How Premium Financing Works for Estate Planning

Jason Stolz CLTC, CRPC

High-net-worth families often face a complex but predictable challenge: they need substantial life insurance coverage to address future estate tax exposure, equalize inheritances, protect closely held businesses, preserve real estate holdings, or provide long-term liquidity for heirs—yet they do not want to liquidate investments, sell appreciated assets, or interrupt a carefully constructed wealth strategy to fund large annual premiums. For families with significant net worth and long planning horizons, premium financing can become a sophisticated solution that aligns liquidity management with estate preservation. Rather than writing multi-million-dollar premium checks out of pocket, qualified clients may use third-party lending to fund premiums while keeping capital invested elsewhere. When structured correctly and monitored carefully, this approach can preserve portfolio growth, enhance estate efficiency, and support intergenerational wealth transfer goals without destabilizing an overall financial plan.

At Diversified Insurance Brokers, we work with affluent households, family offices, estate planning attorneys, and tax advisors to evaluate whether premium financing is appropriate within a broader wealth strategy. Premium financing is not a shortcut, nor is it a universal solution. It is a structured planning tool that requires liquidity, discipline, stress testing, and long-term commitment. When used in the right circumstances—often alongside irrevocable trusts, advanced underwriting strategies, and conservative policy design—it can provide leverage and estate liquidity in ways that traditional premium funding does not. For high-income earners and families evaluating large policy structures, it is also important to understand how this strategy compares to traditional approaches such as paying premiums directly or using alternative wealth transfer strategies. If you are exploring large coverage structures, you may also want to review our guidance on life insurance for high income earners to understand baseline design considerations before layering in financing.

Schedule a Private Estate Planning Strategy Call

Discuss premium financing structures, ILIT coordination, and large policy design with a licensed advisor.

Request a Confidential ConsultationPremium financing, in the estate planning context, refers to a strategy where a third-party lender provides the capital needed to pay premiums on a large permanent life insurance policy. Rather than committing significant personal liquidity to fund premiums—often hundreds of thousands of dollars per year—the client borrows those premium payments and posts collateral. The life insurance policy is frequently owned by an irrevocable life insurance trust (ILIT), which keeps the death benefit outside the insured’s taxable estate. The combination of trust ownership and financing allows a family to secure a large death benefit designed to address projected estate taxes, provide equalization among heirs, or create liquidity for business succession without disrupting investment allocations or forcing asset sales at inopportune times.

Estate planning often centers around liquidity timing. Estate taxes, where applicable, are typically due within a defined period after death. Families with concentrated wealth in businesses, commercial real estate, private equity, or long-held appreciated assets may not want those holdings liquidated under pressure. Life insurance provides tax-efficient liquidity at death. Premium financing addresses the challenge of funding that insurance while maintaining portfolio strategy. Instead of pulling capital out of investments—potentially triggering capital gains or disrupting compounding—the client uses bank capital while retaining control of underlying assets. For families that prioritize keeping money working in operating businesses or market investments, this preservation of opportunity cost is often central to the appeal.

The structure typically includes four core components: the permanent life insurance policy, the irrevocable trust, the lender, and the collateral arrangement. The policy is often indexed universal life (IUL), whole life, or guaranteed universal life (GUL), depending on the objectives and risk profile. The trust applies for and owns the policy, keeping it outside the taxable estate. The lender advances annual premium payments under a structured agreement. The client pledges collateral—commonly marketable securities or cash—until the policy’s internal value grows sufficiently to offset risk. This collateral is a key element and must be carefully evaluated for liquidity impact and volatility exposure.

Families considering this strategy must understand that premium financing is long-term in nature. It is not a short-cycle arbitrage. Interest rate fluctuations, policy performance variability, and collateral value changes all influence outcomes. Therefore, conservative design assumptions and annual monitoring are essential. Before exploring financing, many clients compare policy types and structures, such as those explained in our overview of whole life insurance with cash value growth, to understand foundational product mechanics. Financing amplifies both advantages and risks, which is why policy selection matters deeply.

One of the primary reasons affluent families explore premium financing is estate tax mitigation. While exemption levels fluctuate with legislation, many households anticipate future tax exposure due to appreciating assets. Life insurance owned inside an ILIT can provide liquidity without increasing estate value. If structured properly, the death benefit flows to the trust beneficiaries free of income tax and outside the taxable estate. That liquidity can then be used to pay estate taxes, equalize inheritances, or preserve business continuity. The financing component allows the family to acquire this coverage without large current out-of-pocket expenditures.

Another motivation is preserving investment allocation. Ultra-high-net-worth investors often hold portfolios with expected returns exceeding borrowing costs over long periods. While returns are never guaranteed, maintaining capital in diversified or operating investments may align better with long-term wealth strategy than redirecting large sums into premium payments. For perspective on how large investors think about capital deployment and leverage, you may also review how ultra high net worth investors build wealth, which explores broader strategic principles.

From a mechanical standpoint, once the ILIT is established by estate counsel, it applies for the life insurance policy. Underwriting must be completed just as with any large permanent policy. In fact, underwriting precision is even more important in financed cases, because policy longevity and performance affect loan dynamics. Depending on age and health profile, clients may need to understand underwriting expectations in advance. While high-net-worth applicants often qualify favorably, medical evaluation still applies, as described in our explanation of what is a life insurance exam.

After approval, the lender advances premium payments annually according to the loan agreement. Interest may be paid annually or allowed to accrue, depending on design. The client provides collateral that protects the lender in the event policy values or performance underperform expectations. Over time, as policy cash value accumulates, collateral requirements may decline. Eventually, some strategies are structured to allow the policy’s internal value to support loan resolution. Other families plan to repay the loan from outside assets at a strategically chosen time. In some cases, the loan remains outstanding until death, with the death benefit satisfying the obligation before distributing remaining proceeds to beneficiaries.

It is critical to stress-test interest rate scenarios. Rising interest rates can increase loan costs. While some financing structures use fixed rates, many involve variable components tied to benchmarks. A conservative projection must account for possible increases and ensure that cash flow and collateral capacity can withstand stress. Similarly, policy performance assumptions—especially in indexed universal life—should be modeled under conservative crediting scenarios. A design that works only under optimistic assumptions is not prudent estate planning.

Collateral risk is equally important. If marketable securities are pledged and market values decline, additional collateral may be required. Families must maintain liquidity reserves sufficient to address potential calls without disrupting core investment strategy. For clients heavily invested in market-based assets, scenario modeling should include downturn cycles and volatility periods.

Compared to paying premiums out of pocket, financing introduces complexity but preserves liquidity. Direct funding is simpler and removes loan risk. However, large estate cases can require millions in cumulative premium commitments. For some families, the opportunity cost of diverting that capital outweighs the borrowing cost, especially when long-term investment horizons and asset growth expectations are strong. The decision ultimately becomes a balance between simplicity and capital efficiency.

Policy selection plays a decisive role. Whole life offers stability and predictable value growth, appealing to conservative estates prioritizing guarantees. Indexed universal life provides flexible premium structure and performance potential tied to market indices, though it introduces variability. Guaranteed universal life focuses primarily on death benefit guarantees with minimal emphasis on cash accumulation. Each product interacts differently with financing. The right fit depends on estate objectives, risk tolerance, and projected timelines.

Premium financing is generally best suited for families with net worths in the multi-million-dollar range—often $5–10 million and above—who possess strong liquidity and diversified asset bases. It is not appropriate for households with limited reserves, unstable income, or low tolerance for interest rate volatility. Before considering financing, clients should ensure foundational estate planning elements are in place, including updated wills, trusts, and asset titling.

Explore Financed vs. Non-Financed Policy Designs

We provide side-by-side illustrations and stress testing to help you evaluate whether premium financing aligns with your estate objectives.

Request an Estate Strategy ReviewAt Diversified Insurance Brokers, our role is to coordinate illustrations, underwriting strategy, lender communication, and long-term monitoring. We model conservative assumptions, evaluate break-even points, and coordinate with estate counsel to ensure structural integrity. Annual reviews are essential. Interest rates shift, markets fluctuate, and estate laws evolve. A premium financing strategy must be dynamic, not static.

For affluent families who require substantial estate liquidity and prefer to maintain portfolio alignment, premium financing can be a powerful and efficient tool. When structured prudently, it allows leverage without sacrificing control, preserves investment capital, and provides clarity for heirs. When misapplied or under-monitored, it introduces unnecessary risk. The difference lies in conservative design, disciplined review, and experienced coordination. If your estate plan includes large projected tax exposure, business succession considerations, or asset equalization goals, premium financing may deserve careful evaluation within a broader wealth preservation framework.

Related Life Insurance & Estate Planning Guides

Talk With an Advisor Today

Choose how you’d like to connect—call or message us, then book a time that works for you.

Schedule here:

calendly.com/jason-dibcompanies/diversified-quotes

Licensed in all 50 states • Fiduciary, family-owned since 1980

Premium Financing & Estate Planning FAQs

Is premium financing risky for estate planning?

Do I need an ILIT to use premium financing?

Can the loan stay outstanding until death?

What type of life insurance is best for premium financing?

What kind of net worth do I need?

About the Author:

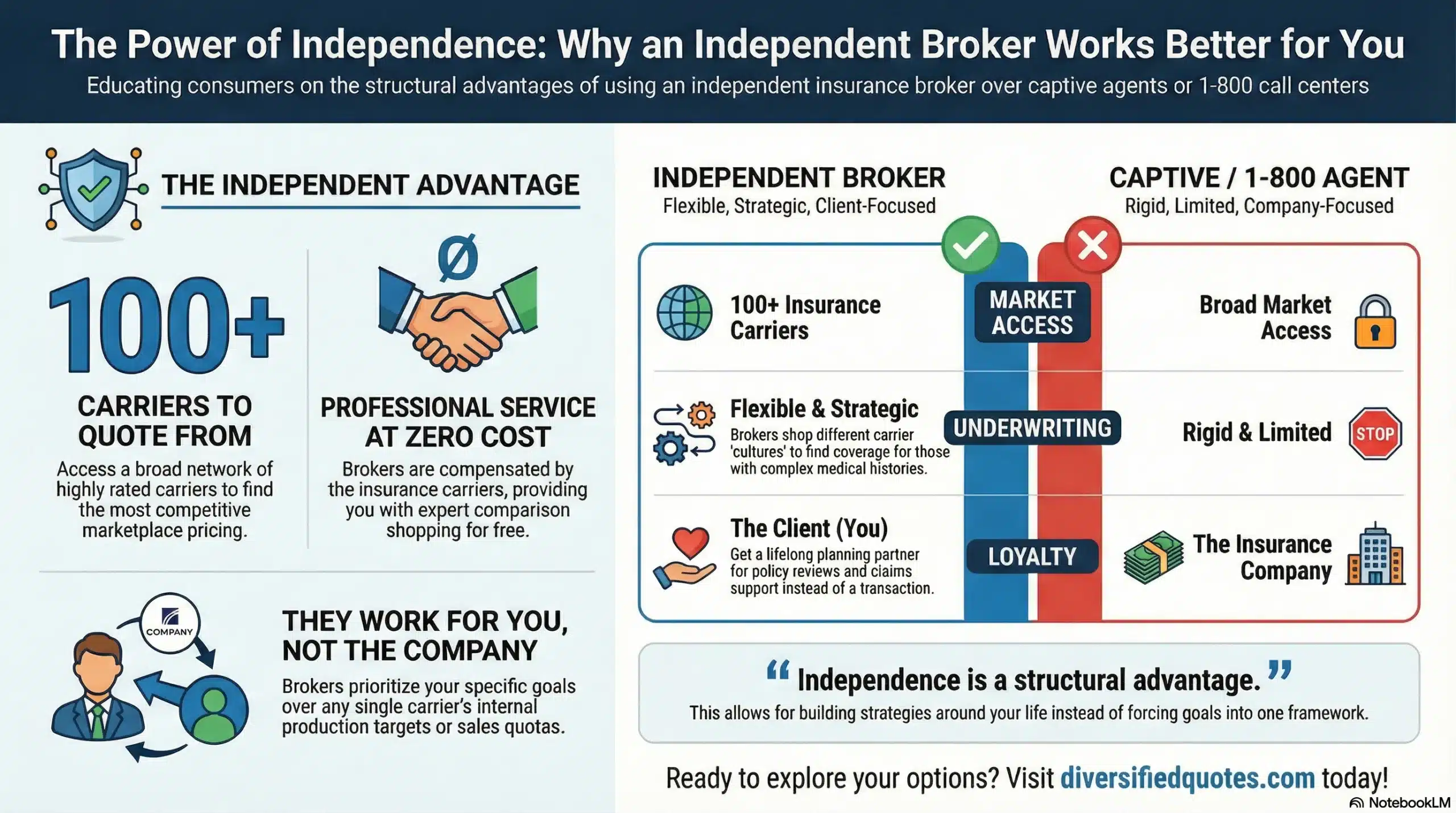

Jason Stolz, CLTC, CRPC and Chief Underwriter at Diversified Insurance Brokers, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.