Medicare Enrollment for People Still Working

Still Working at 65? Build Your Medicare Game Plan

We’ll confirm if you can safely delay Part B and Part D, coordinate with your employer plan, and map out penalty-free steps.

Request Medicare Review Explore Medicare Services Call 800-533-5969

Medicare enrollment for people still working doesn’t have to be confusing, but it does need to be handled correctly. The right approach depends on three things: (1) your employer size, (2) whether your coverage is considered creditable for Medicare timing rules, and (3) the month your active employment coverage actually ends. When those details are clear, you can often delay certain parts of Medicare safely, avoid gaps in coverage, and prevent late enrollment penalties that can follow you for life.

Where most people get into trouble is assuming the rules are the same for everyone. They are not. A retiree leaving a large employer plan can have a very different enrollment path than someone working for a small business. Add in COBRA, retiree coverage, HSAs, or a working spouse’s plan, and it’s easy to make a well-intended decision that results in denied claims or penalties. If you want a simple penalty-proof framework, this guide walks you through the decision points and the timeline to follow.

At Diversified Insurance Brokers, we help working adults confirm what they can delay (and what they should not), create a clear enrollment timeline, and compare plan options when they’re ready to transition. If you’re concerned about timing, start with our guide on how to avoid Medicare late enrollment penalties, then use the steps below to map your exact path.

Employer Size: The First Decision Point

20+ employees vs. fewer than 20—why it matters at 65

Employer size is the first fork in the road because it determines which coverage is typically primary at age 65. If your employer (or your working spouse’s employer) has 20 or more employees, the group plan is usually primary and Medicare is generally secondary. Many people with large employer coverage can delay Part B while actively working and remain protected from late enrollment penalties—assuming their coverage meets the requirements.

If the employer has fewer than 20 employees, Medicare generally becomes primary at 65. In that situation, delaying Part B can create real problems. Claims may be processed incorrectly, cost sharing can spike, and you may face penalties if you don’t enroll on time. If you’re unsure which category you fall into, review the most common issues in Medicare enrollment mistakes to avoid and how the timing can interact with your retirement income plans in how Medicare and Social Security work together.

In practice, “employer size” questions often come down to how the plan is structured (single employer, multi-employer group, union plan, etc.). When you request a review, we confirm the correct primary/secondary ordering so your enrollment path matches your real-world coverage.

What Counts as “Creditable Coverage” While You’re Working

Active employment coverage is the key

To delay Medicare without penalties, you generally need active employment coverage that’s considered creditable for medical (Part B timing) and prescription drugs (Part D timing). Large-group employer coverage often qualifies, but it’s not automatic—especially if you have unusual plan designs, carve-outs, or specialty retiree options.

Two warnings matter here. First, COBRA and retiree coverage are not the same as active employment coverage for Medicare timing purposes. Second, Marketplace/ACA plans are not designed to replace Medicare once you’re eligible. These are two of the most common reasons people unintentionally create penalties and coverage gaps after age 65.

When you’re approaching retirement and ready to transition, it helps to understand what you’re moving into. Most retirees choose between a Medigap strategy or Medicare Advantage, so it’s worth reviewing Medicare Advantage vs. Medicare Supplement. If you lean Medigap, also see Plan G vs. Plan N to understand how premium and cost-sharing trade-offs work.

Parts A, B, and D: What You Can Delay Safely (and What You Can’t)

Most “still working” mistakes come from delaying the wrong part

When you’re still working at 65, the question isn’t “Should I enroll in Medicare?” It’s “Which parts should I start now, and which parts can I delay without penalties or claim issues?” For many working adults, Part A feels “free,” Part B feels expensive, and Part D feels optional. But timing rules can be strict, and the safest choice depends on your employer size and your plan’s creditable status.

Part A generally covers hospital services. Many people enroll in Part A at 65 even while working, especially if they are not contributing to an HSA. However, Part A enrollment can create an HSA issue because Medicare enrollment blocks HSA contributions. That’s why HSA timing is a separate section below.

Part B covers outpatient and medical services and is the part most people delay while still working. If you have large employer coverage and it is creditable, delaying Part B can be reasonable. If your employer is small, delaying Part B can be a mistake that leads to denied claims. If you want a clearer framework, our breakdown of Medicare Part B explains what Part B does and why timing matters.

Part D is prescription coverage. Even if you rarely take medications, delaying Part D without creditable drug coverage can trigger penalties later. That’s why it’s essential to confirm whether your employer plan’s drug coverage is creditable for Part D timing rules, not just whether it “covers prescriptions.”

HSA Timing and the 6-Month Look-Back

How Medicare enrollment affects HSA contributions

HSAs are a powerful planning tool for working adults, but they require careful Medicare coordination. Once you enroll in any part of Medicare—even Part A—you generally cannot contribute to an HSA. This is where many people accidentally create an HSA contribution problem while trying to be proactive about Medicare.

One critical detail is that Part A can be retroactive for up to six months in certain situations. That means a person who enrolls close to retirement may discover Part A backdated to an earlier month, which can create an HSA contribution issue for months they thought were still “safe.” That’s why many people stop HSA contributions six months before their intended Medicare start date. If your Medicare start date is tied to Social Security, use the Social Security filing checklist so timing stays coordinated.

Good planning here is simple: if you want to maximize HSA contributions, we map the date your HSA contributions should stop, then work backward from your expected Medicare enrollment date and retirement date so everything remains consistent.

COBRA and Retiree Coverage Pitfalls

Helpful for cost-sharing, risky for Medicare timing

COBRA and retiree coverage can be useful in retirement planning, but they are commonly misunderstood. The key issue: COBRA is not treated as active employment coverage for Medicare timing rules. Retiree coverage is also not the same as active employment coverage. If someone chooses COBRA at 65 and delays Part B, they may find claims denied or processed incorrectly, and penalties can accrue.

Many people assume, “I have COBRA, so I’m covered.” The problem is that Medicare may be expected to be primary once you’re eligible, and COBRA may pay secondary (or not pay certain claims) if you haven’t enrolled correctly. The safest move is confirming your exact timing steps before coverage changes. If you want the penalty overview, review how to avoid Medicare late enrollment penalties.

If you’re transitioning off employer coverage and considering COBRA as a bridge, we’ll map whether Part B should start immediately and how prescription coverage should be handled so you don’t fall into the most common timing trap.

Special Enrollment Period: Your Safe Window When You Stop Working

Why this window is the difference between “smooth transition” and “penalty risk”

For many people who delay Part B due to active employment coverage, the Special Enrollment Period is the safe, penalty-free window to enroll once employment ends. This is the reason “still working at 65” can be perfectly fine—when the steps are followed correctly.

The challenge is that the SEP timeline is measured from the end of active employment or active coverage (depending on the situation). That means you should plan the month your employer coverage ends, the month you want Medicare to begin, and the month your retirement date actually lands. If you guess incorrectly, you can create a gap, an overlap that disrupts HSA contributions, or a late enrollment penalty exposure.

This is where it helps to have a clear plan for your “last day of work,” “coverage end date,” and “Medicare effective date.” With the right timeline, you can retire, keep coverage uninterrupted, and start your Medicare plan with confidence.

A Simple Working-to-Retired Timeline

What to do—and when to do it

6–9 months before retirement: Confirm employer size and verify whether your medical coverage is creditable for Part B timing and whether your prescription coverage is creditable for Part D timing. Decide which retirement coverage structure you prefer by reviewing Medicare Advantage vs. Medicare Supplement.

3–5 months before retirement: Identify your target Medicare start month. If you have an HSA, plan when HSA contributions must stop. Gather plan information and set a time to review options so you’re not forced into last-minute decisions.

2–3 months before retirement: Prepare enrollment steps for Parts A and B (if needed) and align prescription coverage timing. If you plan to use Medigap, review Plan G vs. Plan N and decide which cost-sharing structure fits your budget and usage.

At retirement (or coverage end): Use the SEP for Part B if you delayed it. Add drug coverage immediately (Part D or an MA-PD plan) so you don’t create a penalty exposure. This is also the moment to decide whether you want Medigap plus Part D or Medicare Advantage with bundled benefits such as dental and vision coverage.

Choosing Coverage When You Retire

Medigap vs. Medicare Advantage—how to decide

When you retire, most decisions come down to how you want your costs structured. Medigap is often favored by retirees who want predictable cost sharing and broad provider access. It can work especially well for travelers, snowbirds, and people who prefer fewer network constraints. If you lean this direction, comparing Plan G vs. Plan N helps you match premium level to expected usage.

Medicare Advantage can be appealing for retirees who want lower premiums and packaged extras, including dental, vision, hearing, and sometimes wellness benefits. The trade-off is network structure and annual plan changes. If you’re exploring this route, it helps to review the landscape of best-rated Medicare Advantage companies and then compare real options in your ZIP code using the calculator below.

If you want an unbiased approach, the best first step is to compare plans using your local plan availability, your doctor preferences, and your prescription profile rather than general advice.

Common Working Scenarios

How the rules apply in practice

Large employer (you are working): You may be able to keep your group plan as primary and delay Part B and Part D without penalty. The key is confirming creditable status and then using the SEP when you retire. At retirement, compare Medicare Advantage vs. Medicare Supplement based on travel, networks, and budget priorities.

Small employer (you are working): Medicare is often expected to be primary at 65. Enrolling in Part A and Part B on time usually prevents claim issues and penalties. From there, many retirees choose Medigap (review Plan G vs. Plan N) plus Part D, or a competitive Medicare Advantage plan that includes prescription coverage.

Covered under a working spouse’s plan: Confirm whether the spouse’s employer has 20+ employees and whether the plan is creditable for both medical and drugs. If yes, delaying Part B may be safe. If not, enrolling on time helps avoid gaps and penalties.

Considering COBRA as a bridge: COBRA can help with cost-sharing but does not protect you from timing rules. If Medicare should be primary, delaying Part B can cause problems. Review the penalty framework in how to avoid Medicare late enrollment penalties and confirm your exact path before your employer coverage ends.

Compare Plans and Costs in Minutes

Use our Medicare calculator to see plan options available in your ZIP code and compare costs side-by-side.

Confirm Your “Still Working” Medicare Timeline

We’ll verify employer size, confirm creditable coverage, coordinate HSA timing, and outline the exact steps to avoid penalties.

Related Medicare Enrollment Resources

Explore the most common Medicare timing questions and plan comparisons.

Questions now? Call 800-533-5969

Medicare Enrollment for People Still Working: FAQ

Do I have to enroll in Medicare at 65 if I’m still working?

Does my spouse’s employer plan let me delay Medicare?

Can I keep COBRA instead of signing up for Medicare?

What is the Special Enrollment Period (SEP) when I retire?

Can I contribute to an HSA if I enroll in Part A only?

Should I choose Medigap or Medicare Advantage when I retire?

About the Author:

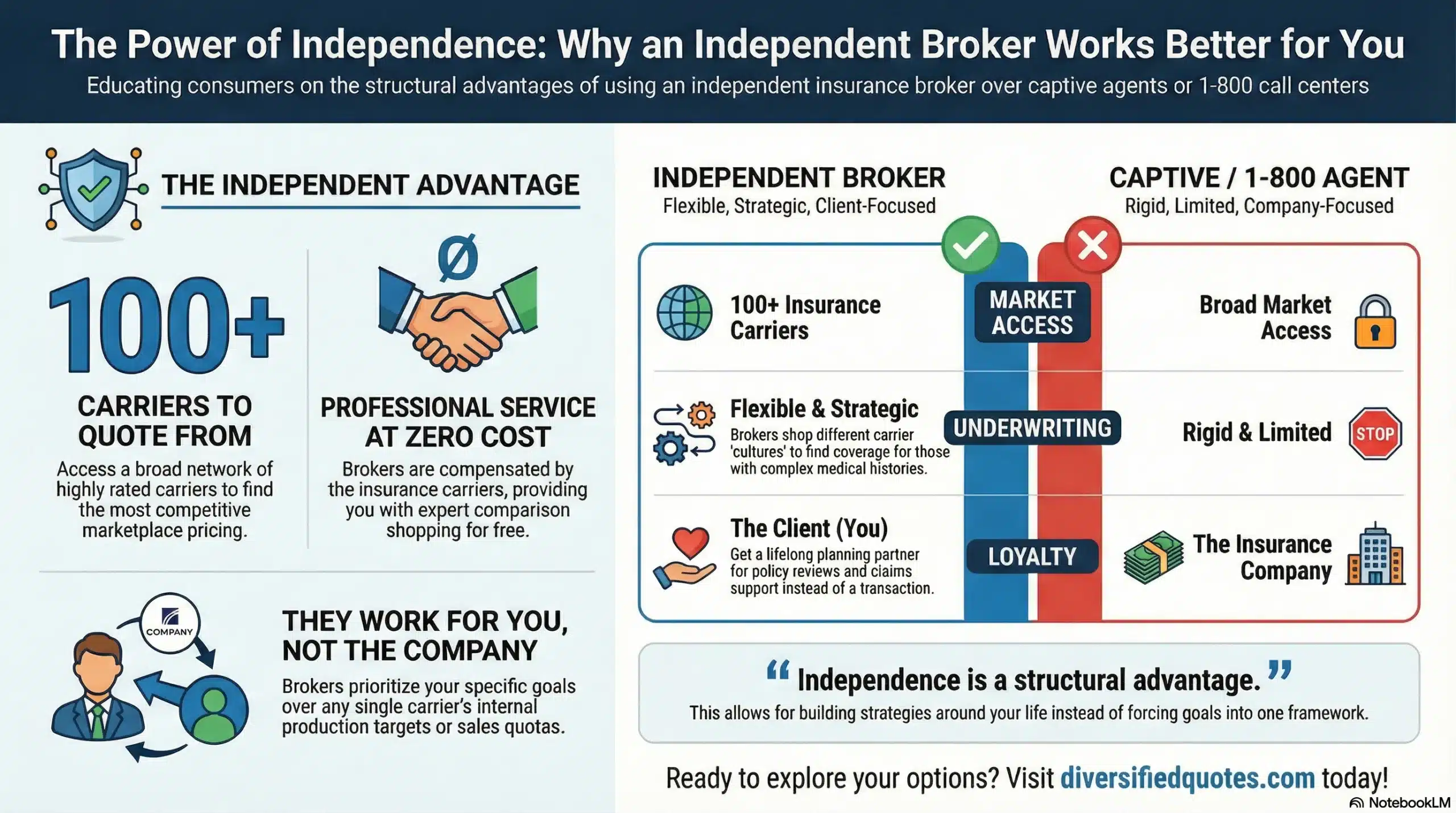

Tonia Pettitt, CMIP©, is a seasoned Medicare specialist with more than 40 years of hands-on experience guiding individuals and families through the complexities of Medicare planning. As a senior advisor with the nationally licensed independent agency Diversified Insurance Brokers, Tonia provides clear, dependable guidance across all areas of Medicare—including Medicare Advantage, Medicare Supplement (Medigap), and Part D prescription coverage. Leveraging active contracts with dozens of highly rated insurance carriers, she helps clients compare options objectively and secure the most suitable coverage for their health and budget.

Known for her patient, education-first approach, Tonia has built a reputation as a trusted resource for retirees seeking reliable, unbiased Medicare support. With four decades of experience across evolving Medicare laws, carrier changes, and plan structures, she brings unmatched insight to every client conversation—ensuring clients feel confident, protected, and fully prepared for each stage of their retirement healthcare journey.