a CDL.

Does working at heights change my rate?

It can. Height and frequency of exposure are often major rating factors. Many carriers want average height, max height, and how often you’re exposed. Strong safety protocols (fall protection, harness use, training) can help support better outcomes.

Do different construction trades get different premiums?

Yes. Underwriting and pricing can vary significantly by trade. A project manager or foreman with mostly supervisory duties may qualify for more favorable pricing than an ironworker, roofer, tower crew member, or demolition worker. The key is matching your trade to carriers that price it more competitively.

Can construction workers get no-exam life insurance?

Often, yes—within certain age and face amount ranges. No-exam options can be a good fit when speed matters, but fully underwritten policies can sometimes be more cost-effective when health and job duties are favorable.

How much life insurance should a construction worker consider?

A common starting point is 10–15× annual income, then add remaining mortgage balance and major debts. Many construction families also factor in childcare, education goals, and income replacement timeframes. Some people “ladder” multiple term policies to match coverage to specific milestones.

What’s better for construction workers—term life or permanent life?

Term life is usually the most affordable way to get a large death benefit during peak working years. Permanent life may make sense for lifetime goals (estate planning, special-needs planning, business continuity) or when someone wants coverage that doesn’t expire.

What if I already have union or employer group life insurance?

Group life is a great start, but it’s often limited (commonly 1–2× salary) and may not be portable if you change jobs or retire. Many families keep group life and add an individual policy to reach the coverage amount they actually need.

Do tobacco or vaping affect life insurance pricing for construction workers?

Yes. Nicotine use is one of the biggest premium drivers. Most carriers treat cigarettes, vaping, chewing tobacco, and nicotine replacement similarly for underwriting class. If you’re tobacco-free, you typically have access to much better pricing regardless of occupation.

How can I improve approval odds or pricing?

Clear job descriptions, accurate height/duty details, consistent safety training (OSHA 10/30, PPE and fall-protection practices), and a clean driving history help. Health factors matter too—controlled blood pressure, stable weight/build, and no nicotine use often improve outcomes substantially.

Diversified Insurance Brokers helps construction professionals nationwide compare carriers and underwriting classes to find the best available fit for your trade and risk profile.

About the Author:

Jason Stolz, CLTC, CRPC and Chief Underwriter at Diversified Insurance Brokers, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.