Life Insurance for High Risk Occupations

Jason Stolz CLTC, CRPC

When you apply for life insurance, underwriting typically assigns you to a risk class such as Preferred, Standard, or a Table rating. In some cases, however, the insurance company uses a more precise pricing adjustment known as a flat extra. A flat extra is an additional dollar charge per $1,000 of coverage that is added on top of your base premium when there is a clearly defined, measurable risk that cannot be fully addressed through a percentage-based rating alone. Rather than increasing your entire premium proportionally, the carrier isolates the specific exposure and prices it separately. At Diversified Insurance Brokers, we regularly work with applicants who receive flat extras due to medical history, occupational hazards, aviation involvement, or high-risk avocations, and we often succeed in reducing or restructuring those offers by carefully positioning the case with the right carrier.

The key distinction is structural. A table rating increases your premium by a percentage relative to Standard rates. A flat extra adds a fixed dollar amount per $1,000 of coverage. Because it scales directly with face amount, the financial impact depends heavily on how much coverage you are purchasing. A modest flat extra on a small policy may be negligible, while the same adjustment on a seven-figure policy can materially change long-term cost. Understanding that dynamic allows you to plan intelligently rather than react emotionally to the initial offer.

Received a Flat Extra Offer?

We’ll review your underwriting decision, compare multiple carriers, and work to reduce or limit the surcharge.

Flat extras are most commonly applied when the risk is identifiable and quantifiable. For example, applicants seeking life insurance after cancer may receive a temporary flat extra if treatment was recent but prognosis is favorable. Those with a history of substance abuse may receive a defined surcharge period while demonstrating continued stability. In occupational underwriting, professions involving heavy machinery, aviation exposure, or hazardous environments frequently trigger flat extras because the additional mortality risk can be estimated actuarially. Individuals participating in activities such as skydiving or scuba diving are often assessed similarly, with pricing adjusted according to frequency and intensity of participation.

To understand the real-world impact, consider how a flat extra is calculated. If you apply for $750,000 of coverage and receive a $5 per $1,000 flat extra, the additional annual cost equals $3,750 layered on top of your base premium. That amount remains consistent as long as the flat extra is in force. Some flat extras are temporary and automatically fall off after a defined period, commonly between two and ten years. Others remain for the life of the policy if the underlying exposure persists.

The following table illustrates how flat extras affect different coverage amounts. This assumes the same flat extra rate but demonstrates how total cost scales directly with face value.

| Coverage Amount | Flat Extra ($5 per $1,000) | Additional Annual Cost |

|---|---|---|

| $250,000 | $5 × 250 units | $1,250 per year |

| $500,000 | $5 × 500 units | $2,500 per year |

| $1,000,000 | $5 × 1,000 units | $5,000 per year |

| $2,000,000 | $5 × 2,000 units | $10,000 per year |

This scaling effect is why strategy matters. Sometimes adjusting face amount, layering multiple policies, or structuring term durations differently can materially reduce long-term cost exposure while still meeting planning objectives. Reviewing foundational pricing factors such as those explained in how life insurance pricing works can help you understand how the flat extra fits into the broader premium structure.

High-risk occupations represent one of the most common triggers for flat extras. Logging professionals, offshore oil workers, structural ironworkers, commercial fishermen, private pilots, and certain military roles often receive flat extras because of consistent exposure to elevated hazard. Even within the same profession, pricing can vary significantly depending on specific duties. A pilot who flies occasionally for recreation may be treated very differently from a commercial test pilot performing aerobatics. Similarly, a construction supervisor working primarily in an office environment may be evaluated differently from a field-based crane operator.

Avocational risks are assessed with similar nuance. Frequency, certification level, and depth of participation all influence underwriting outcomes. A diver with advanced certification who limits dives to controlled environments may receive a smaller flat extra than someone engaged in deep wreck exploration. A skydiver completing a few recreational jumps annually may be treated differently from a competitive participant. These distinctions highlight why carrier selection is critical. Underwriting appetites vary widely, and a case that results in a $7 flat extra at one company may receive a $3 temporary flat extra at another.

Medical flat extras are often temporary. For example, individuals with a recent melanoma diagnosis may receive a defined five-year surcharge that automatically drops off if no recurrence occurs. Cardiac procedures, certain autoimmune disorders, or complex metabolic conditions may be treated similarly depending on stability and documented follow-up. Because flat extras frequently have a defined expiration period, it is important to review the policy at that milestone to confirm the charge is removed as scheduled.

Compare Life Insurance Premiums Instantly

See how underwriting classes and potential flat extras affect real-world pricing.

Perhaps the most important takeaway is that a flat extra is not a decline. It represents a willingness by the carrier to issue coverage with an adjusted price reflecting a specific exposure. In many cases, that exposure decreases over time. Strategic case presentation, updated medical documentation, and thoughtful carrier selection can substantially improve the outcome. At Diversified Insurance Brokers, we routinely pre-underwrite cases before formal submission, allowing us to identify which carriers are most likely to offer competitive terms before placing your application.

Let’s Strengthen Your Underwriting Outcome

If you’ve been assigned a flat extra, we may be able to reduce the amount or limit the duration.

High-Risk & Specialized Underwriting Topics

Explore additional planning resources for complex medical and occupational profiles.

Life Insurance Planning Fundamentals

Strengthen your overall protection strategy with foundational guidance.

High-Risk Occupation & Activity Guides

Explore occupation- and activity-specific underwriting details.

Talk With an Advisor Today

Choose how you’d like to connect—call or message us, then book a time that works for you.

Schedule here:

calendly.com/jason-dibcompanies/diversified-quotes

Licensed in all 50 states • Fiduciary, family-owned since 1980

FAQs: Life Insurance for High-Risk Occupations

Can I get life insurance if my job is considered high risk?

Yes. Many people in dangerous professions qualify for life insurance. Approval and pricing depend on your exact duties, how often you’re exposed to hazards, where you work, and which carrier you apply with.

What occupations are often considered high risk?

Common examples include construction and heavy equipment roles, commercial trucking, logging, roofing and iron work, offshore oil and mining, certain maritime jobs, first responders, aviation roles, and some military or contractor work in hazardous zones.

How do carriers evaluate risk for high-risk jobs?

Insurers evaluate your specific duties, frequency of hazardous exposure, safety controls and training, equipment and environment hazards, travel requirements, and whether your role is regulated or supervised versus more independent and exposed.

Will my job cause higher premiums or a table rating?

Possibly. Many high-risk jobs receive an occupational surcharge or table rating, but the amount varies widely by carrier. Some applicants still qualify for standard pricing when their duties are classified in a safer occupational class.

What types of life insurance are available for high-risk workers?

Traditional term and permanent policies may be available (often with a rating). If traditional underwriting is difficult, simplified-issue policies can provide coverage with fewer medical requirements, usually for smaller benefit amounts.

How can I improve my approval chances and reduce cost?

Provide clear details about your duties, document safety training and certifications, maintain a clean safety record, and manage personal risk factors like tobacco use, weight, and blood pressure. Most importantly, work with an independent broker who can target carriers that are more favorable for your occupation.

About the Author:

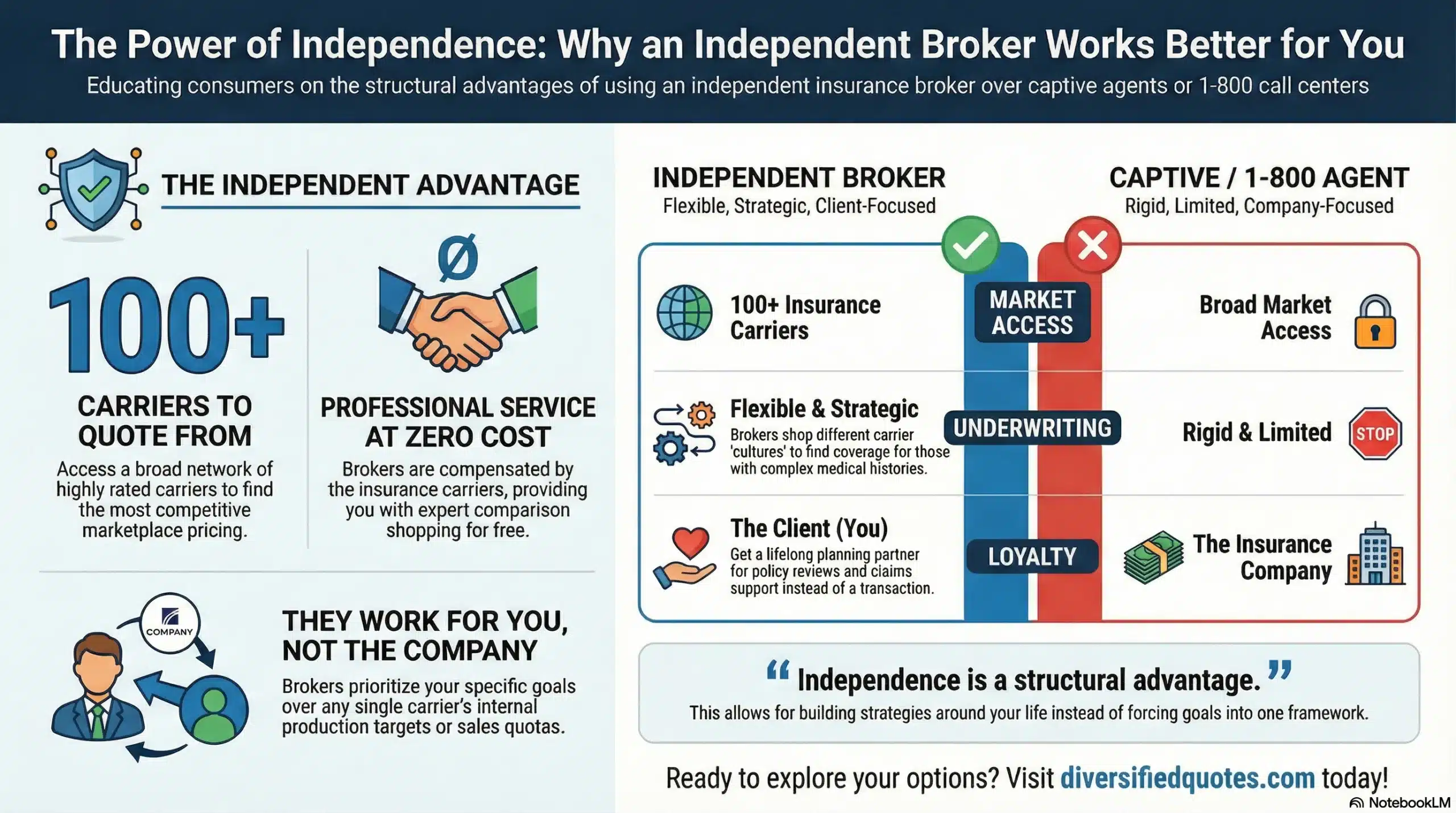

Jason Stolz, CLTC, CRPC and Chief Underwriter at Diversified Insurance Brokers, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.