Annuity Quotes

Over 100 Carriers to Quote From. Here are a few of them!

At Diversified Insurance Brokers, we specialize in helping individuals, couples, and business owners find the right annuity solutions to protect their retirement savings, create guaranteed income, and preserve wealth with the top Annuity Quotes in the industry. Whether you’re looking for a safe alternative to the stock market, a way to defer taxes on your savings, or a reliable income stream you can’t outlive, an annuity can be a powerful part of your financial plan.

Shopping for an annuity isn’t just about finding the highest rate—it’s about choosing a product that fits your goals, time horizon, and risk tolerance. Our annuity quote service gives you direct access to the latest fixed, fixed indexed, and bonus annuity rates from top-rated insurance carriers. You’ll be able to compare options side-by-side, evaluate features, and see exactly how your money can grow and generate income over time.

Get Your Free Annuity Quote

Request a quote from top-rated annuity carriers, current fixed and bonus rates, and income rider options—all with no obligation.

Find the Right Annuity Path

Compare current fixed (MYGA) rates, explore upfront bonus options, or see top lifetime income strategies—all from trusted carriers.

Why Get an Annuity Quote?

Rates, bonuses, and features can vary greatly between annuity products. By requesting a quote, you’ll receive a customized overview of the options that best fit your needs. This is especially important because annuity terms can change quickly—what’s available today may be different tomorrow.

- Access to Current Rates: Stay up to date with fixed and indexed annuity rates from leading carriers.

- Compare Multiple Products: Review options side-by-side for growth potential, liquidity, and income features.

- Personalized Recommendations: See products tailored to your retirement income needs, time horizon, and goals.

- No-Obligation Service: Get the information you need without any pressure to buy.

Types of Annuities You Can Quote

We provide quotes for a wide range of annuities, each designed for different financial objectives:

- Fixed Annuities: Offer a guaranteed interest rate for a set period, providing safety and stability.

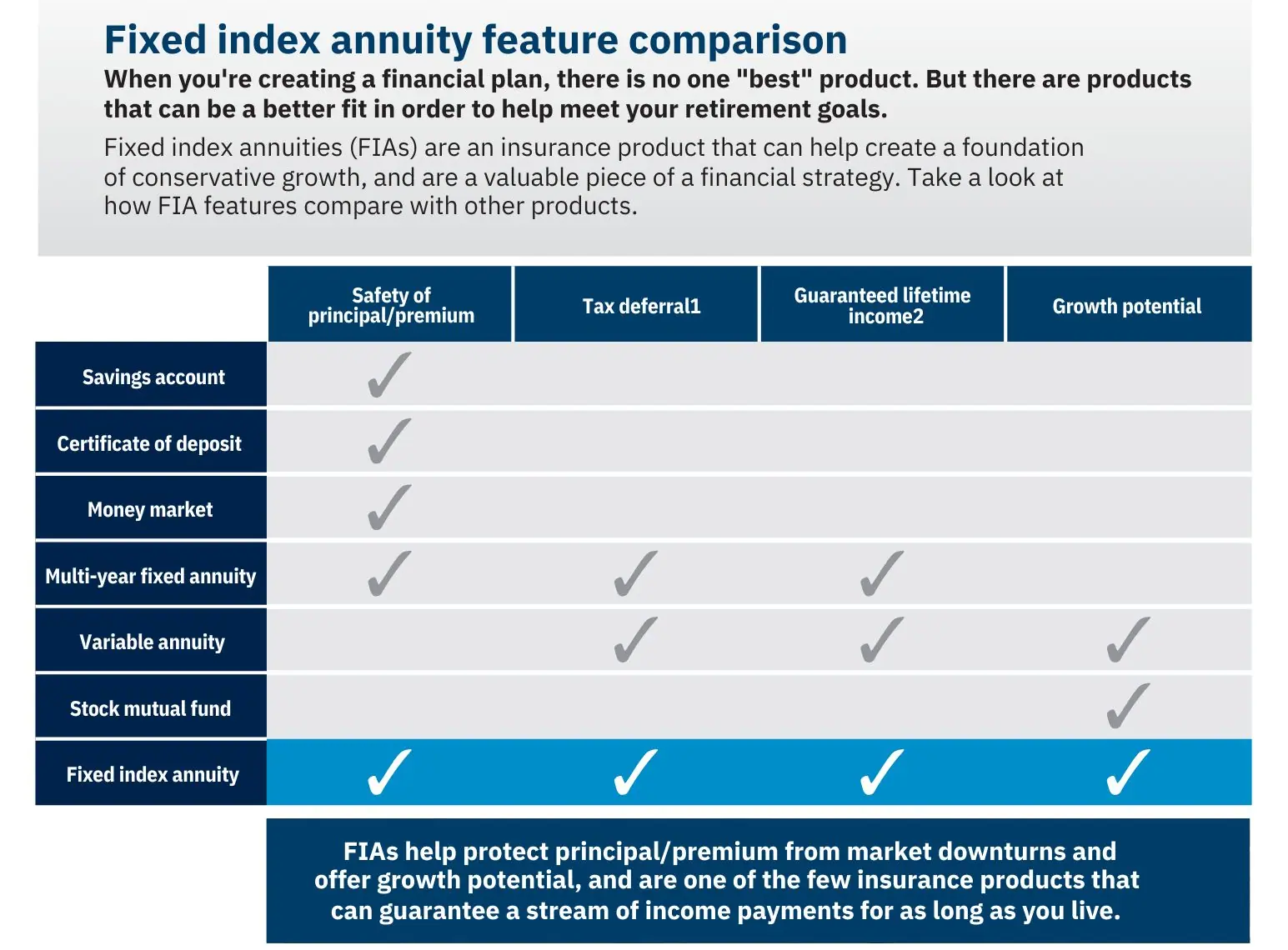

- Fixed Indexed Annuities: Link growth to an index (like the S&P 500) while protecting your principal from losses.

- Bonus Annuities: Provide an upfront bonus to your account value, helping you jumpstart growth or income potential.

- Income Annuities: Convert a lump sum into guaranteed lifetime or period-certain payments.

How the Annuity Quote Process Works

Getting your annuity quote is fast, secure, and straightforward:

- Tell Us About Your Goals: We’ll ask a few quick questions about your savings, retirement timeline, and income needs.

- We Search the Market: Our advisors access current rates and features from over 100 top-rated carriers.

- You Review Your Options: We’ll present a customized list of annuities that fit your profile, with details on rates, bonuses, and payout options.

- Decide on the Right Fit: Take your time reviewing the details, ask questions, and move forward only if it’s right for you.

Why Choose Diversified Insurance Brokers?

With decades of experience and relationships with over 100 carriers, we provide unbiased advice and access to products you may not find on your own. We’re not tied to one company, which means we can focus entirely on what’s best for you. From comparing rates to explaining complex features, our goal is to help you make confident, informed decisions.

Request your annuity quote today and take the first step toward a secure, worry-free retirement.

Frequently Asked Questions About Annuity Quotes

What information do I need to get an accurate annuity quote?

How do rate riders affect my quote?

Can I compare quotes from multiple carriers?

What payout options are available?

How quickly will I get a quote?

Are quotes guaranteed?

Can I update my quote later?

Talk With an Advisor Today

Choose how you’d like to connect—call or message us, then book a time that works for you.

Schedule here:

calendly.com/jason-dibcompanies/diversified-quotes

Licensed in all 50 states • Fiduciary, family-owned since 1980

Related Pages

- How Diversification Works Differently for Million-Dollar Portfolios

- When Is Medicare Open Enrollment?

- How Much Does Life Insurance Cost?

- Roth Conversions with a Fixed Indexed Annuity

- How Much Income Does an Annuity Pay?

- Disability Income for Professional Athletes

- Disability Income Insurance for Firefighters

- What Do Insurance Companies Do with Your Money?

About the Author:

Jason Stolz, CLTC, CRPC, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.