Protect Your Paycheck with Disability Insurance

Your income is your most valuable asset. If an illness or injury prevents you from working, disability insurance steps in—replacing lost income so you can keep paying bills, supporting your family, and safeguarding your financial future.

Don’t leave your livelihood unprotected—get your personalized quote here.

Disability Insurance: An Overview

What Is Disability Insurance?

Disability insurance is designed to protect your income if you’re unable to work due to illness or injury. In exchange for regular premium payments, the insurance company provides you with a monthly benefit—replacing a portion of your lost income while you recover.

Whether you’re facing a short-term setback or a long-term disability, this coverage ensures you can continue paying essential expenses like your mortgage, utilities, and groceries—without draining your savings or risking your financial future.

👉 Get your disability insurance quote here

How Disability Insurance Can Help You

Disability Insurance Protects Your Income—and Your Independence

If an illness or injury prevents you from working, disability insurance ensures you can still meet your financial obligations. Whether the disability is short-term or long-term, this coverage helps replace lost income—so you can continue paying bills, supporting your family, and maintaining your lifestyle.

It offers more than just financial protection—it gives you the peace of mind to focus on recovery without the added stress of wondering how to stay afloat.

👉 Get your disability insurance quote here

.

Protect Your Income with Disability Coverage from MassMutual

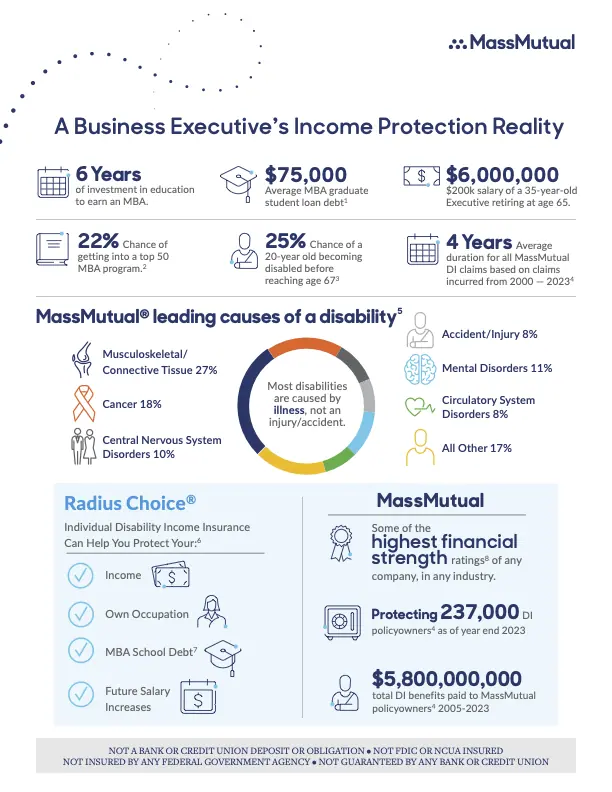

If you’re a high-earning professional or business executive, your income is one of your most valuable assets. But what happens if an illness or injury prevents you from working? Disability income insurance from MassMutual offers strong, own-occupation protection—designed to replace lost income and preserve your lifestyle during a disability.

With more than $5.8 billion in benefits paid and among the highest financial strength ratings in the industry, MassMutual has helped protect over 237,000 policyowners. Most disabilities are caused by illness, not accidents—making income protection an essential part of a sound financial plan.

Get a quote today and learn how MassMutual can help protect your earning potential.

Benefits of Disability Insurance

-

It offers peace of mind knowing that you have a safety net in case you are unable to work due to an injury or illness.

Short-Term vs Long-Term Disability Insurance

-

-

Covers temporary disabilities lasting a few weeks to several months—typically up to 3 to 6 months.

-

Ideal for situations like post-surgical recovery or minor injuries that temporarily prevent you from working.

-

Benefits begin quickly, often within 1 to 2 weeks of becoming disabled, offering immediate income protection during short recovery periods.

-

Medical Underwriting vs. Non-Medical Underwriting

-

Medical underwriting is the process insurance companies use to evaluate your health before approving a policy. This helps determine your eligibility, premium rate, and any policy exclusions or limitations. The process typically includes:

-

Reviewing your medical history, including any pre-existing conditions, medications, or past treatments

-

Requesting a physical exam or lab work, depending on the type of policy and coverage amount

-

Assessing overall risk to determine if you qualify for coverage and at what cost

Understanding this process can help you prepare—and improve your chances of securing favorable coverage.

-

No Obligation Consultation

Secure Your Income. Protect Your Future.

Disability insurance is a critical part of any sound financial plan—providing income protection when illness or injury prevents you from working. Understanding the differences between short-term and long-term coverage, as well as how underwriting works, empowers you to make the right decision for your financial security.

At Diversified Insurance Brokers, we’re here to help you find the policy that fits your needs. Whether you’re recovering from a temporary condition or planning for long-term protection, our team will guide you every step of the way.

Don’t leave your income unprotected.

Get a personalized disability insurance quote or contact us today to explore your options with confidence.

Need More Information?

We’re here to help you plan with confidence.

Use our Lifetime Income Calculator to explore your retirement options, or complete the form to connect with our expert team. We’ll guide you step-by-step—no pressure, no obligation.

One Click Away from Coverage — Get a Quote or Apply Today for Life Insurance, Annuities, Medicare & More

From instant term life to guaranteed issue policies, fixed annuities to Medicare supplements, we make it easy to compare top-rated options and apply online in minutes. Whether you’re planning for retirement, protecting your family, or exploring long-term care coverage, you’re just one click away from customized protection.

FAQs: Disability Insurance

What is disability insurance and who needs it?

Disability insurance replaces part of your income if an illness or injury prevents you from working. It’s valuable for anyone who relies on a paycheck—employees, professionals, and the self-employed.

What’s the difference between own-occupation and any-occupation coverage?

Own-occupation pays benefits when you can’t perform the substantial duties of your job, even if you can work elsewhere. Any-occupation requires that you be unable to work in any reasonable job for which you’re qualified.

How much coverage can I get?

Individual policies typically insure 40%–70% of your pre-tax income (benefit percentage varies by occupation, income, and other coverage). We’ll help calculate an amount that fits your budget and risk.

How do elimination period and benefit period work?

The elimination period is your waiting period before benefits start (commonly 30, 60, 90, or 180 days). The benefit period is how long benefits can pay (2 years, 5 years, to age 65/67/70). Shorter waits and longer benefit periods cost more.

Will benefits be taxable?

If you pay premiums with after-tax dollars, benefits are generally tax-free. If an employer pays premiums or you deduct them, benefits are typically taxable. Always confirm with your tax pro.

What riders should I consider?

Popular riders include Residual/Partial Disability (for reduced income), Cost-of-Living Adjustment (COLA), Future Increase Options, Catastrophic Disability benefits, and Student Loan or Retirement Contribution riders.

Can self-employed people qualify?

Yes. Carriers use recent tax returns to verify income. Many self-employed clients pair personal DI with Business Overhead Expense (BOE) coverage to keep the business running during a claim.

How do group disability plans compare with individual policies?

Group DI is convenient but often taxable, with lower caps and limited definitions. Individual DI is portable, customizable, and can offer stronger definitions and tax-free benefits when you pay premiums personally.

What affects the cost?

Age, health, occupation class, benefit amount, elimination/benefit periods, and riders all impact price. Small design tweaks (e.g., 90-day wait, to-age-65 benefits) can meaningfully reduce premiums.

How do I apply and how long does underwriting take?

We gather a short application, verify income, and complete health questions; some cases require labs or medical records. Decisions often arrive in 1–4 weeks, faster for simplified-issue programs.