Annuity Benefits

Over 100 Carriers to Quote From. Here are a few of them!

See Your Annuity Benefits in Action

Compare guaranteed income, principal protection, and tax deferral across top carriers—no pressure, just clear options.

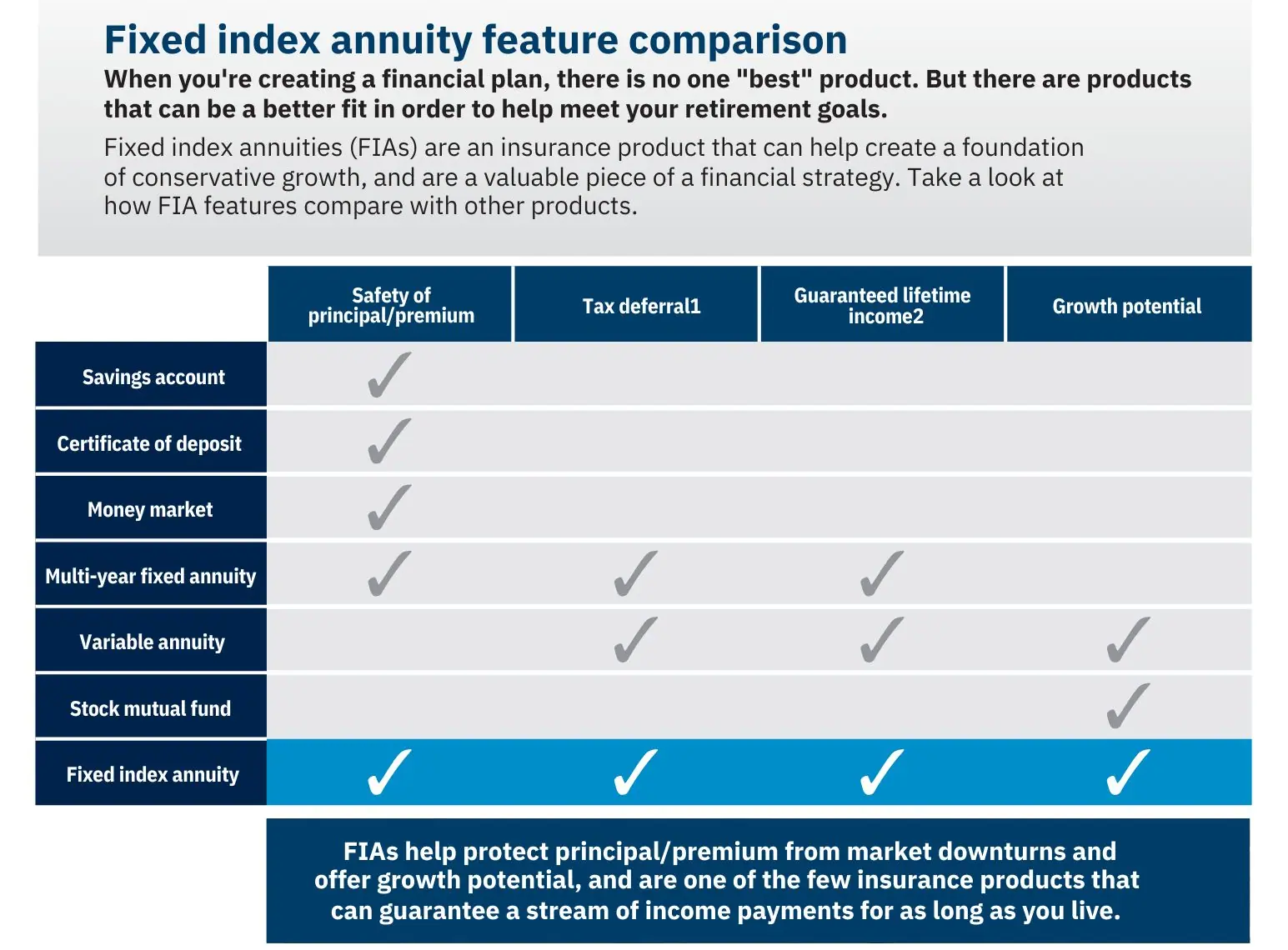

Thinking about an annuity? Understanding annuity benefits can help you decide whether a contract belongs in your retirement plan. While no single product fits everyone, the benefits of annuities—guaranteed lifetime income, principal protection, tax-deferred growth, and optional riders—can solve real-world problems like market volatility, sequence risk, and longevity risk. It’s also important to know how these benefits interact with taxes and other coverage such as how life insurance works and disability or long-term care insurance. Below we break down the major advantages of annuities, who they fit, and how to compare options confidently.

Annuity Income Benefits

Lifetime income benefits and predictable monthly paychecks

For many retirees, the #1 benefit of annuities is guaranteed income for life. Immediate income annuities (SPIAs) start paying right away, while income riders on fixed indexed annuities allow you to defer and lock in a guaranteed payout for the future. The key advantage is reliability—payments arrive regardless of market performance, helping cover essential expenses like housing, utilities, and healthcare.

- Single vs. joint life: Choose income for one life or continue to a spouse.

- Deferred income: Waiting to start payments can raise the payout (more deferral, larger lifetime amount).

- Budget support: Pair guaranteed income with Social Security to reduce sequence-of-returns risk and coordinate with how disability income needs or employer benefits fit into the bigger picture.

For larger portfolios, it’s common to ask what a substantial allocation can produce—resources like how much a $4 million annuity pays can help high-net-worth investors benchmark potential lifetime income.

Principal Protection & Downside Control

Benefits of fixed annuities and indexed annuities for risk management

Fixed annuities credit a guaranteed rate and protect principal from losses. Fixed indexed annuities (FIAs) credit interest linked to an index with a floor (no market-loss to principal from the index). These benefits can stabilize the conservative portion of a portfolio, offering a middle path between cash/bonds and equities.

- Zero market-loss to principal (FIA/Fixed): Shields retirement savings from downturns.

- Crediting choices: Fixed rates, participation strategies, or performance triggers. If you’re specifically comparing multi-year guarantees, it’s helpful to review the best MYGA annuity rates for different terms.

- Optional riders: Nursing home, enhanced income, or legacy features (availability varies).

Many clients first encounter annuities when rolling out of low-yield bank products. If you’re sitting on maturing CDs, guides such as whether you can transfer a CD into an annuity can clarify how guarantees, taxes, and liquidity compare.

Tax Deferral & RMD Coordination

How tax-deferred growth and required distributions interact

Tax deferral lets earnings compound without annual taxation until withdrawal, potentially improving long-term outcomes versus taxable accounts. Inside IRAs, annuities follow IRA rules; in non-qualified accounts, earnings are tax-deferred until distributed. Understanding taxation across your plan is crucial—beyond annuities, many families also ask whether life insurance benefits are taxable, how disability insurance payments are taxed, and whether long-term care benefits are taxable when planning for retirement income.

When it comes to leaving money behind, it’s equally important to recognize that annuity death benefits may be taxed differently than other assets—our overview on whether annuity death benefits are taxable explains how beneficiaries are affected.

If you annuitize an IRA annuity, the scheduled payments generally satisfy the RMD for that contract. A QLAC (if you use them) can defer RMDs on the allocated amount until income begins, helping with bracket management later in retirement.

Fixed vs. Indexed vs. Immediate: Which Benefits Fit?

Match annuity types to your retirement goals

- Fixed annuity benefits: Guaranteed multi-year rate (MYGA), simplicity, and principal protection—rate shoppers often compare this with dedicated pages like the highest fixed annuity rates and other term-specific comparisons.

- Indexed annuity benefits: Growth potential with a floor, plus optional lifetime income riders.

- Immediate annuity benefits (SPIA): Highest emphasis on guaranteed income starting now.

If your top priority is predictable income, compare SPIAs and FIAs with income riders. If you want conservative growth and protection, evaluate fixed or indexed annuities without income riders. For clients focused on locking in the strongest contractual guarantees, resources like the highest guaranteed annuity rates can provide a snapshot of top long-term guarantees.

How to Compare Annuity Benefits

Rates, guarantees, income factors, fees, and liquidity

- Rate/crediting terms: Fixed rate, caps/participation on FIAs, and renewal practices. If you’re rate-driven, a quick pass through the highest annuity rates today can help you see how your offer stacks up.

- Income factors: Age, deferral length, single vs. joint, and guaranteed payout percentages.

- Liquidity: Free withdrawals, penalty schedules, and return-of-premium options (if available).

- Rider costs/benefits: Income or care riders provide value if you’ll use them.

- Carrier strength: Financial ratings and claims-paying ability matter for long-term guarantees.

Who Benefits Most from Annuities?

When annuity advantages align with your plan

- Pre-retirees seeking to secure future income and reduce sequence risk.

- Retirees who want “paychecks for life” to cover essentials.

- Conservative investors prioritizing principal protection and stability.

- Couples who want survivor income continuity and clear death-benefit rules.

Some households also rely heavily on insurance beyond annuities—such as life insurance for income replacement or disability coverage to protect paychecks. If you’re managing health concerns along the way, it can be helpful to coordinate annuities with resources like the best life insurance for pre-existing conditions and planning for final expenses using guides such as how much burial insurance you may need.

Healthcare and support costs also matter. Many clients balance guaranteed income with government benefits and coverage, and will review how Medicare works and whether Medicare covers nursing home care before deciding how much income to allocate toward long-term care or supplemental coverage.

Estimate Guaranteed Income

Use our annuity income calculator to compare payouts

💡 Note: The calculator accepts premiums up to $2,000,000. If you’re investing more, results increase in direct proportion — for example, doubling your premium roughly doubles the guaranteed income at the same age and options.

View Today’s Fixed Annuity Rates

Compare top MYGA and fixed annuity rates by term, carrier, and deposit amount.

View Today’s Highest Annuity Rates

Explore current high-yield and bonus-style annuity options across multiple terms.

Helpful resources

Request a Personalized Annuity Quote

We’ll compare leading carriers and show guaranteed income options tailored to your goals.

Prefer to talk? Call 800-533-5969

FAQs: Annuity Benefits

What are the main benefits of annuities?

Guaranteed income, principal protection (fixed/FIA), tax-deferred growth, and optional riders for income or care needs.

Which annuity has the best income benefits?

SPIAs deliver immediate payments; FIAs with income riders can offer strong lifetime payouts after a deferral period.

Do annuities protect my principal?

Fixed and fixed indexed annuities protect principal from market losses; terms vary by contract.

How do taxes work on annuity benefits?

Earnings are tax-deferred. IRA annuities follow IRA rules; non-qualified annuities tax earnings when withdrawn. For broader planning, many families also review the tax treatment of other coverages such as life insurance, disability, and care benefits.

Can annuities help with RMDs?

Annuitized IRA annuity payments generally satisfy the RMD for that contract; other IRAs have separate RMDs.

About the Author:

Jason Stolz, CLTC, CRPC, is a senior insurance and retirement professional with more than two decades of real-world experience helping individuals, families, and business owners protect their income, assets, and long-term financial stability. As a long-time partner of the nationally licensed independent agency Diversified Insurance Brokers, Jason provides trusted guidance across multiple specialties—including fixed and indexed annuities, long-term care planning, personal and business disability insurance, life insurance solutions, and short-term health coverage. Diversified Insurance Brokers maintains active contracts with over 100 highly rated insurance carriers, ensuring clients have access to a broad and competitive marketplace.

His practical, education-first approach has earned recognition in publications such as VoyageATL, highlighting his commitment to financial clarity and client-focused planning. Drawing on deep product knowledge and years of hands-on field experience, Jason helps clients evaluate carriers, compare strategies, and build retirement and protection plans that are both secure and cost-efficient.