What is the Difference in Stocks, Bonds and Annuities

Jason Stolz CLTC, CRPC

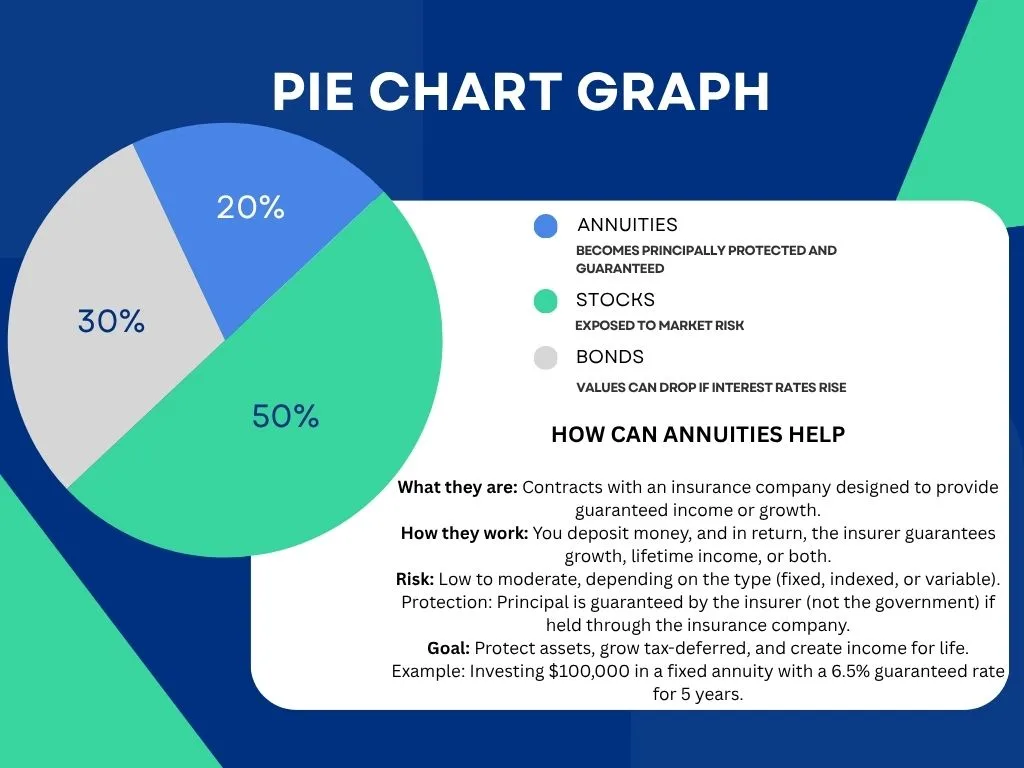

Stocks, bonds, and annuities all show up in retirement conversations, but they are not interchangeable. They behave differently, carry different risks, and play very different roles when you’re trying to create a plan that lasts for decades. In simple terms, stocks are designed for long-term growth, bonds are typically used for income and stability, and annuities are built to provide guarantees—especially when it comes to turning savings into predictable retirement income.

At Diversified Insurance Brokers, we help clients compare options across 75+ carriers and create strategies that balance growth, safety, and reliable income. For many families, the key isn’t choosing one “best” investment. The key is understanding what each tool can do well, what it cannot do, and how to combine them so your retirement plan feels stable in real life, not just on paper.

1. Stocks – Growth With Market Risk

Stocks represent ownership in a company. When you buy a stock, you’re buying a small piece of that business. If the company grows, your shares may increase in value, and some stocks may also pay dividends. Over long time periods, stocks have historically produced some of the strongest returns of any major asset class, which is why they often form the foundation of retirement accumulation strategies during a person’s working years.

The tradeoff is that stocks do not come with guarantees. Your account balance can rise quickly, but it can also drop fast—and those declines can happen at the exact time you least want them. A 20% drop may feel manageable when you’re 42 and still working. The same drop can feel devastating when you’re 67 and withdrawing money for income.

That’s where retirees face a threat that investors don’t always think about until it’s too late: sequence-of-returns risk. This is the risk that if the market falls early in retirement, withdrawals lock in losses and reduce the amount of money that can participate in the recovery later. Even if the market rebounds, the portion you already sold can’t rebound with it.

Sequence risk doesn’t mean stocks are “bad.” It simply means that stocks are not designed to guarantee retirement income. Stocks are excellent accumulation engines, but for many retirees, the income phase requires a different kind of structure—one that isn’t dependent on perfect market timing.

Example: Stock Market Risk in Retirement

Imagine a retiree with $500,000 invested primarily in equities. They retire at age 65 and begin withdrawing $25,000 per year to supplement Social Security. If the market drops 25% in the first two years of retirement, the account value may shrink to around $375,000. But the retiree still needs income.

Now the retiree is selling shares at depressed values to cover living expenses. Even if markets rebound later, the portfolio may not recover as expected because the share count has been reduced by withdrawals taken during the decline. This is why the early retirement years are so sensitive. The combination of withdrawals plus market drops can create a permanent drag on the plan.

This is one reason many retirees choose to carve out a portion of their assets into a vehicle that can continue paying income even during a market downturn. In many cases, that “income foundation” is built using an annuity strategy designed for predictable retirement cash flow.

2. Bonds – Stability With Rate and Inflation Risk

Bonds are typically considered the “middle ground” between stocks and annuities. When you buy a bond, you are lending money to an issuer, which may be a corporation, a municipality, or the U.S. Treasury. In exchange, you receive interest payments, and if the bond is held to maturity, you generally receive your principal back.

For decades, bonds have played an important role in retirement portfolios because they tend to fluctuate less than stocks, and they can generate steady interest income. In theory, bonds can help smooth out volatility and reduce the overall risk profile of a portfolio. But bonds have their own risks that often get overlooked, especially by retirees who assume bonds are always “safe.”

One key risk is interest-rate risk. When interest rates rise, older bonds with lower yields often become less attractive, and their market value can fall. This effect is especially pronounced in longer-duration bonds. Retirees who hold bond funds (instead of individual bonds to maturity) often feel this pain, because the price of the fund can drop as rates rise.

Another major risk is inflation. Even if bond prices stay stable, inflation reduces the purchasing power of the interest payments. If inflation averages 3%–4% for a period of time and the bond yield is not meaningfully higher, the retiree may feel like they are falling behind—even though the account looks “stable.”

Finally, bonds do not solve longevity risk. Bond interest payments are not guaranteed for life. When bonds mature, retirees must reinvest at whatever rates are available at that time. That can create reinvestment uncertainty, especially for people trying to build a reliable long-term retirement income plan.

This is why many retirees who once relied on bonds for income and stability now explore fixed and fixed indexed annuities as a modern alternative. Instead of hoping interest rates cooperate over time, retirees may prefer locking in contract-based guarantees that are built specifically for retirement income planning.

Example: When Bond Yields Fall Short

Suppose you purchase $200,000 in 10-year Treasury bonds at a 4.2% yield. That might generate around $8,400 per year in interest income. For some retirees, that income helps. But there are two practical concerns: it’s not inflation-adjusted, and it stops at maturity.

At maturity, the retiree must reinvest. If rates are lower at that point, income may decline. If inflation has climbed higher than expected, that fixed interest stream may feel smaller every year. Many retirees find themselves trying to solve a problem that bonds were never designed to solve: producing stable income that lasts across a retirement that could span 25–35 years.

By comparison, funds allocated into a fixed annuity can offer a guaranteed rate for a set period, tax-deferred growth, and in many cases, the ability to later convert to a lifetime income stream using optional rider features. It’s not that bonds are “wrong.” It’s that many people are looking for a tool that can do a different job.

3. Annuities – Secure Growth and Guaranteed Income

Annuities are financial contracts issued by insurance companies. Depending on the type, annuities can provide guaranteed interest, principal protection, tax-deferred growth, and most importantly for retirees, the ability to create guaranteed lifetime income. Unlike stocks and bonds, annuities are specifically designed to solve two retirement problems that are difficult to solve with traditional investments alone: income certainty and longevity risk.

When someone asks, “What’s the biggest difference between annuities and everything else?” the answer is usually this: annuities are built for outcomes. Stocks and bonds can be wonderful tools for growth and diversification, but they do not promise a paycheck for life. Annuities can.

That doesn’t mean every annuity is right for every person, and it doesn’t mean you should “annuitize everything.” It does mean annuities can play a powerful role in a balanced plan when the retiree wants to protect a portion of assets from market volatility and create a more predictable monthly retirement income baseline.

Annuities generally fall into three broad categories that match three common retirement needs.

Fixed Annuities (MYGAs) provide a guaranteed interest rate for a specific period of time. Many retirees compare these to CDs because of the fixed rate component, but annuities typically provide additional benefits like tax deferral and more flexible long-term retirement planning designs. When retirees want a place to park money safely while earning a contract-based return, MYGAs can fit that role well.

Fixed Indexed Annuities (FIAs) are designed for people who want growth potential linked to an index (such as the S&P 500) but do not want market losses credited to their annuity value due to downturns. FIAs are often used by conservative investors who like the idea of participating in market upside to a degree, while protecting principal from negative index years. This can be especially attractive in the years leading up to retirement, when a major market decline could derail timing.

Income Annuities are built specifically to produce a predictable paycheck stream. These can be structured to provide guaranteed income for life, and in many cases can include options for spousal continuation or death benefit features depending on design. For retirees who want to cover essential expenses with income that doesn’t depend on market performance, income annuities can create a “personal pension” feeling inside the plan.

At the time of publication, many of our clients are seeing competitive guaranteed rates on fixed annuities and strong product structures on indexed designs. If you want to compare options, you can review current fixed annuity rates and explore current bonus annuity rates for products that offer premium credits at purchase (depending on product design and availability).

For many retirees, the most meaningful advantage of annuities isn’t simply “rate.” The advantage is the ability to create a plan where income is structured to continue no matter what happens in markets, and no matter how long the retiree lives.

Example: Annuity for Lifetime Income

Consider a 65-year-old who allocates $300,000 into an income-focused annuity strategy. Depending on age, design, and payout structure, this could potentially generate roughly $21,000–$24,000 per year in retirement income for life. The amount depends on multiple variables, including whether the income is single life or joint life, whether there are period-certain features, and what options are selected.

The key difference is that the payments can be designed to continue even if the individual lives to age 95 or 100. This is the type of guarantee that stock portfolios and bond ladders generally cannot promise in a contractual way. For retirees who value predictability, this can remove a tremendous amount of stress from the plan.

Comparing Stocks, Bonds, and Annuities Side by Side

When clients compare stocks, bonds, and annuities, it helps to think less about which one is “best” and more about what job each one is supposed to do. Stocks may be your growth engine. Bonds may be your stabilizer. Annuities may be your income floor and your guaranteed outcome tool. The goal isn’t to pick one and ignore the others. The goal is to build a structure where each component supports a different part of your retirement plan.

| Feature | Stocks | Bonds | Annuities |

|---|---|---|---|

| Primary Goal | Long-term growth | Interest income and stability | Guaranteed growth and/or lifetime income |

| Risk Level | High (market volatility) | Moderate (rate risk + inflation risk) | Low to none (contract-based guarantees) |

| Principal Protection | No | Partial (depends on market rates and holdings) | Yes (based on annuity type and rider choices) |

| Tax Treatment | Dividends/capital gains can be taxable annually | Interest income taxable annually | Tax-deferred until withdrawal (non-qualified) |

| Liquidity | High | Moderate | Limited during surrender period; often 10% free annually |

| Income Reliability | Unpredictable | Fixed, ends at maturity | Can be guaranteed for life (depending on design) |

What Retirees Should Consider Before Choosing Between Them

The biggest mistake retirees make is assuming that an investment’s historic performance automatically translates into a retirement income plan. Growth matters, but retirement is not only about growth. Retirement is about creating a system that can handle withdrawals, market volatility, inflation, taxes, and longevity all at the same time.

Stocks can do extremely well over the long run, but a retiree doesn’t get to live “over the long run” as a spreadsheet. Retirement happens one year at a time, and the early years matter more than most people realize. Bonds can provide stability, but interest rates and inflation can change the real-world value of bond income. Annuities can provide guarantees, but they must be designed correctly so the client has the right balance between growth, liquidity, and income.

Most successful retirement plans don’t rely on only one of these tools. They blend them. They use stocks for long-term growth and inflation protection, bonds or fixed products for stability, and annuity guarantees to cover the core income needs that must show up every month no matter what markets do.

One helpful way to look at retirement planning is to separate expenses into two categories: needs and wants. Needs are the bills that must be paid—housing, food, insurance, utilities, healthcare, and basic lifestyle requirements. Wants include travel, hobbies, gifting, and lifestyle upgrades. Many retirees feel more confident when their needs are covered by reliable income sources, and their wants can be funded from investments that are more flexible.

This is why annuities have become more common in modern retirement plans. They can act like a paycheck foundation, allowing the retiree to stay invested in other areas without panic selling during downturns.

How Stocks Often Fit in a Retirement Plan

Stocks are often best used as a long-term growth component. They can help maintain purchasing power over time, and they can provide an important inflation hedge in ways that fixed income cannot always match. For many retirees, some exposure to stocks is still necessary, especially if retirement could last 30 years.

However, the role stocks play should often be adjusted as retirement approaches. The closer someone gets to needing the money, the more dangerous market volatility becomes. This doesn’t mean retirees should avoid stocks entirely. It means they should be thoughtful about how much risk they are taking with the money they cannot afford to lose.

Retirees who stay heavily concentrated in stocks may face two challenges. The first is emotional: large drawdowns can cause stress and lead to bad decisions. The second is mathematical: the combination of withdrawals plus volatility can create a drag on the portfolio that is difficult to recover from.

Many retirees feel more comfortable when their stock allocation supports long-term growth and discretionary spending goals, while core lifestyle income is protected elsewhere. That balance can make the plan feel much more livable.

How Bonds Often Fit in a Retirement Plan

Bonds can play a useful stabilizing role, especially when paired with stocks to reduce volatility. In many portfolios, bonds serve as a source of interest income and as a buffer that can potentially reduce portfolio swings. Bonds can also help retirees avoid selling stocks in a down market by providing another pool of funds to draw from.

But bonds are not “risk-free.” Retirees who hold longer-duration bonds can experience losses when rates rise, and bond income may not keep pace with inflation. For many clients, the idea of “safe bonds” has shifted, especially after periods where bond funds fell at the same time stock markets were choppy.

This is why many retirees compare bonds not only against annuities, but also against fixed annuity rates. When the goal is stable growth and stable income planning, fixed annuity contracts can sometimes compete directly with bond strategies—particularly when retirees want to remove reinvestment uncertainty.

How Annuities Often Fit in a Retirement Plan

Annuities tend to work best when they are used intentionally. They are not meant to replace every investment. They are meant to solve specific retirement problems: creating income you cannot outlive, reducing market exposure for the “must have” portion of retirement spending, and helping clients feel confident that the plan can survive market volatility.

Many retirees use annuities to replace a portion of what would have historically been bond allocation. Instead of relying only on bond yields and market behavior, retirees can lock in contractually defined growth or income structures. In many cases, this increases predictability without removing all upside potential from the overall plan.

It’s also important to understand that annuities are not “one thing.” The word annuity describes a category with different sub-types. A fixed annuity is very different from an indexed annuity. An income annuity is different from an accumulation annuity. The right match depends on the goal.

If someone is nearing retirement and wants to protect savings while still having growth potential, a fixed indexed annuity may be worth exploring. If someone wants a predictable income foundation, an income-focused strategy may make more sense. If someone wants a safe place to park cash for a set timeframe with guaranteed interest, a MYGA might fit well.

When designed correctly, annuities can be one of the most effective “sleep well at night” tools in retirement planning. They don’t eliminate every risk, but they can eliminate some of the biggest retirement risks that cause real-world stress.

Why Annuities Stand Out for Retirement Income Planning

From a practical standpoint, the biggest benefit annuities offer is the ability to create a retirement paycheck that doesn’t rely on markets cooperating. Retirees can use a portion of their assets to secure a baseline income stream, and that income can continue even if markets experience volatility.

This can be especially valuable in the first 10 years of retirement, when market declines combined with withdrawals can create the greatest long-term damage to a portfolio. When income needs are partially met by guaranteed sources, retirees may not need to sell down stocks during downturns. That can help keep the long-term plan healthier.

Many retirees also appreciate the tax-deferred growth potential of annuities in non-qualified accounts. While annuities are not the right fit for every tax situation, tax deferral can be an advantage when a retiree is trying to manage income levels and avoid unnecessary tax spikes.

Another key advantage is simplicity. A well-designed annuity strategy can remove guesswork from retirement budgeting. Instead of wondering how much you can safely withdraw, a portion of income can be contractually defined. This can create clarity and confidence.

The Retirement “Income Phase” Is Different Than the “Growth Phase”

One of the most important retirement planning shifts happens when a household transitions from accumulation to distribution. During accumulation, your goal is often to grow assets. During distribution, your goal becomes keeping assets sustainable while producing income. That change in goal changes how you should evaluate risk.

A 40-year-old investor can ride out volatility because time is on their side. A 68-year-old retiree may not have that luxury. Even if the retiree has time, they don’t have the same emotional and financial flexibility to wait out drawdowns while still withdrawing income. That’s why income planning requires more structure.

Stocks can still be valuable during retirement, but many retirees don’t want 100% of their financial security dependent on market performance. Bonds can still help, but bond income alone may not feel sufficient. Annuities can fill the gap by creating contract-based income certainty.

This is exactly why so many modern retirement strategies focus on blending all three tools rather than picking a single winner.

Common Retirement Strategies That Blend Stocks, Bonds, and Annuities

Retirement planning typically works better when each investment type has a job. A household might allocate some funds to stocks for long-term growth and inflation protection. They might allocate some funds to bonds or fixed options for stability. Then they might allocate some funds to annuities to create guaranteed income or guaranteed accumulation outcomes.

Many retirees feel comfortable with an approach where essential expenses are covered by predictable income, while discretionary spending is supported by a flexible investment portfolio. That can reduce stress during volatile years because the retiree isn’t forced to sell investments just to pay the bills.

Another benefit of blending strategies is that it helps avoid an “all or nothing” mindset. Retirement isn’t usually about choosing between growth and safety. Retirement is about building enough growth while still maintaining enough safety that you can actually enjoy your lifestyle without constant fear of market headlines.

At Diversified Insurance Brokers, we often help clients compare designs across multiple categories so the final plan feels balanced. For some households, that means using annuities to replace a portion of bond exposure. For others, it means using annuities to create an income floor that complements their existing market-based portfolio.

When Stocks Might Be the Wrong Tool for a Retirement Need

Stocks may be the wrong tool if the money has a near-term purpose that cannot tolerate a loss. For example, if a retiree needs a down payment for a home in two years, or they need funds for a major planned expense, using stocks may expose that goal to unnecessary risk.

Stocks may also be a poor fit for clients who will panic during volatility. Even if the math says stocks will likely recover, emotional decision-making can ruin the plan. Selling at the wrong time is one of the biggest reasons some retirees underperform what the market actually returned over the same period.

This isn’t a critique of stocks. It’s a reminder that retirement planning is personal. The best portfolio is not the one that looks best in hindsight. It’s the one the retiree can stick with through real-life uncertainty.

When Bonds Might Be the Wrong Tool for a Retirement Need

Bonds may be the wrong tool if the retiree expects bond income to fully solve inflation and longevity challenges. Bonds can provide predictable interest for a period of time, but retirees often outlive bond ladders or face reinvestment risk at maturity. If interest rates drop in the future, bond income may be lower than expected, and the retiree may feel pressured to take more risk later.

Bond funds can also surprise retirees when interest rates rise. Some investors assume bond funds behave like bank savings accounts. They do not. Bond funds can lose value, sometimes significantly, and retirees who need liquidity may end up selling at the wrong time.

Bonds can still be useful, but they may not be the best “income engine” for retirees who want stable retirement cash flow for life.

When Annuities Might Be the Wrong Tool for a Retirement Need

Annuities may be the wrong tool if the retiree needs full liquidity on the entire balance, or if they are unwilling to accept any surrender schedule structure. Many annuities have surrender periods, and while many offer free withdrawal provisions (often 10% per year), they are not designed to function like a checking account.

Annuities can also be a poor fit if someone is chasing maximum upside with no limitations. For example, a fixed indexed annuity will often have caps or participation rates that limit credited interest in exchange for downside protection. That tradeoff is intentional, but it’s not what every investor wants.

That said, many retirees are not trying to maximize upside. Many retirees are trying to maximize retirement reliability. For that goal, annuities can be an excellent tool when used correctly.

If you want to learn more about liquidity and access rules, you can read through annuity free withdrawal rules to understand how many contracts are structured.

Tax Differences Between Stocks, Bonds, and Annuities

Taxes are another major difference between these investment types. Stocks can generate taxable dividends and capital gains. Bonds typically generate taxable interest income. Annuities, when held in non-qualified accounts, typically grow tax-deferred and are taxed upon withdrawal based on earnings.

Tax deferral can help retirees control timing. It can reduce annual tax drag during accumulation, and it can provide planning flexibility during retirement. That doesn’t mean annuities are always the best tax solution, but it is one reason they remain a popular option for conservative retirement planning strategies.

Some retirees also use annuities specifically to manage income planning in years where market gains might push taxable income higher than desired. By keeping some assets in tax-deferred structures, the retiree may have more control over the tax impact of distributions.

In many cases, having more than one “tax bucket” can make retirement planning simpler: taxable, tax-deferred, and tax-free. The best mix depends on the client’s goals, retirement timeline, and income structure.

Inflation Risk and Longevity Risk: The Two Retirement Threats Most People Underestimate

Inflation and longevity are two forces that quietly destroy retirement plans. Inflation reduces purchasing power year after year. Longevity risk is the risk of living longer than expected and running out of money. Stocks can help with inflation over the long run, but they do not guarantee income. Bonds can provide predictable interest for a period of time, but they do not guarantee inflation-adjusted income for life. Annuities can provide income that cannot be outlived, but they may not always keep pace with inflation unless structured carefully.

This is why diversified retirement planning is about managing tradeoffs. A strong retirement plan usually involves combining the strengths of each category while reducing their weaknesses. When structured correctly, a household can have growth potential, stability, and guaranteed income working together.

For many retirees, the “peace of mind” benefit of a guaranteed income floor is just as valuable as the numeric return. A plan that feels stable is a plan that is more likely to be followed consistently, which often matters more than chasing the perfect outcome.

Why Retirees Prefer Annuities Today

With market volatility and inflation concerns still fresh for many households, retirees are increasingly using annuities as a way to add certainty to retirement. Modern annuities can combine guaranteed growth, tax deferral, liquidity features, and lifetime income options in a way that feels closer to the pension systems many retirees grew up expecting.

For many households, the question is no longer, “Should I use annuities or investments?” The question is, “How much certainty do I want, and which dollars are best suited for guarantees?” A common approach is to allocate a portion of assets toward annuity-based income planning while keeping other assets invested for growth and flexibility.

This kind of balance can transform retirement. Instead of worrying every month about what markets are doing, retirees can focus on enjoying life, knowing that their baseline needs are supported by reliable income. The result is often a plan that feels less stressful and more sustainable across decades.

If you want a broad overview of annuities and how they work, start here: Annuities Overview.

Lifetime Income Calculator

💡 Note: The calculator supports up to $2,000,000 in premium. Larger deposits scale proportionally. For higher balances, request a customized illustration.

Explore Fixed and Bonus Annuity Rates

Compare options nationwide and see how guaranteed growth or upfront bonuses can enhance your retirement plan.

Or request a personal quote tailored to your state and income goals:

Related Annuity Education Pages

If you’re comparing how annuities work versus traditional investments, these pages go deeper into annuity types, rules, and how guaranteed income strategies are built.

Related Retirement Strategy Pages

These pages focus on retirement withdrawal strategy and the real-world planning issues that make “stocks vs. bonds vs. annuities” such an important decision for retirees.

Talk With an Advisor Today

Choose how you’d like to connect—call or message us, then book a time that works for you.

Schedule here:

calendly.com/jason-dibcompanies/diversified-quotes

Licensed in all 50 states • Fiduciary, family-owned since 1980

FAQs: Stocks vs. Bonds vs. Annuities

Are annuities safer than stocks?

Fixed and fixed indexed annuities protect principal from market loss and can provide guaranteed income. Stocks can grow more over time but fluctuate and can decline during bear markets.

Why consider annuities if I already own bonds?

Bonds can lose value when rates rise. Many retirees use annuities to lock in higher guaranteed yields and create lifetime income that bonds alone can’t guarantee.

Can I access my money in an annuity?

Most contracts allow limited penalty-free withdrawals during the surrender period. See free withdrawal rules for details.

How are annuities taxed compared to brokerage accounts?

Non-qualified annuities defer taxes on growth; payments are taxed on the gain portion (exclusion ratio). Brokerage dividends/interest are taxed annually. Learn more: non-qualified annuity.

Which annuity type fits a conservative investor?

Fixed annuities (MYGAs) offer guaranteed rates for a set term. Fixed indexed annuities add index-linked upside with principal protection. We’ll compare both to your timeline and income goals.

About the Author:

Jason Stolz, CLTC, CRPC and Chief Underwriter at Diversified Insurance Brokers, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.