Life Insurance for Veterans with PTSD

Jason Stolz CLTC, CRPC

Life insurance for veterans with PTSD is absolutely possible—and in many cases it can still be affordable—when the application is positioned correctly and submitted to carriers that underwrite PTSD in a practical, modern way. Veterans often assume a PTSD diagnosis (or a VA disability rating) automatically leads to a decline or a high table rating. The reality is more nuanced. Most life insurance underwriters focus on stability, treatment consistency, day-to-day functioning, and the presence (or absence) of higher-risk related factors like recent hospitalizations, substance misuse, or severe ongoing impairment.

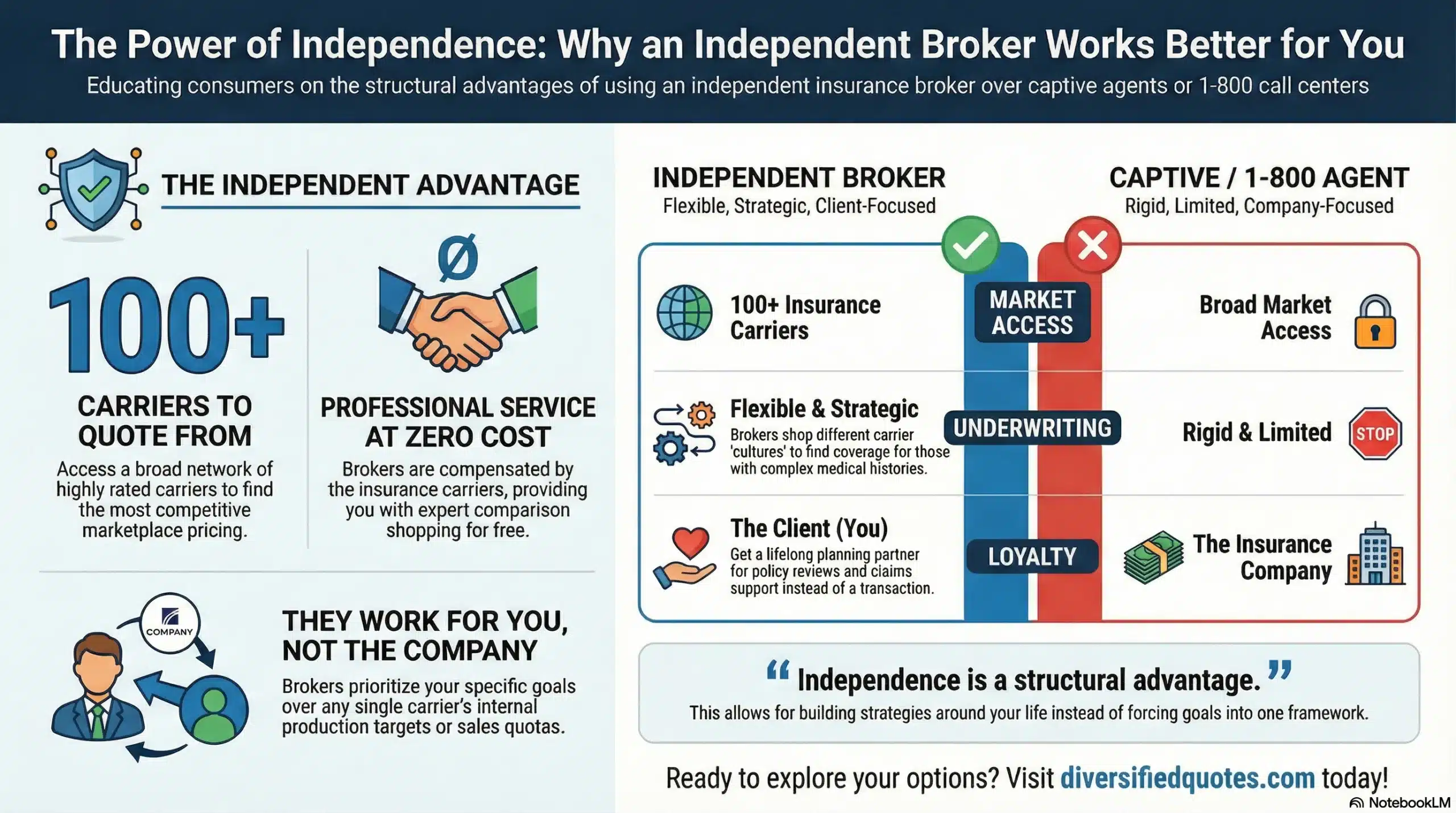

At Diversified Insurance Brokers, we help veterans navigate this process with clarity, respect, and confidentiality. Our advisors compare options across a broad carrier network and guide you through the underwriting details that actually move your outcome—so you don’t waste time with the wrong companies, get surprised by last-minute requirements, or accept an inflated quote that wasn’t necessary. PTSD cases are not “one-size-fits-all,” and carrier selection matters more here than almost any other part of the purchase.

Many veterans also want to understand how private life insurance fits alongside military and VA benefits. Some veterans are still active duty or in the Guard/Reserves; others are fully separated and building a civilian career and family. Either way, the goal is the same: create reliable protection that stays in force long-term and gives your family certainty—without creating unnecessary underwriting friction.

Request a Life Insurance Quote for Veterans

We compare 75+ top-rated carriers to find coverage designed for veterans with PTSD.

Can Veterans with PTSD Get Life Insurance?

Yes. Veterans with PTSD commonly qualify for term life, permanent life, and (when needed) final expense coverage. The deciding factors are rarely “PTSD” by itself. Underwriting typically hinges on whether symptoms are stable, whether treatment is consistent, whether there have been recent crises or hospitalizations, and whether the overall health and lifestyle picture supports a strong risk profile.

Underwriters generally try to answer one question: “Is this condition controlled and predictable, or is it active and unstable?” Stable, well-managed PTSD is often treated differently than PTSD with frequent acute episodes, recent suicidal ideation, repeated inpatient stays, or significant functional impairment. The better you document stability, the more likely you are to receive a fair offer—often from carriers that have more veteran-friendly mental health guidelines.

It also helps to know that different carriers evaluate PTSD differently. Some are conservative and apply broad rules that can lead to unnecessary ratings. Others are more evidence-based and focus on time since last episode, current medications, consistent follow-up care, work stability, and whether the file shows good day-to-day functioning. This is where working with an independent agency matters—because the “best price” isn’t just the cheapest quote you see online. The best price is the price you can actually get approved for after underwriting finishes.

How Underwriting Typically Looks at PTSD for Veterans

Life insurance underwriting doesn’t “judge” PTSD; it measures risk. Underwriters review a combination of diagnosis history, symptom pattern, treatment timeline, medication adherence, and medical records. If your PTSD is being treated responsibly and your life is stable—employment, family routines, driving record, and general health—many carriers are willing to offer coverage that is much closer to standard pricing than most veterans expect.

PTSD cases are often smoother when the file shows consistent care. Regular therapy visits, stable medication management, and clear documentation from your physician or mental health provider can help the carrier see that the condition is under control. In contrast, inconsistent treatment, long gaps in care, or repeated urgent interventions can cause the carrier to assume the condition is unpredictable—even if you feel stable now.

Carriers also review whether PTSD is the primary mental health issue or whether it overlaps with additional diagnoses. For example, if the medical records show depression or anxiety as significant ongoing concerns, the carrier may consider the combined picture. If this applies, you may find it helpful to review: Life Insurance for Depression.

Finally, carriers pay close attention to recency. A stable condition for years can be underwritten very differently than a condition that was unstable in the last 6–24 months. Time is a powerful underwriting variable. In many PTSD cases, “time since last crisis” is as important as the diagnosis itself.

VA Disability Ratings and Life Insurance: What Actually Matters

Many veterans worry that a VA disability rating for PTSD will automatically block coverage. In most cases, it does not. A VA rating can signal to the insurer that PTSD exists and may indicate severity, but the carrier still focuses primarily on functional stability and medical documentation. Veterans with VA ratings often qualify for policies, especially when symptoms are well-managed and the file supports stability.

From an underwriting standpoint, what matters is whether PTSD is controlled, whether treatment is consistent, and whether the last major incident was remote. If your daily functioning is stable—working, caring for family, managing responsibilities—and medical records show responsible ongoing care, many carriers will treat the case as insurable.

When PTSD is part of a broader list of pre-existing conditions, underwriting becomes more “stacked.” That doesn’t mean a decline is inevitable, but carrier selection becomes even more important. In those cases, this resource can help: Life Insurance with Pre-Existing Conditions.

What Details Help You Get the Best Outcome

Veterans often ask what information actually improves their odds. The answer is not one single thing—it’s the overall picture. Underwriters typically look for stability signals: consistent care, stable medications (if used), no recent hospitalizations, no recent suicidal ideation, and no recent substance misuse. They also want the application to match the medical record. When the application answers are vague or inconsistent with the record, the carrier tends to assume the worst and rate the policy more conservatively.

In practice, a clean underwriting file usually includes a clear timeline: when PTSD was diagnosed, how symptoms have been managed, what treatment has been used, what medications are currently taken (if any), and when the most recent significant episode occurred. A stable work history and stable daily functioning can also support a more favorable view, especially when the record indicates good compliance.

It’s also common for veterans to have additional service-related health history—sleep issues, chronic pain, orthopedic injuries, or other conditions. Carriers will consider these as part of the total profile. The key is not to “hide” anything, but to present the file accurately and choose a carrier that evaluates the case fairly.

Term Life vs Permanent Life for Veterans with PTSD

Term life insurance is often the most cost-effective way to secure a large death benefit for a defined period, such as 10, 20, or 30 years. Many veterans use term insurance to protect income, pay off a mortgage, cover childcare costs, and protect family finances during working years. If the goal is maximum coverage for the lowest premium, term is usually the first place we look—assuming underwriting fits.

Permanent life insurance (such as whole life or universal life) can be a good fit when the goal is lifelong coverage, estate planning, or creating a policy that does not expire. Permanent insurance is not automatically “better,” but it can be valuable when long-term certainty is the priority. For veterans who are concerned about future health changes, permanent coverage can also be part of a strategy to maintain coverage without worrying about renewing or replacing term later.

Some veterans also use a blended approach: a permanent policy for lifelong coverage and a larger term policy layered above it for the high-need years. This can create a balance between affordability and long-term certainty.

What If You’ve Been Declined or Quoted Too High?

A decline or high quote from one insurer does not define your insurability. PTSD underwriting varies widely across carriers. Many veterans are declined by direct-to-consumer platforms not because coverage is impossible, but because those platforms typically submit to one carrier path with rigid underwriting rules. When the carrier is not a fit, the outcome is worse than it needs to be.

This is where our process is different. We work from an underwriting-first perspective. We identify which carriers tend to treat stable PTSD more reasonably, which carriers are most conservative, and how to position the case so the underwriter has what they need to make a fair decision. In many cases, changing carrier selection and clarifying stability can shift the result from “decline” to “approve,” or from an unnecessary table rating to a more reasonable class.

If you want veteran-specific PTSD guidance beyond this page, you can also review: Life Insurance for PTSD.

Medical Exams, Records, and What to Expect

Depending on your age, coverage amount, and the carrier, you may need a paramedical exam. In PTSD cases, the exam itself is usually not the primary issue. The exam is typically focused on basic vitals and labs. The bigger underwriting driver is often the medical record review—especially if the carrier requests an attending physician statement or mental health treatment records.

Knowing what to expect helps avoid delays. If you want a quick overview of the exam process and what carriers test, see: What Is a Life Insurance Exam?.

One important point: the goal is not to “over-explain” PTSD on an application, but to answer accurately and consistently. Underwriters don’t want speculation. They want facts: dates, treatment type, stability, and whether there have been major events. When the application is clean and consistent, underwriting tends to move faster.

Compare Life Insurance Rates for Veterans

Use our calculator to see real-time quotes, including options for veterans with PTSD.

Life Insurance Quoter

Coverage Planning for Veterans and Military Families

Veterans often want clarity on how private life insurance fits into the broader military benefits picture. If you are still connected to the military through active duty, Guard, or Reserves, you may have access to group benefits. If you are fully separated, your benefits structure changes. Either way, relying on group coverage alone can create gaps, especially when coverage ends after separation, changes after retirement, or is not enough to protect a spouse and children long-term.

Private life insurance gives you a layer of protection that is portable. It follows you regardless of employer, location, or career changes. Many veterans choose to lock in private coverage when they are relatively young and healthy, because that is when premiums are typically lower and underwriting options are broader. Waiting until later—after more medical history accumulates—can narrow choices.

PTSD cases also intersect with broader military underwriting topics. If you want a military-specific overview of how life insurance underwriting works for service members and veterans, you may also explore: Life Insurance for the Military.

A Realistic Case Example

A 38-year-old Army veteran with a PTSD diagnosis described as mild and stable was declined by a direct-to-consumer carrier path. The decline was not because the veteran was uninsurable; it was because that carrier’s mental health rules were rigid and their process did not position the case well. We reviewed the timeline, confirmed stability, and submitted through a more favorable underwriting route. The result was a $250,000 20-year term policy at a reasonable class for the veteran’s overall profile—providing meaningful protection for a spouse and children with a straightforward approval process.

That’s the pattern we see often: the outcome changes when the case is matched to the right carrier and presented clearly. Not every case will look like this, but many veterans are surprised at how workable the options become when the strategy is correct.

Why Work With Diversified Insurance Brokers?

Since 1980, Diversified Insurance Brokers has helped families nationwide secure life insurance in both standard and high-risk underwriting situations. Veterans with PTSD deserve a process that is professional, respectful, and built around real underwriting outcomes—not assumptions. We know what underwriters ask, what documentation matters, and which carrier philosophies are most reasonable for stable PTSD cases.

When you work with our advisors, you get a structured approach. We start with the basics—coverage goal, timeline, and budget—then we evaluate underwriting realities. If PTSD is part of the file, we factor it in alongside overall health and lifestyle. If there are other issues, we coordinate the case so it stays consistent. If you need a high-risk pathway, we guide you to the right place to begin: High-Risk Life Insurance Services.

If your goal is a smaller policy specifically to cover burial and final expenses—especially if you’re older or want simplified underwriting—this resource can be useful: Burial Insurance.

And if you want an overview of why independent comparison matters—especially for underwriting-sensitive cases—this page explains our approach: Best Independent Insurance Agent.

Related Pages

Explore additional resources on mental health underwriting, veteran coverage, and high-risk policy options.

Talk With an Advisor Today

Choose how you’d like to connect—call or message us, then book a time that works for you.

Schedule here:

calendly.com/jason-dibcompanies/diversified-quotes

Licensed in all 50 states • Fiduciary, family-owned since 1980

FAQs: Life Insurance for Veterans with PTSD

Can veterans with PTSD qualify for life insurance?

Yes. Many veterans with PTSD qualify for term, whole life, or final expense insurance. Approval depends on symptom stability, treatment history, and overall health—not simply the diagnosis itself.

Does having a VA disability rating for PTSD affect approval?

A VA disability rating alone does not disqualify you. Insurers focus more on how well symptoms are controlled, daily functioning, and whether treatment is ongoing and stable.

How does PTSD severity impact life insurance rates?

Mild or well-managed PTSD often results in standard or near-standard rates. Moderate to severe symptoms, recent hospitalizations, or unstable treatment may lead to higher premiums or limited policy options.

Does being in therapy or taking medication help underwriting?

Yes. Consistent therapy, medication compliance, and regular follow-ups demonstrate stability and responsibility, which can significantly improve underwriting outcomes.

What types of life insurance are available for veterans with PTSD?

Depending on individual circumstances, veterans may qualify for term life, permanent life, or final expense policies. Fully underwritten policies often offer the best pricing when symptoms are stable.

Will past psychiatric hospitalizations affect eligibility?

Hospitalizations are reviewed carefully. The timing, frequency, and reason matter. Older, isolated events with long-term stability afterward are viewed more favorably than recent or repeated admissions.

What if I was previously declined for life insurance due to PTSD?

A prior decline does not eliminate future options. Different carriers have different underwriting philosophies, and improved stability or documentation can change outcomes significantly.

How long does underwriting usually take for PTSD cases?

Underwriting time varies based on medical records and treatment documentation. Well-documented, stable cases often move faster than complex cases requiring additional review.

Can veterans combine private life insurance with VA or military benefits?

Yes. Private life insurance is commonly used to supplement VA or military benefits, providing long-term coverage that remains in force regardless of service status.

About the Author:

Jason Stolz, CLTC, CRPC and Chief Underwriter at Diversified Insurance Brokers, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.