Is Instant Decision Term Life Insurance Expensive

Jason Stolz CLTC, CRPC

Is instant decision term life insurance expensive? In most cases, no. Modern online term life platforms use digital underwriting to reduce costs, speed up approvals, and offer highly competitive pricing. Many healthy applicants are surprised to learn that instant decision coverage can cost the same — or sometimes less — than traditionally underwritten policies that require exams and weeks of waiting. If you are comparing options, it helps to understand how pricing works, when instant approval is most cost-effective, and how it compares to fully underwritten coverage.

Before choosing a policy, it’s smart to calculate your needs. If you’re unsure about coverage amounts, review our life insurance needs guide or use our term life insurance calculator to estimate the right protection level based on income, debt, and family goals.

Get Instant Term Life Insurance

Apply online in minutes — no medical exam, no waiting, real-time decision.

Apply NowOne of the biggest misconceptions is that “instant” means “simplified” or “watered down.” That confusion often comes from mixing up instant decision term with guaranteed issue or simplified issue life insurance. Those products typically carry higher premiums because insurers accept more health risk without full underwriting. Instant decision term, however, uses real-time data sources — prescription checks, medical records databases, identity verification, and risk algorithms — to assess eligibility in seconds. It is still fully underwritten; it simply happens faster.

Applicants in excellent health may receive pricing comparable to traditional policies. If you have medical conditions, your rate class may vary — and in some situations you may benefit from reviewing options like life insurance with pre-existing conditions, life insurance for elevated liver enzymes, or even niche underwriting guides such as life insurance for colitis and Crohn’s.

For healthy non-smokers, example pricing often looks like this:

- Male, 35, $500,000 / 20 years: approximately $20–$30 per month

- Female, 40, $750,000 / 20 years: approximately $32–$48 per month

- Male, 45, $1,000,000 / 20 years: approximately $60–$90 per month

- Female, 30, $1,000,000 / 30 years: often under $45 per month

These ranges are competitive with exam-based policies. The key reason is cost efficiency. Traditional underwriting involves paramed exams, lab processing, attending physician statements, manual file review, and weeks of follow-up. Instant platforms remove much of that overhead. Lower administrative costs allow insurers to maintain competitive premiums.

However, instant decision term is not automatically the lowest-cost solution for every applicant. Individuals with complex histories — such as prior heart conditions, significant weight fluctuations, or specialized occupational risks — may benefit from a fully underwritten carrier comparison. For example, professionals in high-risk roles can review underwriting considerations in our guides to life insurance for roofers or life insurance for police officers. Lifestyle risks, including aviation or extreme sports, are discussed in our resource on life insurance for extreme sports participants.

Coverage limits are another common question. Many instant platforms allow up to $3,000,000 in term coverage, which is sufficient for most households replacing income, covering mortgage debt, or funding college plans. If you require advanced estate strategies, you might explore permanent options such as survivorship joint whole life insurance, which is structured differently than term coverage.

Applicants often compare instant term to employer benefits. While workplace plans can be useful, they are not portable and may be limited in amount. If you’re deciding between employer coverage and private policies, see our comparison of group vs. individual life insurance. Business owners may also review specialized planning pages like group health insurance for consulting firms for broader risk management strategy.

It is also important to distinguish term insurance from other financial products. Some consumers compare life insurance to annuities or long-term care coverage. These serve different purposes. If retirement income planning is your focus, explore resources like how much a $4 million annuity pays or 40-year guaranteed growth annuity strategies. For care protection later in life, our guide on whether long-term care insurance is worth it can clarify that decision.

The application process itself is straightforward. You complete an online form, answer health and lifestyle questions, authorize digital record checks, and receive a decision in minutes. In some cases, the insurer may request additional information, but many applicants are approved instantly. This efficiency is why instant decision term remains affordable — the insurer saves time and cost, and those savings help maintain pricing parity.

Check Your Instant Price

See what you qualify for in minutes — secure coverage without an exam.

Get Your Online RateUltimately, instant decision term life insurance is not inherently expensive. For healthy applicants, it is one of the most efficient and competitively priced ways to secure financial protection. If your health profile is more complex, underwriting outcomes may vary — but comparing options ensures you do not overpay. Evaluating needs, reviewing underwriting categories, and selecting the appropriate term length are the real drivers of cost, not simply whether approval is instant.

Talk With an Advisor Today

Choose how you’d like to connect—call or message us, then book a time that works for you.

Schedule here:

calendly.com/jason-dibcompanies/diversified-quotes

Licensed in all 50 states • Fiduciary, family-owned since 1980

FAQs: Is Instant Decision Term Life Insurance Expensive?

Is instant decision term life more expensive than traditional term?

Why are instant decision products sometimes cheaper?

Does skipping the medical exam raise the cost?

Who gets the lowest instant decision pricing?

Can I get coverage instantly?

Is instant decision term life safe and reputable?

About the Author:

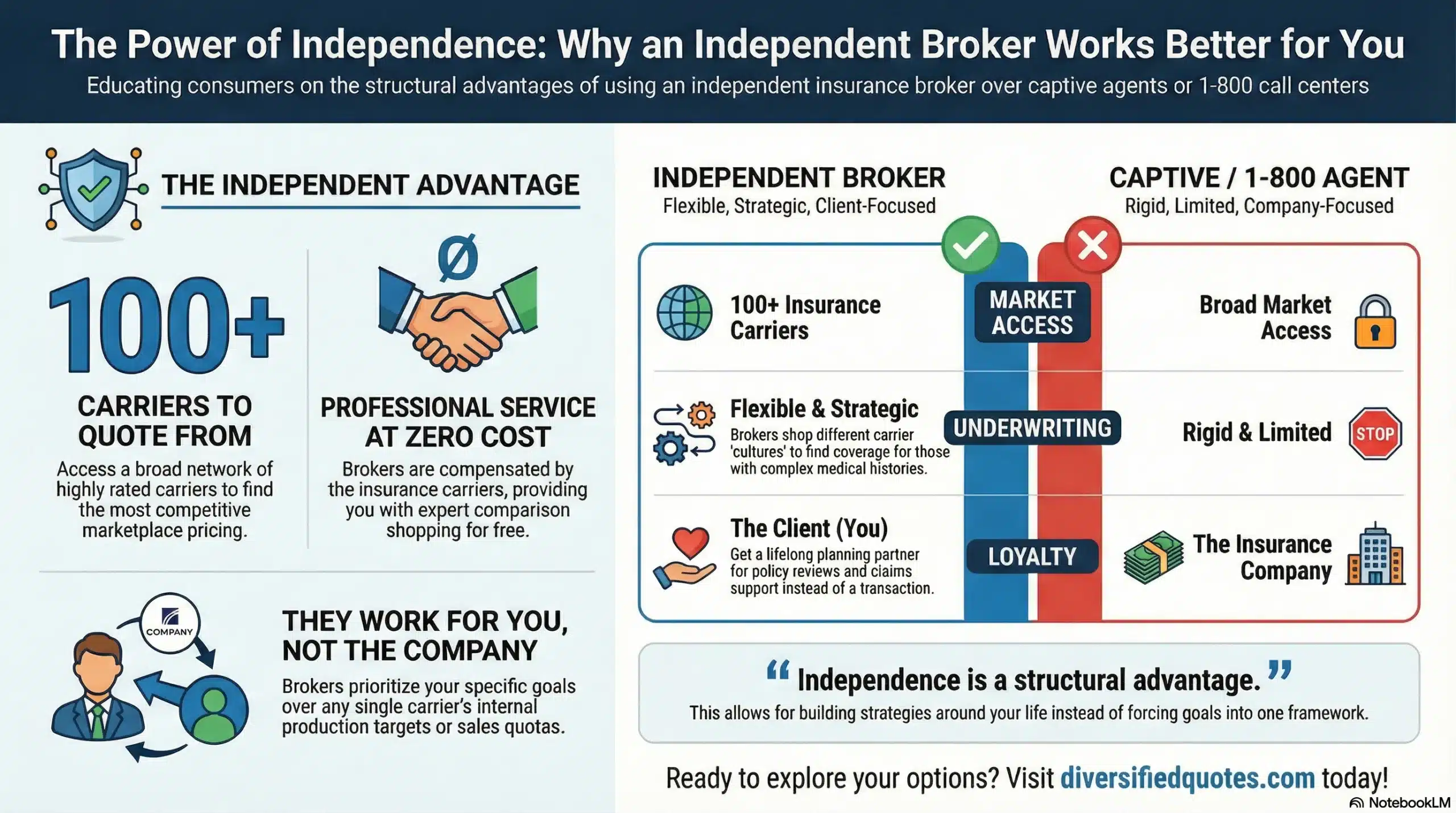

Jason Stolz, CLTC, CRPC and Chief Underwriter at Diversified Insurance Brokers, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.