Lifetime Income Annuity Options

Planning for steady income in retirement starts with the right strategy. At Diversified Insurance Brokers, we help retirees and pre-retirees compare lifetime income annuity options designed to create a reliable paycheck you can’t outlive. Because we’re independent, we can shop the market across 100+ top-rated carriers and line up multiple product designs side-by-side—so you can see what changes when you adjust the income start date, add a spouse, build in inflation features, or prioritize liquidity. Some people want the highest guaranteed paycheck available. Others want a balance between contractual income and access to funds. Many want a plan that keeps pace with rising costs. The “best” lifetime income annuity is the one that fits how you actually plan to live in retirement, and our job is to help you choose it with clarity.

Most retirees discover a simple truth at some point: growth is important, but income reliability is what pays the bills. Market-based portfolios can be excellent for long-term accumulation, yet retirement introduces a different set of risks—especially sequence-of-returns risk (taking withdrawals during a down market), longevity risk (living longer than expected), and inflation risk (everyday costs rising faster than your budget). Lifetime income annuities are built specifically to address those risks by turning a portion of your assets into contractual income that continues as long as you live. The details matter, though. How the income is produced, when it starts, whether it covers two lives, and what happens to beneficiaries can vary widely by product type and carrier. That’s why comparing options is so valuable.

Note: The calculator accepts premiums up to $2,000,000. If you’re investing more, results increase in direct proportion — for example, doubling your premium roughly doubles the guaranteed income at the same age and options.

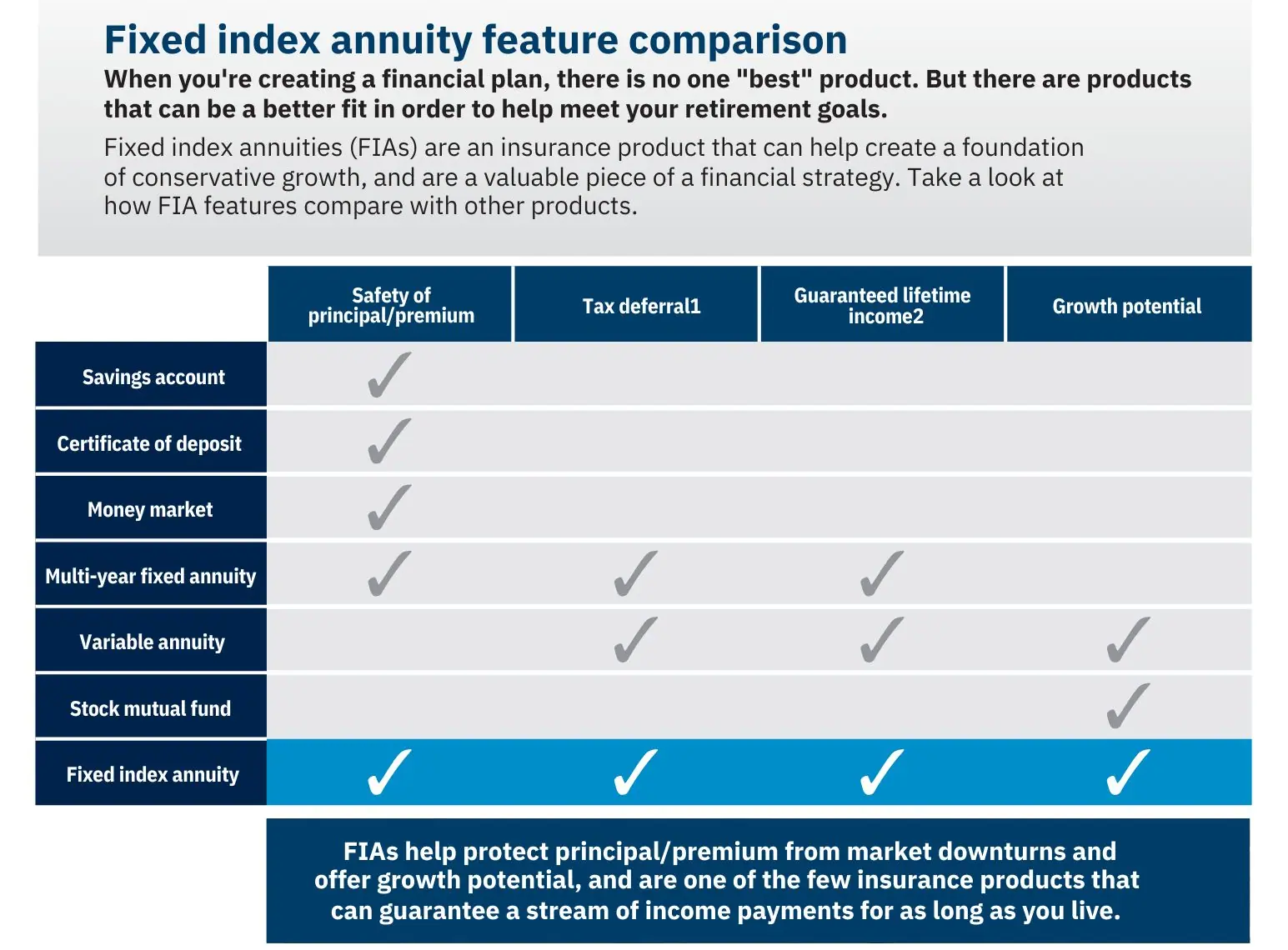

When you see lifetime income numbers on a quote or illustration, it helps to understand what’s driving them. In some cases, the income is produced by a traditional immediate income annuity (often called a SPIA) that converts a lump sum into income starting now. In other cases, the income is produced by a deferred income annuity (DIA) where you deposit funds today and “turn on” income later. And in many modern retirement strategies, lifetime income comes from a fixed indexed annuity (FIA) that includes a guaranteed lifetime income rider—allowing the account to have a growth component while separately building an income base used to calculate future withdrawals. These approaches can solve different problems, so selecting the right one starts with your timeline and goals.

A lifetime income annuity is a contract designed to provide guaranteed payments for as long as you live. You allocate a premium (a lump sum or a series of deposits, depending on product design), and the insurance company agrees to pay income based on the terms you choose. That income can be structured for one life or for joint lifetimes, which is often important for married couples who want the surviving spouse to continue receiving income. Depending on the type of annuity, income can start immediately or at a future date. Many people use lifetime income annuities to cover essential expenses—housing, food, utilities, insurance premiums—so discretionary spending can be more flexible. When paired with Social Security and other savings, it can create a more “pension-like” retirement plan, and it can reduce the stress of managing withdrawals during volatile markets.

It’s also helpful to understand that “lifetime income” can be created in more than one way. A SPIA or DIA generally creates income by converting premium into a stream of payments based on actuarial pricing and the payout option you select. A fixed indexed annuity with an income rider usually creates income through a rider formula that allows guaranteed withdrawals for life while maintaining an underlying accumulation value, subject to contract provisions and withdrawal rules. Both can be appropriate, but they behave differently. The right choice depends on whether you want to retain control over principal, whether you need liquidity, how much guaranteed income you want, and whether you’re trying to address longevity risk, inflation sensitivity, or both.

Immediate income annuities are typically used when you want income to start now or very soon, often within 30 days of funding. This can be useful when retirement begins and you want a consistent monthly check to replace a paycheck. Deferred income annuities are often used when you have a gap between today and when income needs to begin—such as retiring at 67 but planning at 62. Because payments start later, the future income can be meaningfully higher than an immediate-start contract, depending on age, timing, and carrier pricing. Fixed indexed annuities with income riders are often used when you want a combination of principal protection, growth potential tied to an index, and guaranteed lifetime withdrawals—especially when you want to delay income and build a larger future withdrawal amount while maintaining some flexibility in the underlying account.

Choosing the right lifetime income approach is mostly about matching the product’s strengths to your retirement timeline. If you need income right away and you want a clear, contractual paycheck with strong predictability, an immediate income annuity can be a strong fit. If your primary goal is income later, a deferred income annuity can be powerful because it rewards patience with higher future income. If you want income later but also want the flexibility of an accumulation account and optional features, a fixed indexed annuity with an income rider can make sense—especially if you want to keep the potential for account value growth while still building guaranteed withdrawal capability.

Many clients use more than one approach. For example, a portion of assets can be allocated to an immediate income annuity to cover essential expenses today, while another portion is positioned for higher income later using a deferred income annuity or rider-based strategy. This “layering” approach can be especially useful if you plan to delay Social Security, if you want increasing income over time, or if you want to reduce reliance on portfolio withdrawals early in retirement. We can model these combinations and show you how changes in deposit amounts, payout types, and start dates affect income and flexibility.

Payout options change results, and understanding them prevents surprises. A life-only payout typically provides the highest monthly income because payments stop at death. A life with period certain payout guarantees payments for a minimum period (like 10 or 20 years) even if you die early, which increases beneficiary protection but usually reduces the monthly amount compared to life-only. Refund features can also protect beneficiaries but may lower the starting payout. Joint and survivor options provide income for two lives and often reduce the monthly payment compared to a single-life option because payments are expected to last longer. The “best” option depends on whether you prioritize maximum income, spouse protection, or beneficiary guarantees.

Inflation features also change outcomes. If you choose a payment schedule that increases each year, your starting income is usually lower, but the income can rise over time. This can help with purchasing power, especially in longer retirements. Some clients prefer to keep annuity income level and rely on other assets for inflation, while others prefer an increasing income design for simplicity and predictability. A practical way to decide is to identify which expenses are most sensitive to inflation (like healthcare, food, utilities, and home services) and decide whether you want those covered by “level” income or income that grows.

Liquidity is another major planning factor. Traditional immediate income annuities are usually not designed for withdrawals once the contract is issued, because the premium has been converted into income. Deferred income annuities also generally focus on future income rather than access. Indexed annuities with income riders often provide more flexibility because they typically maintain an accumulation value and may allow penalty-free withdrawals up to a stated percentage after a waiting period, though withdrawals can reduce future income and may trigger surrender charges if taken beyond the free-withdrawal amount. This is why a layered approach can work well: keep cash reserves for near-term needs, build guaranteed income for essential expenses, and keep growth-oriented assets for long-term flexibility.

Taxes matter as well, and how the annuity is funded can change the after-tax result. If you fund an annuity with qualified dollars (like IRA or 401(k) funds), payments are generally taxable as ordinary income. If you fund an annuity with non-qualified dollars (after-tax savings), a portion of each payment may be treated as return of principal while the remainder is taxed as earnings, depending on the structure. Coordinating annuity income with Social Security timing and required minimum distributions can improve cash flow consistency and reduce stress around portfolio withdrawals during down markets. While we’re not providing tax advice, we do help clients think through practical timing and coordination so the retirement income plan works in real life.

At Diversified Insurance Brokers, lifetime income planning is not about pushing one product. It’s about matching the right contract design to your goals. We compare carriers, explain the rider and payout tradeoffs, and model multiple scenarios so you can make a confident decision. If you want a pension-like paycheck, we’ll show you the most direct ways to create it. If you want guaranteed income but also want flexibility, we’ll compare options that preserve access. If you want to keep part of your plan positioned for growth while protecting principal, we’ll model indexed strategies and show what changes when caps, participation rates, spreads, and income riders are included.

To help you keep the research organized, you may also want to review how different annuity types behave in retirement. Start with our main annuity hub to explore options across fixed, indexed, and income-focused designs, then compare current rates for fixed annuities and indexed annuities to see what the market looks like right now. If you want to understand the mechanics behind indexed crediting and the levers that affect results, our educational pages can help you evaluate what matters and what is just marketing language. When you’re ready, we can build a side-by-side comparison for your age, state, premium amount, and income timeline.

Compare Lifetime Income Annuity Options

Request a personalized illustration and compare income start dates, single vs. joint payouts, and inflation-friendly options.

Related Pages

Talk With an Advisor Today

Choose how you’d like to connect—call or message us, then book a time that works for you.

Schedule here:

calendly.com/jason-dibcompanies/diversified-quotes

Licensed in all 50 states • Fiduciary, family-owned since 1980

FAQs: Lifetime Income Annuity Options

What is a lifetime income annuity?

A lifetime income annuity is a contract where you allocate premium to an insurance company, and in return you receive regular income payments that can last for your lifetime (and, if elected, for a spouse’s lifetime as well).

What types of lifetime income annuities are common?

Common types include immediate income annuities (payments start soon), deferred income annuities (payments start later), and fixed indexed annuities with lifetime income riders. Each approach solves a different retirement income problem.

How does “period certain” work with lifetime income?

Lifetime income with period certain means payments are guaranteed for your life, and if you die early, payments continue to a beneficiary for a minimum number of years. Adding a guarantee typically reduces the starting payment compared to “life only.”

What is a joint and survivor annuity?

A joint and survivor option provides income for two people, usually spouses. After one spouse dies, income continues for the survivor, often at the same amount or at a reduced percentage depending on the option chosen.

Can I add inflation protection to lifetime income?

Some contracts allow payments to increase over time using a fixed annual increase or another structure. Inflation-friendly designs usually start with a lower initial payment in exchange for future increases.

What are the trade-offs of choosing lifetime income?

The main tradeoffs are liquidity and flexibility versus certainty. Some lifetime income approaches are less liquid once started, and options that protect beneficiaries or add inflation features can reduce the starting payout.

How do age and timing affect payouts?

In general, starting income later tends to increase the future monthly payment, while starting sooner produces income immediately. Product type, rates, and payout options also influence results.

Are there options to protect beneficiaries?

Yes. Options like period certain, refund features, and joint-life payouts can provide beneficiary protection. The best choice depends on whether your priority is maximum income or leaving a larger benefit to heirs.

When is a lifetime income annuity a good choice?

It can be a good fit when you want reliable income that isn’t dependent on market performance, you want protection against outliving assets, and you have funds you can allocate to income without needing full access to every dollar.

About the Author:

Jason Stolz, CLTC, CRPC, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.