Why Capital Preservation Is the New Goal for Retirees

Concierge Wealth Services

Why Capital Preservation Is the New Goal for Retirees

In today’s uncertain markets, retirees increasingly lean toward preservation first—not chasing yield. The math of drawdowns, sequence risk, longevity, and inflation demands that sustaining capital becomes as essential as generating income. This shift reflects a more sustainable mindset for retirees who want longevity and optionality.

1) Why Drawdowns Destroy Retirement Outcomes

Downward swings in the early years of retirement cause more damage than late declines because withdrawals exacerbate losses. A 20% drop early means a bigger base loss going forward, leading to compounding shortfalls. Understanding sequence of returns risk is fundamental.

Many retirees mistakenly focus on long-term averages—but the path matters more when you’re taking distributions.

2) Stability Over Volatility

Retirees often prefer capital durability to headline returns. That might mean lower volatility strategies, downside filters, or managed drawdown limits—even if they slightly reduce upside in strong markets.

3) Liquidity as Safety Buffer

Allocating capital to highly liquid reserves ensures retirees aren’t forced to sell into weakness. This cash buffer is more than convenience—it’s insurance against sequence risk and emotional selling pressure.

4) Layering for Optionality

Ultra-wealthy retirees often layer a base of capital-preserving assets with opportunistic growth allocations. The growth layer is sized intentionally—never risking capital needed for basic withdrawals.

This layering approach depends on sound exposure limits, rigorous risk tracking, and an understanding that growth allocations are upside levers, not foundations.

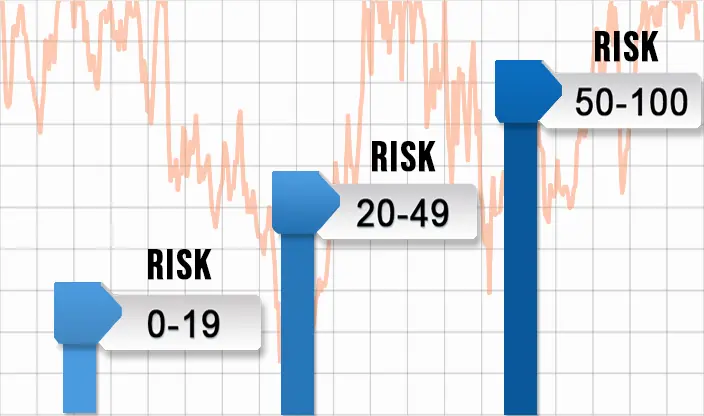

5) Quantitative Risk Controls

Institutions use drawdown thresholds, volatility corridors, and correlation regimes to “slow the ship” when conditions deteriorate. Retirees can borrow these disciplines without needing prediction—just clear rules.

6) Governance & Policy Review

Policies should define triggers, reversion paths, and decision protocols. That way, when volatility strikes, decision-makers aren’t second-guessing — they’re following agreed structure.

Where Concierge Wealth Comes In

Through Concierge Wealth Services, qualified clients may receive introductions to independent fiduciary advisers who prioritize capital durability—even while enabling growth. If you’re exploring readiness, begin with An Invitation to Explore More.

Related Topics to Explore

- Concierge Wealth Services

- Sequence of Returns Risk

- How Smart Investors Manage Risk Without Sacrificing Growth

- Quantitative Risk Management

- Institutional Investing Secrets the Ultra-Wealthy Use

Request a Confidential Conversation

📞 Call us at 800-533-5969

Important: We do not provide securities or investment advice. If appropriate, we may introduce you to an independent SEC-registered investment adviser for evaluation under their regulatory framework.

Why Capital Preservation Is the New Goal for Retirees — Frequently Asked Questions

Why is preservation more important than growth now?

Because large drawdowns early in retirement can permanently impair future income potential. Preserving principal helps maintain options and stability.

Is this approach too conservative?

No. It’s about calibrating exposure, not eliminating growth. Many retirees use structured layering—durable assets first, growth exposures second.

Can risk frameworks help?

Yes—quantitative thresholds, governing drawdowns, and liquidity buffers help manage volatility and reduce emotional selling risk.

Will you suggest specific investments?

No. We do not provide securities or investment advice. Qualified clients can be introduced via Concierge to independent advisers who make those decisions.

How to get started?

Start with An Invitation to Explore More to learn about the evaluation and introduction process.

Important Notice: Wealth management and investment advisory services are provided exclusively through our independent SEC-registered investment adviser partner. Our insurance firm does not offer securities or investment advice.

About the Author:

Jason Stolz, CLTC, CRPC, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.