Life Insurance for Kidney Disease

Jason Stolz CLTC, CRPC

Life Insurance with Kidney Disease — Get Matched to the Right Carrier

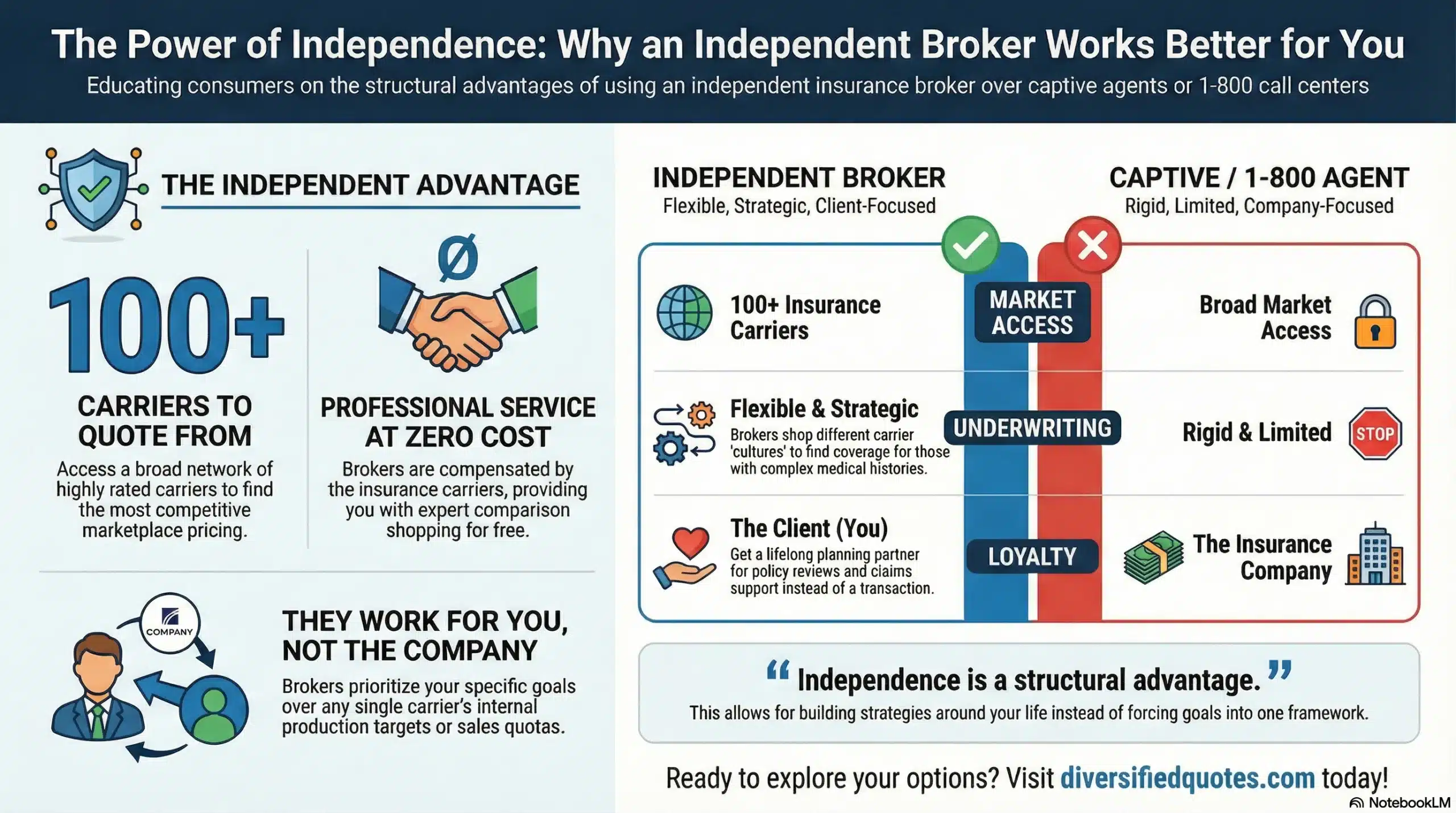

We’ll compare kidney-friendly underwriting approaches across 100+ A-rated insurers and help you pursue the best available outcome—clearly and confidentially.

Tip: Current labs + recent specialist notes usually make underwriting faster and smoother.

Diversified Insurance Brokers helps clients nationwide find life insurance even with chronic kidney disease (CKD), reduced kidney function, proteinuria, and other renal conditions. Kidney underwriting isn’t one-size-fits-all. Some carriers are more comfortable with stable early-stage CKD, others are better when hypertension or diabetes is part of the picture, and transplant histories often require a different underwriting lane entirely. That’s why carrier selection matters—because the same lab profile can get very different outcomes depending on who reviews it and how the case is presented.

If you’re dealing with broader medical underwriting concerns too, our guide to life insurance with pre-existing conditions explains why a single diagnosis can be priced conservatively by one company and treated more reasonably by another when stability is well documented.

How Kidney Disease Affects Life Insurance Underwriting

With kidney disease life insurance, underwriting is usually less about the label (“CKD”) and more about the trend. Underwriters are trying to answer one practical question: is kidney function steady, improving, or declining—and what does the broader health context suggest about the next few years?

Most carriers anchor their decision on current and historical lab values—especially eGFR, creatinine, and urine protein markers. A stable trend over time often underwrites far better than a single “snapshot” result, even if that snapshot doesn’t look perfect. Carriers also look closely at the likely cause of impairment (hypertension, diabetes, autoimmune conditions, congenital issues, etc.) and how well the underlying driver is controlled.

If the carrier requires a medical exam, this overview of what a life insurance exam is explains what’s typically collected and why those labs matter for renal underwriting.

Kidney Disease Life Insurance Profiles and Typical Outcomes

Below is a practical way to think about “where you might land” depending on CKD stage, dialysis status, and overall stability. These are not guarantees—carrier, state, and full health history always matter—but it’s a realistic framework we use when setting expectations before underwriting begins.

| Profile | Likely Product Path | Typical Outcome |

|---|---|---|

| Early-stage CKD (often stage 1–2) with stable labs | Term life or universal life | Standard to mild table ratings, case-by-case |

| Moderate CKD (often stage 3) with steady trend | Term (sometimes limited) + permanent options | Table ratings; amount/term depend on stability |

| Advanced CKD (often stage 4) with close monitoring | Permanent life more likely than long-duration term | Heavier table ratings; limited carrier options |

| Active dialysis | Guaranteed-issue whole life (fallback) | Acceptance with graded benefits; modest face amounts |

| Post-kidney transplant with good follow-ups | Permanent life (UL/WL) with careful underwriting | Often possible after a stability period, case-by-case |

Outcomes vary by carrier, your state, and your full health profile. Our job is to find the underwriting lane that fits your situation and avoid submissions that are likely to be handled overly conservatively.

What Underwriters Want to See for Kidney Disease Life Insurance

If you want the best shot at approval (and the strongest available rate class), the application needs to tell a clean, consistent story. Underwriters don’t just want “you have CKD.” They want a timeline, stable documentation, and clear evidence of follow-up and management.

Current kidney labs + trend history: The most important driver is typically your eGFR/creatinine trend, supported by BUN and urine protein markers. If the file includes multiple data points over time (not just one lab), carriers can underwrite with more confidence.

Specialist documentation: Nephrology notes that confirm diagnosis, likely cause, current stage, and management plan often reduce back-and-forth. When the specialist note clearly states “stable,” “no progression,” or outlines controlled management, underwriting usually moves faster.

Medication consistency: A clean medication list and consistent follow-through helps underwriters feel comfortable that the condition is being managed appropriately. Carriers routinely cross-check Rx history and records, so clarity here prevents delays.

Control of related risks: If kidney impairment is tied to blood pressure or diabetes, control indicators can heavily influence the outcome. If you’re comparing help options and want to understand why carrier selection matters, our guide on best independent insurance agent explains what to look for when the underwriting stakes are higher.

Life Insurance with Kidney Disease on Dialysis

Life insurance while on dialysis is typically the most challenging underwriting scenario for renal conditions. Most fully underwritten term and traditional permanent policies are difficult during active dialysis because carriers view the risk as elevated and less predictable. That said, many clients can still secure meaningful protection through a fallback route like guaranteed-issue whole life, which typically involves no medical questions.

These policies commonly include graded benefits in the first couple of years and are usually best for final-expense protection or “some coverage is better than none” situations. If you’re on dialysis and you want immediate protection, it’s often smarter to start with realistic fallback options first and then revisit fully underwritten coverage later if your situation changes.

Dialysis note: If you’re on dialysis, ask us about guaranteed-issue and simplified-issue options first. We’ll tell you what’s realistic and what’s not.

Life Insurance After a Kidney Transplant

Life insurance after a kidney transplant can be possible, but underwriting typically depends on time since transplant, graft function stability, medication compliance, and whether there have been complications (rejection episodes, infections, hospitalizations, or significant comorbidities).

Most carriers want to see a meaningful stability window with consistent follow-ups and steady function before they’ll consider traditional fully underwritten policies. In many transplant cases, we pre-screen first to avoid unnecessary declines and to identify which underwriting lanes are realistic based on your timeline and current labs.

Steps and Timeline for Kidney Disease Life Insurance

Kidney disease life insurance can move quickly when we start with the right information and match you to the right underwriting lane. In most cases, the best process looks like this:

- Quick intake: Basic details, medication list, and recent kidney-related labs (or the most recent nephrology summary).

- Pre-underwriting: We evaluate carrier fit and likely outcomes before you commit to a formal application.

- Targeted quoting: You’ll see realistic options (term, permanent, and fallback routes) side by side.

- Underwriting support: If records or labs are needed, we guide the process and reduce surprises.

Estimate Life Insurance Costs

Use the tool to explore coverage amounts and term lengths. Then we’ll refine your best options based on your kidney labs, stability trend, and underwriting profile.

Helpful resources

Life Insurance with Pre-Existing Conditions

What Is a Life Insurance Exam?

Is Life Insurance Death Benefit Taxable?

Ready to See Your Options?

We’ll compare kidney-friendly carriers and explain the trade-offs in plain English.

Example Case

A 55-year-old applicant with stable early-stage CKD and consistent follow-ups wanted affordable coverage to protect family expenses. After reviewing recent labs and nephrology notes, we matched the case to a carrier with more favorable renal underwriting and secured a better outcome than earlier “generic” quotes that didn’t account for stability and trend.

Related Kidney Underwriting Pages

If kidney labs or staging are part of your story, these pages explain how underwriting decisions are typically made.

Related Coverage Pages

These options can matter when kidney underwriting is tougher or when you want backup coverage in place.

Get a Kidney-Friendly Life Insurance Plan

We’ll shop 100+ carriers and package your case to highlight stability, follow-ups, and best-fit underwriting.

Talk With an Advisor Today

Choose how you’d like to connect—call or message us, then book a time that works for you.

Schedule here:

calendly.com/jason-dibcompanies/diversified-quotes

Licensed in all 50 states • Fiduciary, family-owned since 1980

FAQs: Life Insurance with Kidney Disease

Can I get life insurance with kidney disease (CKD)?

Yes. Many people with stable CKD can still qualify. Approval and pricing depend on kidney function trend, CKD stage, underlying causes, and overall health stability.

How do insurers evaluate kidney function for life insurance?

Underwriters typically review eGFR and creatinine trends, urinalysis/protein findings, specialist notes, medications, and related conditions like diabetes or hypertension.

Can I qualify if I’m on dialysis?

Traditional fully underwritten policies are difficult during active dialysis, but guaranteed-issue whole life is often available with no medical questions and graded benefits.

Will a transplant improve my approval odds?

Often, yes—after a stability period with strong follow-ups and documented graft function. Carriers focus on complications, medication adherence, and overall stability.

Do I need a medical exam for kidney disease life insurance?

Sometimes. Some applicants qualify for accelerated underwriting, but CKD cases often require records (and sometimes labs) so the insurer can confirm stability.

What if I was declined for life insurance due to kidney disease?

A decline doesn’t always mean no forever. Carrier appetite varies. We can pre-screen options, consider different policy types, and use fallback options if needed.

About the Author:

Jason Stolz, CLTC, CRPC and Chief Underwriter at Diversified Insurance Brokers, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.